The data shows that 1,750 BTC left the miner’s wallet, causing a drop in reserve. Meanwhile, analysts are talking about deep dives for Bitcoin!

miners to Binance 1,750 Bitcoin slid; Dump coming?

Bitcoin (BTC) has gained almost 3% in the past day. However, the data shows that miners chose the perfect time to transfer some of their assets to the crypto exchange. According to the data, 1,750 Bitcoins came out of the miner’s wallet. Thus, it caused a decrease in miner reserves. The wallet address deposited this $48 million worth of BTC on Binance, the world’s largest crypto exchange. This move shows that there may be selling pressure from miners.

LookOnChain highlights that the same wallet address deposited 5,791 Bitcoins (approximately $163 million worth) on April 21, 2023. He adds that after that, the BTC price dropped by about 3% in 5 hours.

The miner wallet reportedly received 10,000 Bitcoins (worth approximately $171 million) on December 1, 2022. BTC was trading at an average price of $ 17,101 at that time. However, the wallet currently holds around 2,459 BTC. Also, it’s about $107 million in profit.

Bitcoin will drop over 50% from current levels!

Popular crypto analyst Benjamin Cowen warns that Bitcoin (BTC) will fall further from current levels. Cowen says Bitcoin will likely range between $12,000 and $35,000 for the rest of 2023. If the analyst’s prediction is correct, BTC could drop more than 50% from current prices to the bottom of the range. At the same time, it is likely to climb to the top of the range, gaining over 30%. In this context, the analyst makes the following statement:

My overall prediction is that BTC will spend this year in the $12,000 to $35,000 range. Of course, I could easily be wrong about this. But if you want to be my guest, this is what I would generally suggest.

According to Cowen, BTC is likely to trade lower in the second half of this year due to the negative weather. The analyst expresses his views on this issue as follows:

If Bitcoin is going to rise this year, I predict it will happen in the first half of the year. Because the second half of the year, just like we saw in 2019, will probably be more of a narrative about really increasing recession possibilities… So I think the second half of the year will be mostly bearish for BTC again.

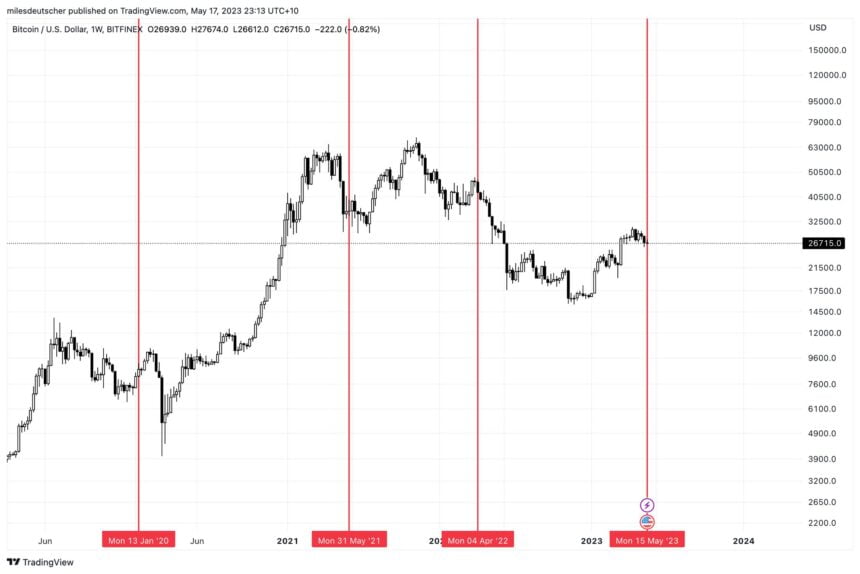

next hin weeks in BTC a 40% drop

Cryptocurrency enthusiasts and traders are closely watching Bitcoin’s performance after the recent price drop. According to analyst Miles Deutscher, BTC typically experiences a temporary rally after a drop. Also, the analyst says that a new low will follow after 5-8 weeks. Deutscher’s analysis shows that in 2020, the price of Bitcoin fell by 56% in 59 days after initially rising. Similarly, in 2021, the price of Bitcoin dropped 24% in 47 days, and in 2022, 42% in 40 days.

However, while BTC is trading at $26,800, if it suffers a 20% loss, its price will likely drop to $21,440, while on a 30% loss it will drop to $18,760. A drop of 40 means a price of $16,080. That means potentially taking Bitcoin back to the low point of the 2022 bear market.

Will 2023 be the best year for BTC?

On the other hand, according to crypto analyst Adrian Zdunczyk, historical data shows that the pre-election years were the best performing years for Bitcoin, with a 98.8% chance of a bull run in 2023. The worst six months of the year usually start in May. However, Zdunczyk believes that an uptrend will emerge in the coming months.

Looking at the weekly chart, Zdunczyk states that Bitcoin is currently experiencing a full reversal to the 200-week trend, completing the average return. There is a strong correlation (0.42) between Bitcoin and the S&P 500. However, BTC maintains the critical support near $25,000. However, if this support level is broken, it is possible for BTC to drop below $20,000.

Furthermore, Zdunczyk says that further declines are possible if BTC stays below $30,000. However, after a successful retest of the 200-day baseline, the support level was confirmed by multiple techniques. Meanwhile, there has been a deterioration in the 50-day average volatility. Thus, the long-term trend is temporarily exhausted. Zdunczyk’s analysis shows the completion of a clear head and shoulders pattern with the technical breakout target at $22,000. However, a gradual rally above $35,000 is possible if the pattern continues.

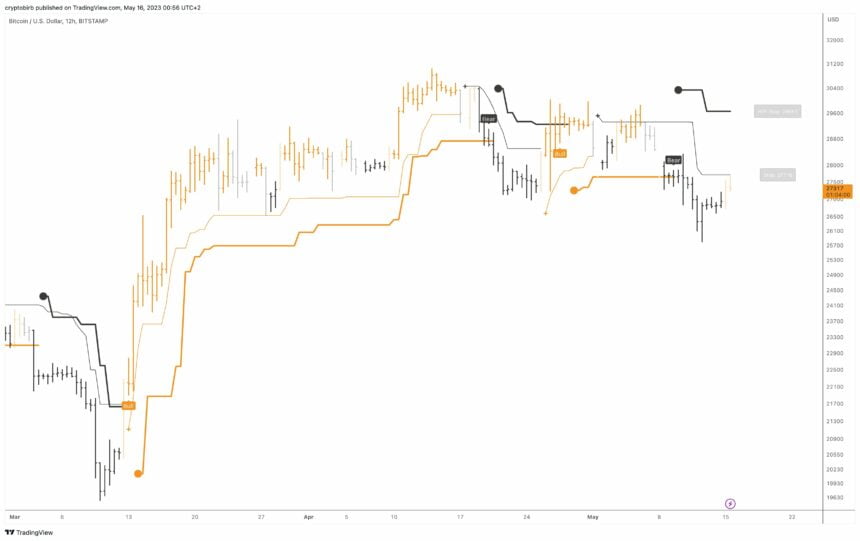

Based on the chart above, local resistance is currently at $28,000, supported by BirbicatorPRO (BPRO) analysis. Bears hold control until there is a strong close above this level. The bulls need to wait for a decisive break above $30,000 for a more credible uptrend.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.