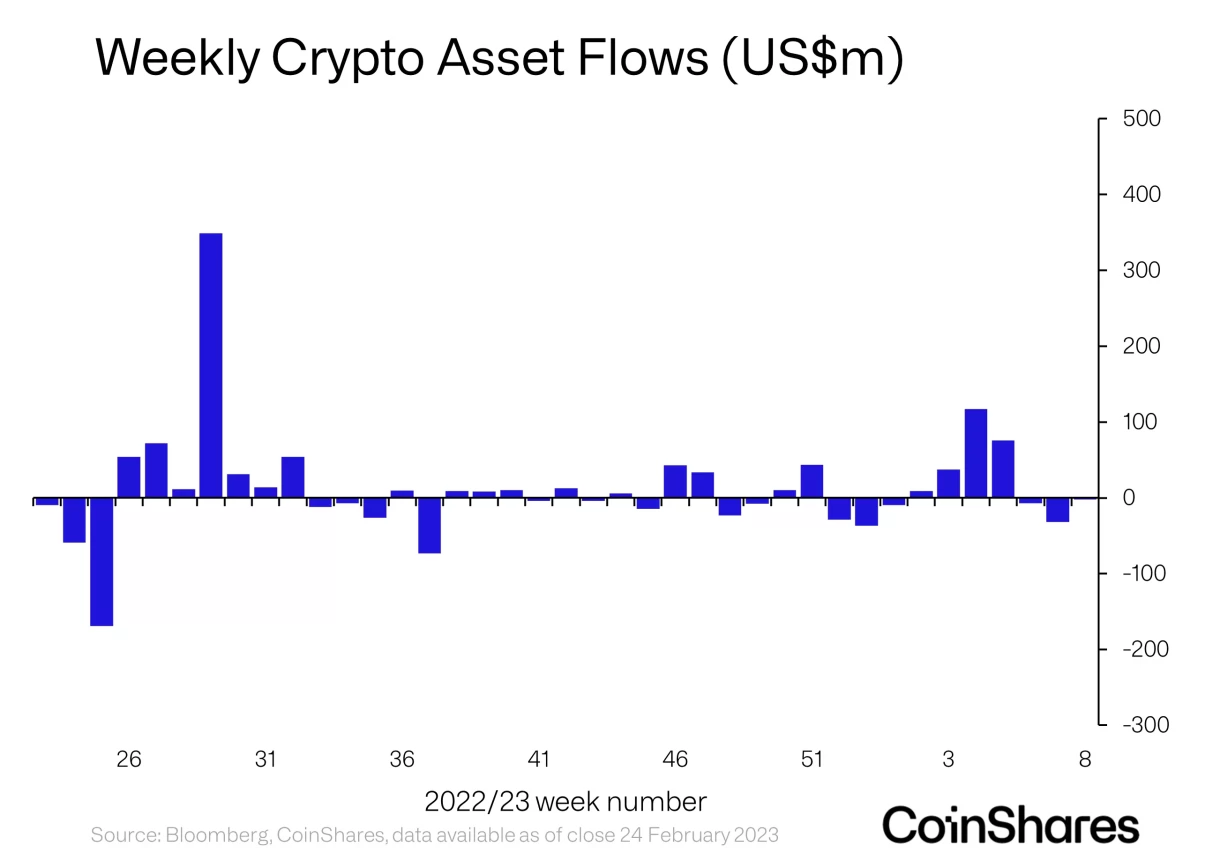

CoinSharesnoted that institutional crypto investment products have been greatly undercut by investors in the past week.

In its latest Digital Asset Fund Weekly Streams Report, CoinShares noted that institutional digital asset investment products have experienced minor outflows over the past week. On the other hand, he found that there were large inflows into short investment products.

“Small outflows totaling US$2 million were seen in digital asset investment products. However, this masks a wider negative mood as the biggest inflows are in short investment products.”

bitcoin (BTC) products took the heaviest hit of the outflows with $11.7 million. Meanwhile, short-Bitcoin products experienced massive inflows of $9.9 million. Short BTC products had the second-highest year-to-date inflows, with nearly $48 million versus Bitcoin’s $146 million.

Koinfinans.com As we reported, Coinshares says it has a potential reason why institutional investors rushed to short BTC products last week.

“Bitcoin saw a total outflow of US$12 million for the third week in a row. Short-bitcoin saw a total of $10 million in inflows. But this negative feeling came only from the USA. We believe this reaction reflects the uneasiness caused by the stronger-than-expected macro data releases among US investors recently. But it also highlights its sensitivity to regulatory pressure in the US.”

AltcoinsEntries and exits were mixed. Institutional investment products Cardano (ADA), Solana (SOL), and Polygon (MATIC) are seeing inflows of $0.4, 0.5, and $0.6 million. On the other hand, Ethereum (ETH), Litecoin (LTC) and multi-asset investment vehicles experienced exits.