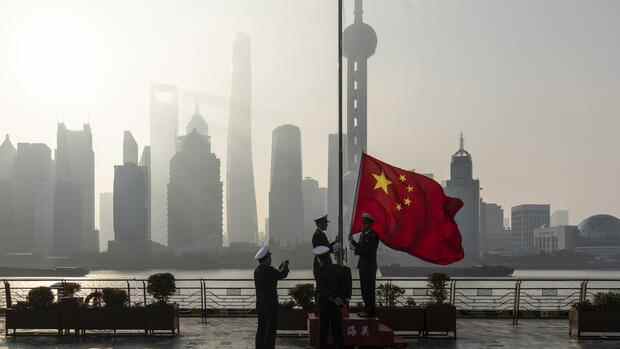

Chinese customs officials hoist the national flag in front of the Lujiazui financial district in Shanghai.

(Photo: Bloomberg)

Berlin The World Bank rang the alarm bells at the end of November: Debt in many emerging and developing countries was rising rapidly, and nobody knew exactly who owed whom how much. The Institute for the World Economy (IfW), together with the World Bank, has now identified a culprit for the misery: China.

“Emerging and developing countries are surprisingly often no longer able to service their debt payments to China as planned. Due to China’s non-disclosure clauses in lending, the exact extent of the defaults is unclear,” says a new study by the IMF and World Bank.

Accordingly, Beijing has now become the central player in lending and restructuring of public debt in developing countries. Since 2008 there have been 71 debt restructurings with Chinese creditors from 39 developing countries. This is more than the number of debt restructurings to the so-called Paris Club, an association of the world’s most important creditor countries (68 restructurings), or to private creditors (21 restructurings of international bonds).

African countries in particular are hanging on to Beijing’s debt drip. They use China’s loans to finance the expansion of their infrastructure, such as rail connections, shipping ports or airports. But that seems to be over now.

Top jobs of the day

Find the best jobs now and

be notified by email.

“China’s boom in lending to developing countries is apparently coming to an end,” says Christoph Trebesch, Research Director for International Financial Markets and Macroeconomics at the IfW Kiel. Trebesch prepared the study together with World Bank chief economist Carmen Reinhardt and her colleague Sebastian Horn.

Déjà vu of the 1980s is imminent

The number of defaults and restructurings has increased dramatically since 2019. Emerging and developing countries with high debts to China are now threatened with a déjà vu of the 1980s. Back then, ongoing debt restructuring to Western creditors resulted in a “lost decade” for many nations.

“The number of payment problems with Chinese creditors is surprisingly high, especially when you consider that hardly anything is known about the processes,” says Trebesch. Numerous payment defaults may not be documented because the existence of the loan agreement is kept secret from the public.

This turns the problem of secret loan agreements into a problem of secret payment defaults. According to the IfW economist, the international community lacks important data for reliable debt sustainability and risk analyzes of emerging and developing countries.

The World Bank sees the problem in a similar way. “There are massive gaps in debt tracking,” the World Bank complains in its report “Debt Transparency in Developing Countries.” And World Bank President David Malpass warned: “The poorest countries will emerge from the Covid-19 pandemic with the heaviest debt burdens in decades, but limited debt transparency will delay crucial debt cleaning and restructuring.”

Sri Lanka is a good example of the volatile debt situation in many developing countries: last year the government had to spend around three quarters of its income on interest payments alone. President Gotabaya Rajapaksa therefore urged Chinese Foreign Minister Wang Yi to postpone debt repayments.

The situation is aggravated by the fact that the debt moratorium of the 20 most important industrialized and emerging countries (G20) for the 77 poorest countries expired at the end of last year. Therefore, the pressure on Germany, as chairman of the G7, to help the poor countries out of the debt trap is growing. However, China does not belong to the G7 and, according to the IfW study, is exacerbating the crisis with its unclear and often harsh approach.

Thumbscrews for the debtors

The IfW had already examined the extent of China’s international lending in 2019 and came to the conclusion that the rest of the world owed China more than five trillion US dollars in 2017, which corresponded to around six percent of global economic output at the time.

Since then, the risks have increased. Trebesch says: “In view of the amount of credit and the possible consequences of a debt crisis for the country concerned, the lack of documentation by the international rating agencies is particularly surprising.”

The risk of national bankruptcies is also growing because China does little to accommodate its defaulting debtors. In the vast majority of payment problems, China’s banks simply extended repayment periods with otherwise unchanged credit conditions.

A reduction in interest rates has only been granted in ten cases in the past 20 years, a reduction in the nominal debt burden only in four cases. “China seems to be repeating the mistakes of the West from the 1980s, since it hardly grants debt cuts, but only extends repayments over time,” criticizes the economist.

More: Over-indebted and unstable: the number of particularly badly indebted countries has more than tripled