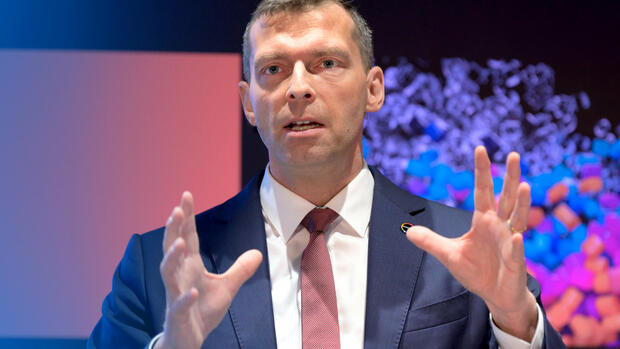

The CEO sees the German locations as internationally competitive.

(Photo: imago images/Rainer Unkel)

Dusseldorf The plastics manufacturer Covestro started the new year much better than expected and surprised the stock market with a stronger forecast. On Friday morning, the share rose by five percent to EUR 38.50. CEO Markus Steilemann does not attribute this to a noticeable economic improvement. “There are still no growth impulses coming from the major economic regions of the world,” he said in an interview with the Handelsblatt.

For Steilemann, it was more the “self-healing powers” that have stabilized the Leverkusen company in recent months. “Our new structure and the streamlining of the portfolio have paid off,” said the CEO. Covestro has parted with some businesses and reduced administration costs, for example. With the current cost level, the group will also get through the next few months well.

For this period, Steilemann still does not expect any boost from the economy. “We’re far from out of the woods,” said the CEO. This applies above all to the domestic markets, where demand is weak. “Europe is and will remain at the bottom of the global economy.” But the Covestro boss also expects restrained momentum for China this year. In the USA, a look at the order books shows signs of at least a slight improvement from May.

The company was helped by the lower energy prices. The plastics manufacturer traditionally buys what it needs on the spot market without being bound by a contract. This has paid off in previous years, but Covestro was badly surprised by the sharp price increase last year. If the cost of energy was once 600 million euros a year, in 2022 it will be almost two billion euros.

Recently, however, the gas price on the spot market has fallen sharply and with it the burden for Covestro. However, Steilemann assumes that the gas price will not fall any further. The group has therefore taken advantage of the situation and now concluded longer-term supply contracts in order to be spared from possible new price peaks on the market.

German sites competitive according to Covestro

Due to the uncertain situation, Steilemann also relies on the “self-healing powers” for the further course of business. Above all, he expects better demand from the global auto industry. Covestro has specified its forecast. After that, at best, stagnation is foreseeable this year, but rather a decline: the group is currently assuming adjusted profit of 1.1 to 1.6 billion euros, after 1.6 billion euros in 2022.

But that’s a lot more than analysts had previously expected. The share price reacted correspondingly positively. The fact that Covestro is restarting the share buyback program should also contribute to this. In the uncertain situation in 2022, the group initially stopped this. From May, shares with a volume of EUR 75 million are to be bought back.

The Dax group wants to resume the share buyback program.

(Photo: dpa)

This step demonstrates the growing confidence of the Covestro management and also makes analysts positive. “We assume that Covestro will recover much faster than expected,” says a recent assessment by Baader Bank.

The Group’s operating profit collapsed in the first quarter to 286 (previous year’s period: 806) million euros, but significantly exceeded the original expectations of both Covestro and analysts. Sales fell by a fifth to 3.7 billion euros due to lower prices and falling demand.

The persistently difficult situation for the chemical industry in Europe and Germany is no reason for Steilemann to withdraw from the home market. “Covestro is also internationally competitive in Germany, and we will continue to fight for that,” said the CEO.

More: Covestro makes a loss of 30 million euros