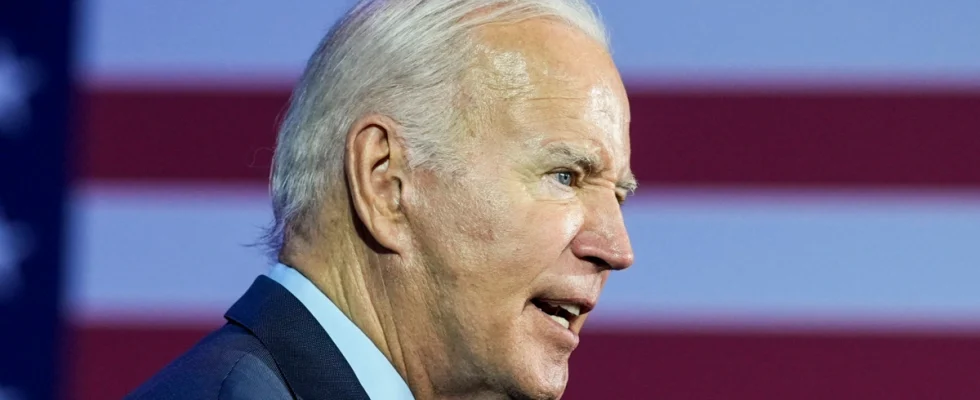

In a recent speech on economic policy, US President Joe Biden targeted cryptocurrency traders and hedge fund managers, stressing the need to eliminate tax loopholes and create a fairer system. Biden’s remarks in Chicago on June 28 highlighted the administration’s commitment to addressing wealth inequalities and ensuring that the wealthiest individuals and companies pay their fair share. Here are the details…

Cryptocurrency statement from Biden

President Biden’s strong stance on tax reform is not a surprise given his ongoing efforts to reshape the US economy. The president acknowledged the rapid transformation his administration has achieved so far, but stressed that there is still a lot of work to be done. He posed a thought-provoking question to the audience, asking if he believed the federal tax system was fair. His call for fairness was met with applause and set the stage for his subsequent disclosures on crypto traders and hedge fund managers.

Biden stressed that it is alarming that the number of billionaires in America has risen from 750 to 1,000 since the beginning of his presidency. He expressed concern that the average tax rate these billionaires currently pay is only eight percent, which is lower than the tax rate paid by many hardworking individuals such as teachers, firefighters and police officers. President Biden has argued that no billionaire should enjoy a lower tax rate than those who serve their communities in essential occupations.

President Biden stressed the need for a fair tax rate while dispelling concerns about a return to the high tax rates of the past. He suggested that billionaires and corporations pay taxes at the highest tax rate currently available, which is less than 30 percent. In this way, he argued, the government could generate billions of dollars in revenue, reduce the budget deficit and finance much-needed initiatives.

Tax evasion concerns rise

Biden accepted his commitment to ensure that Americans earning less than $400,000 per year are not subject to any federal tax increases during his presidency. He said this promise is a key component of his economic agenda, which aims to hold the wealthiest individuals and companies accountable while protecting the middle class. President Biden’s speech reflects growing concern around the expanding crypto market and the potential for tax evasion through various loopholes. Speaking specifically to crypto traders and hedge fund managers, he sends a clear message that these organizations will face further scrutiny and regulation in the coming months.

While the speech did not provide specific details on closing these gaps, it is clear that the Biden administration is committed to ensuring justice and reducing wealth inequality. The President’s words show that the government intends to create an equal playing field where individuals and companies are held accountable for their contributions to society through a fair and sound tax system. At the end of his speech, President Biden emphasizes the importance of establishing a fair tax code for all, by clearly targeting the rich and super-rich. President Biden’s speech serves as a clear indication that the crypto world, including traders and hedge fund managers, can expect more scrutiny and regulation in the near future.

As this new phase of the economic struggle unfolds, we will see how the Biden administration will navigate the complexities of the cryptocurrency world while maintaining its commitment to justice. By focusing on eliminating gaps, it is critical that regulators and industry participants collaborate and strike a balance that supports innovation and economic growth while ensuring a level playing field for all taxpayers. For crypto traders and hedge fund managers, the path to achieving a fairer tax system may be challenging, but Biden’s stance sends a clear signal that management is committed to addressing wealth inequalities and holding the wealthiest individuals accountable. As the details of these proposed changes emerge, the crypto industry will need to adapt and comply with new regulations to ensure transparency and maintain public trust.

What effect could this development have on cryptos?

While President Biden’s speech focused on closing tax gaps for crypto traders and hedge fund managers, it’s important to note that the broader context of his words emphasizes that wealthier individuals and companies should pay their fair share. This signals a broader effort for fairness and economic fairness in tax laws, which could have implications beyond the crypto world. The crypto community should expect increased scrutiny and regulatory measures as the government seeks to ensure tax compliance and close potential loopholes. This may include measures such as stricter reporting requirements, improved oversight, and increased cooperation between regulatory agencies.

While some in the crypto industry see these developments as potential challenges, it is important to acknowledge the potential benefits of increased regulation. A more transparent and accountable crypto market can foster greater investor confidence, attract institutional participation and ultimately contribute to the long-term growth and legitimacy of the industry. Moreover, for crypto traders and hedge fund managers, aligning tax policies with other industries can promote fairness and reduce wealth inequality. By ensuring that all individuals and companies are subject to similar tax obligations, the government aims to create a level playing field and promote a more equitable distribution of wealth.

However, it is equally important for regulators and policymakers to strike a balance between ensuring tax compliance and fostering innovation in the crypto industry. Aware of the unique characteristics of cryptocurrencies and Blockchain technology, policymakers should aim to enact regulations that protect investors and promote market integrity, while allowing for continued growth and innovation.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.