Bitcoin And in altcoins The decline that started last week FOMC continues before the meeting.

While the weakening of inflows to ETFs and BTC outflows from Grayscale were effective in these declines. BTC It fell below $61,000 in the morning hours.

at this point Grayscale’s GBTCWhile there was an outflow of 444 million dollars yesterday, BlackRock ETF experienced the weakest inflow of recent times with only 75 million dollars.

Fidelity’s ETF FBTC, which ranked second after BlackRock Bitcoin ETF IBIT, experienced an inflow of 39.6 million dollars. While all Bitcoin ETFs recorded almost zero inflows, according to yesterday’s ETF data, the total net outflow of $326 million was the largest fund outflow ever recorded for ETFs.

These outflows show that institutional investors are taking a cautious stance before the FOMC decision to be announced today.

While these outflows and weakness on the ETF front affect the price of altcoins as well as BTC. Ethereum It dropped to $3,054.

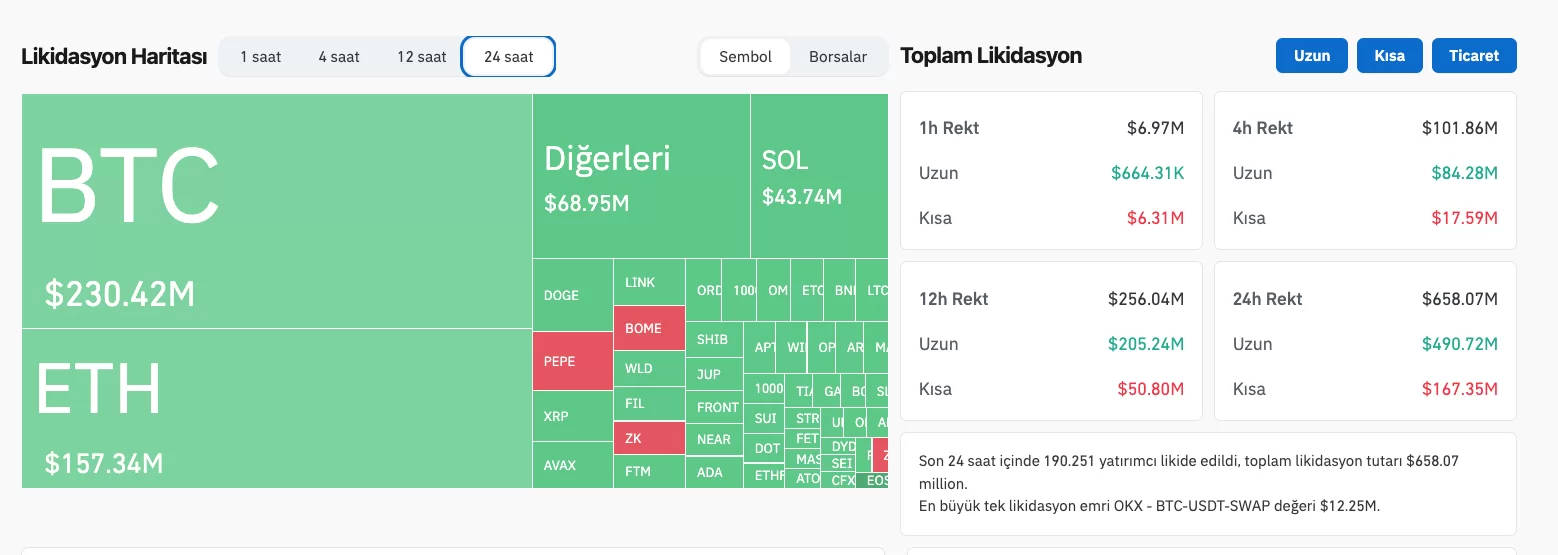

While many leveraged positions were liquidated at this point, according to Coinglass data, $658 million was liquidated in the last 24 hours.

Of these, $490 million consisted of long positions and $167 million consisted of short positions.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!