While Bitcoin (BTC) liquidity fell to the lowest level in the last ten months, accompanied by the banking crisis and regulatory pressures, there were serious slippage increases, especially in the US-based crypto currency exchanges.

While the rise in Bitcoin price continues, the liquidity in the stock markets has come to an end. 10-month low declined. According to experts, the main reason for the withdrawal of liquidity from the markets US-based banking crises and recently against crypto money companies increasing pressures it happened. Since the beginning of January, Bitcoin is about 75% while increasing, liquidity continued to decrease in inverse proportion to this.

Research associate of on-chain analytics platform Kaiko Conor Ryder offered by datarevealed the picture of major liquidity outflows.

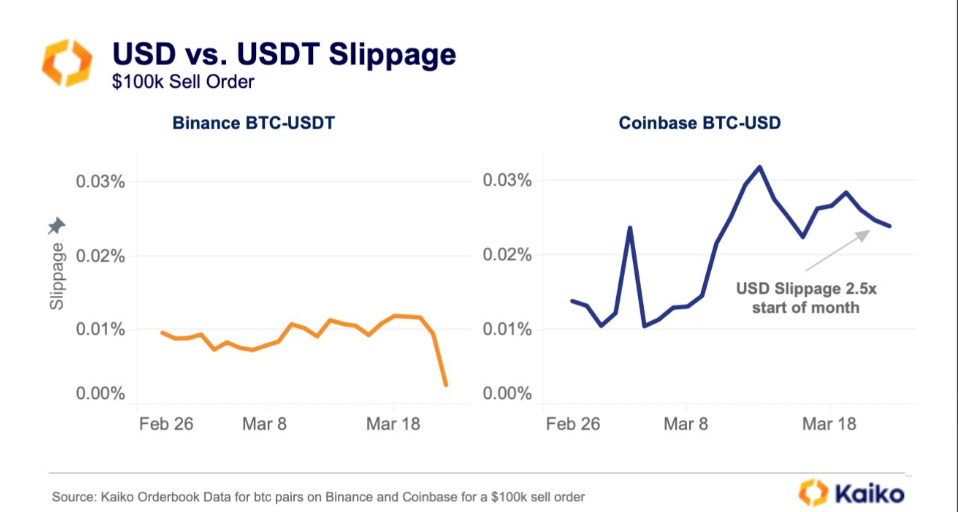

Decreased liquidity Bitcoin with a volatile price movement in stablecoin pairs led to the transaction. The liquidity declines, which accelerated in parallel with the banking crisis that started in the USA and spread all over the world, were especially felt in the USA-based stock markets. Cryptocurrency friendly at the beginning of March Signature Bench bankruptcy of institutions such as FTXIt triggered a liquidity outflow similar to that experienced after the bankruptcy of .

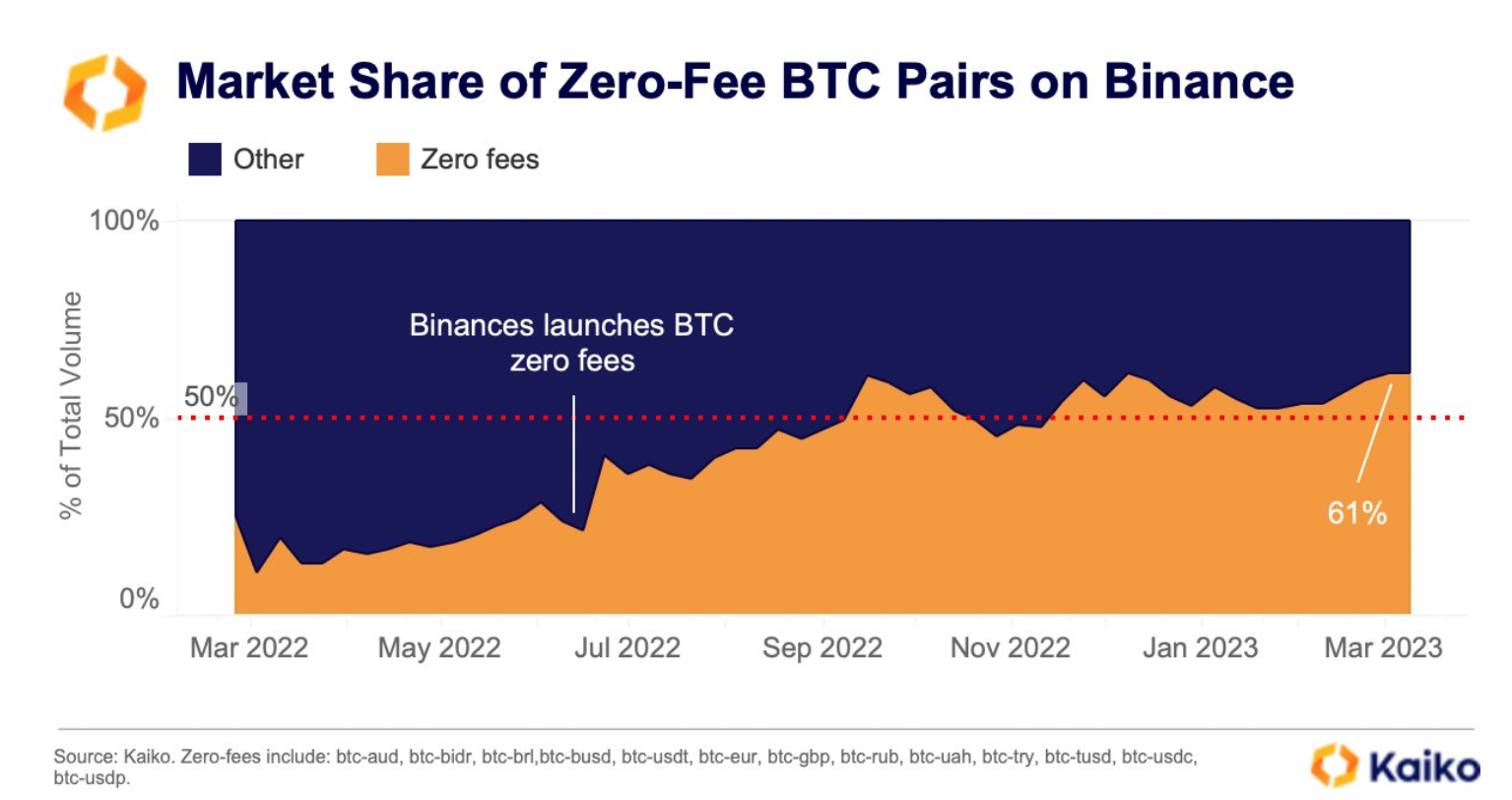

On the other hand, the world’s most voluminous and liquid exchange BinanceThe zero transaction fee project implemented by BTC and stablecoin transaction pairs also determined the direction of liquidity in the market. Binance with this move while succeeding in attracting most of the liquidity to itself. other popular exchanges suffered losses in both trading volume and liquidity.

Binance has finally TrueUSD (TUSD) announced that it has removed the market maker and buyer transaction fees in the parity and has managed to attract a large amount of liquidity for this parity.

The liquidity shortage also led to increased price volatility, forcing investors to pay more price differentials. Especially USDC Coin (USDC) bankruptcy issuer Circle silicone valley at the bank after suffering BTC/USDC The slippage amount in the parity has increased significantly. According to Kaiko data, in this process, BTC/USD the slip of the couple at the beginning of March 2.5 times It increased.