FOX Business reporter Charles Gasparino shared information about the highly anticipated spot Bitcoin ETFs. According to Gasparino, companies that have applied believe that the SEC will make a decision after January 8. After this news, BTC price exceeded 44 thousand dollars. However, analysts say the risk of a price correction increases in the short term. Analysts are talking about 160 thousand dollars in the long term.

Claim: Spot Bitcoin ETF decision comes with surprises!

cryptokoin.comAs you follow from , the market is eagerly awaiting the approval of a spot Bitcoin ETF. There is constant speculation about this and some dates are mentioned. In a recent development, FOX Business reporter Charles Gasparino shared information based on his sources. Accordingly, companies that apply for ETFs to the SEC are confident that the SEC will make a decision after January 8. However, the reporter says there was a peculiar surprise in the decision. In this context, Gasparino shared the following on his social media account X:

Last minute update on Spot Bitcoin ETF: Firms believe the SEC will decide after January 8. They are also confident that the SEC will approve it. But with one difference, unlike regular ETFs, you can only buy shares with cash. The SEC is concerned about ETFs being used as money laundering tools. The story is coming.

According to Coinglass analysts, the risk of price correction is increasing.

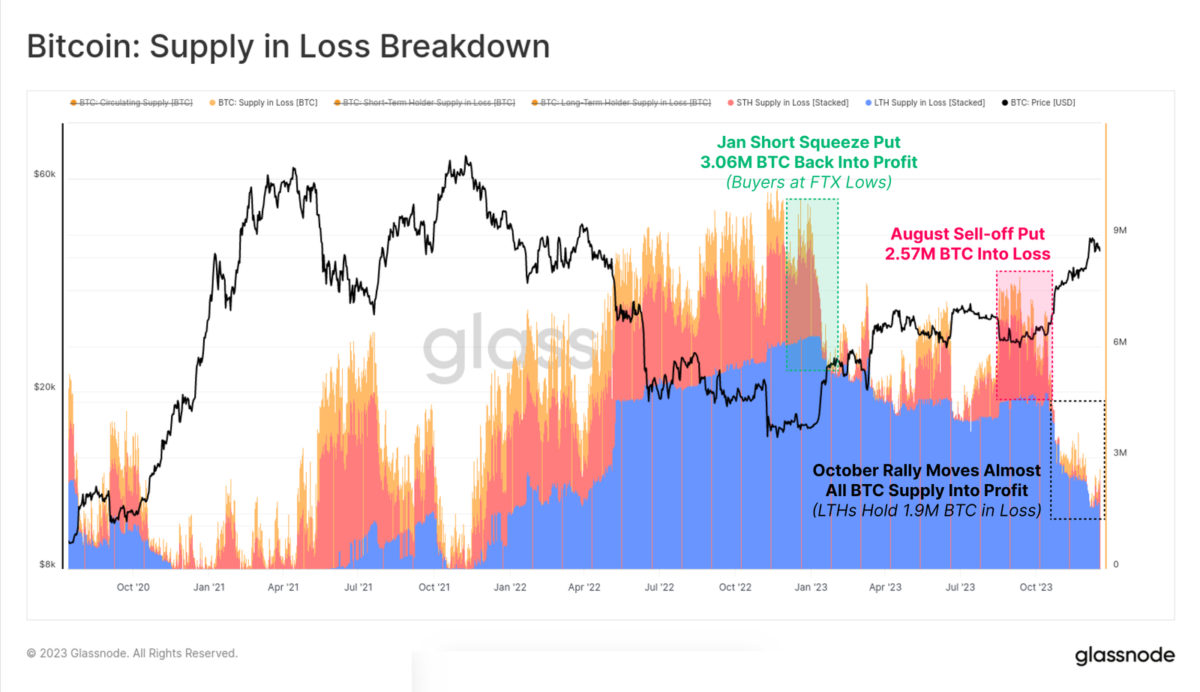

Bitcoin broke the $44,000 mark for the first time in more than a week on Wednesday. In this move, it increased by 4% in the last 24 hours. Coinglass data shows that this breakout caused over $33 million in BTC short liquidation in the last 24 hours. However, according to analysts, BTC is likely to experience increasing selling pressure. Because the majority of the supply in circulation is now at profit. “As the market rose, the vast majority of investor coins became profitable,” Coinglass analysts say in the new report.

Coinglass analysis shows how the total volume of coins held “at loss” dropped to approximately 1.9 million Bitcoins. It also reveals that most are held by long-term holders who bought near 2021 highs. Meanwhile, the percentage of Bitcoin circulating supply that is in profit is currently over 88%. This is a level we have not witnessed since late November 2021. “2023 started with over 50% of BTC supply underwater,” Coinglass said. “This is one of the fastest recoveries in history, second only to the rally in 2019.”

Selling pressure and long-term target for Bitcoin

A recent CryptoQuant report also suggests that selling pressure is increasing for BTC. “In the short term, there is some price correction risk given that short-term Bitcoin holders experience high unrealized profit margins that have historically preceded price corrections,” analysts wrote in the report. says. However, in the report, they draw attention to long-term upward indicators for 2024. In the CryptoQuant report, analysts also make the following assessment:

On-chain valuation and network metrics indicate that Bitcoin remains in a bull market. It may be targeting $54,000 in the medium term and $160,000 as this cycle price top.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!