Binance’s FTX-Alameda Its involvement in the issue caused panic among investors, as interest in bearish demand assets doubled. $203 million reached.

Investors are scrambling to hedge against a potential drop in FTT, the native token of crypto exchange FTX, following Binance’s decision to divest FTT coins and the controversy surrounding Alameda’s balance sheet.

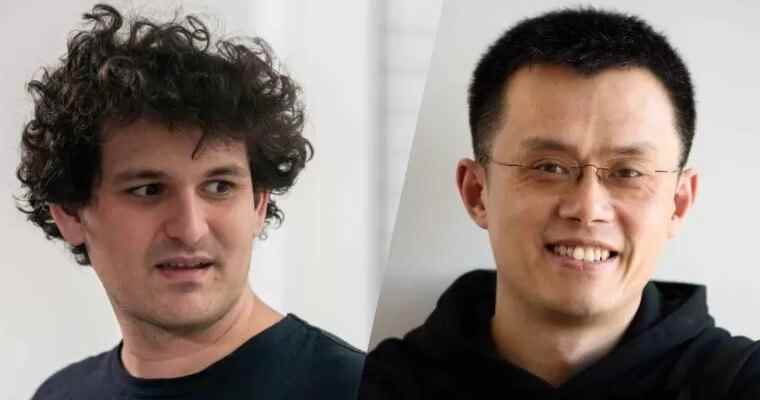

Interest In FTT Futures Doubles As Binance Moves To Settle FTX Token Assets

The amount of dollars devoted to FTT-linked futures and long-terms has more than doubled since the opening of Asian markets, from $87.56 million to $203 million, hitting a 12-month high.

The combination of rising open interest and negative funding rate indicates that investors are taking a bearish position in FTT.

Investor from crypto asset management firm Blofin Griffin Ardern“Last week, Alameda’s balance sheet was questioned, and Binance also announced that it will divest FTT and other assets related to the FTX exchange.

“This seems to have caused panic among investors who choose to hedge their assets, such as FTT.”

Changpeng “CZ” Zhao on Sunday said he would liquidate the remaining FTT tokens that were purchased as part of the exit from Alameda’s sister company FTX last year.

According to crypto exchange Phemex, Alameda owns more than 50% of the FTT token, and a continued drop in the price of the cryptocurrency could have market-wide consequences.

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!