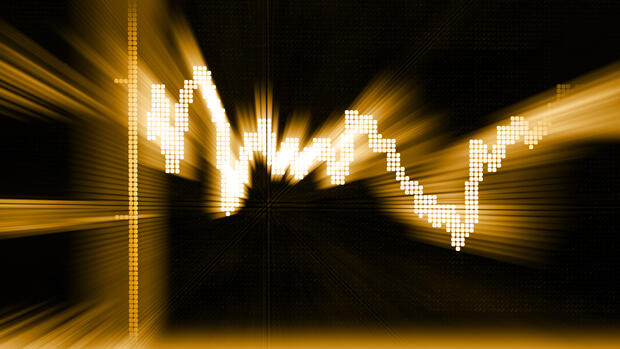

Dusseldorf The leading German index is aiming for 16,000 points: With 15,916 points, the Dax reached a new high for the year on Tuesday. In afternoon trading, the leading German index was at 15,910 points, an increase of 0.8 percent. In the past four trading days, there was a new annual high.

This confirms the forecast that the psychologically important mark of 16,000 points will be tested in the coming trading days. A new record high with prices above 16,290, on the other hand, is likely to be somewhat more difficult, but holds the potential for surprises if prices continue to rise. A look at the Dax chart since 2021 is enough for this realization.

16,000 points is likely because the full year 2023 upside is intact. The brief price slide to 14,458 points in mid-March was a healthy setback and thus confirmation of the upward movement. Since the beginning of the year, the Dax has climbed more than 14 percent.

A new record high has the potential to surprise because prices have not been sustainable above 16,000 points so far. The Dax climbed to 16,290 points in November 2021 and 16,285 points in January 2022, but was unable to maintain the gains and slipped back down again within a few days.

There is no trading month in history that the leading German index has ended above 16,000 points. If the Dax creates a new record high in the long term, that would be a surprise.

For Martin Utschneider, technical analyst at the private bank Donner & Reuschel, everything looks as if the Dax will set a new record high. His new price target is 16,600 points.

To put it cautiously, investor sentiment is also not an obstacle on the way up. An euphoric mood would be a burden, for example, because then many investors would have already bet on rising prices and there would hardly be any other buyers.

But exactly the opposite is the case. According to the current survey by the Frankfurt Stock Exchange, institutional investors are still showing a basic pessimism in the longer term. As is well known, the majority of professionals were already completely wrong at the beginning of the year with their expectations for the stock market year 2023 and are apparently finding it difficult to reconsider their previous attitudes.

>>Read here: Investors are becoming more pessimistic – but the rally could continue

According to the current Handelsblatt survey, private investors are also looking in disbelief at the rising prices. They have sold in the past few days and lowered their investment rate. So there is more money available to get started.

China’s economy is growing significantly

Positive news comes from China. The local economy has recovered significantly. From January to March, the world’s second largest economy grew by an unexpectedly strong 4.5 percent compared to the same period last year.

After the end of the zero Covid strategy at the beginning of December and the wave of corona infections at the beginning of the year, growth in the first three months had increased significantly faster than in the last quarter of 2022, when only 2.9 percent was achieved. However, it is somewhat lower than the government’s plan for the current year of “around five percent”.

For Commerzbank analyst Tommy Wu, the surge in growth “largely reflects pent-up demand after China’s reopening in December last year because of the zero-Covid policy.”

After encouraging economic data from China, the oil price stabilized after falling by two percent at the start of the week. Crude oil of the North Sea variety Brent and US light oil WTI each rose by up to half a percent to 85.20 and 81.22 dollars per barrel respectively. “The remarkable rebound in China’s economy has supported the recent rebound in oil prices,” said CMC Markets analyst Leon Li.

US banks present figures

With Bank of America and Goldman Sachs, other major US banks are presenting figures for the first quarter. At the beginning of the accounting season, their rivals JP Morgan, Citigroup and Wells Fargo surprised with strong profit increases on Friday and boosted the stock exchanges. They benefited above all from the robust business with private customers and rising net interest income, while investment banking weakened.

Netflix is also in the limelight on the other side of the Atlantic. The streaming service presents figures for the first quarter in the highly competitive industry. Netflix has lowered subscription prices in some countries and introduced a cheaper, ad-supported subscription to keep users engaged.

Look at individual values

Drägerwerk: Investors are buying the shares after the medical technology manufacturer is back in the black operationally thanks to easing delivery problems. The stocks are up 9.3 percent. “Back-to-back quarters of profit means a lot for this company after quarters of losses,” said one trader.

Südzucker: Europe’s largest sugar company has once again exceeded its profit forecasts, which have been raised several times, and is allowing its shareholders to participate in this with a significantly higher dividend. The shareholders – above all beet farmers from southern Germany – are to receive a dividend of 70 (40) cents per share. Südzucker last distributed more ten years ago. The supervisory board and the virtual general meeting on July 13 still have to agree to this. And Südzucker does not expect the boom to end. The stock climbed 9.2 percent.

ericsson Due to weakening business with 5G devices in high-margin countries such as the USA, the company missed profit expectations at the beginning of the year. The stock falls 6.9 percent. In February, Ericsson had already announced that 8,500 jobs would be cut due to weakening demand.

Here you can go to the page with the Dax course, here you can find the current tops & flops in the Dax.