Popular on-chain analyst Willy Woo, Bitcoin (BTC) He stated that there is a signal indicating that a significant price increase is on the horizon for the company and explained this signal. Here is the signal that the famous analyst believes will increase the price of Bitcoin (BTC).

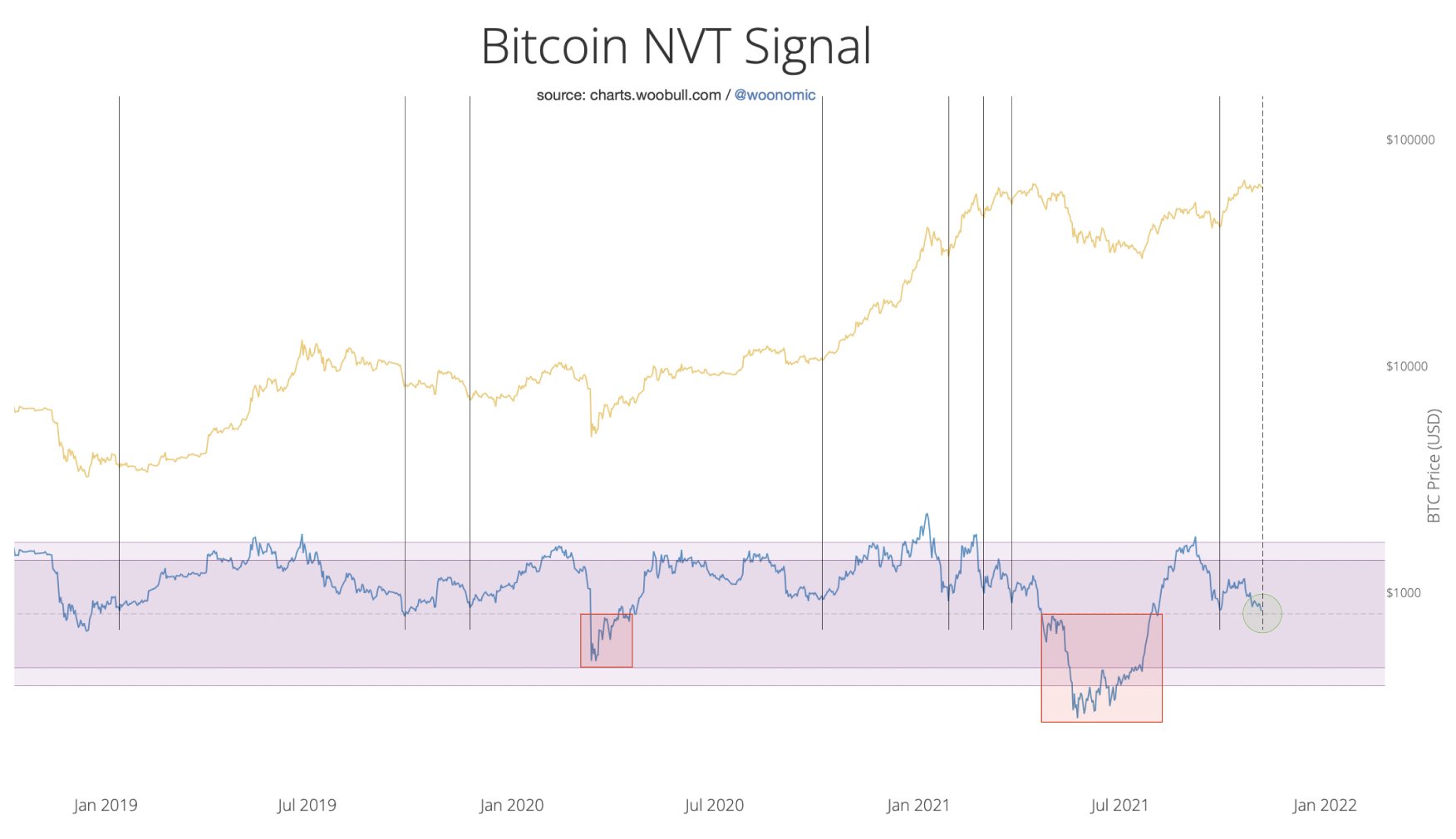

831,000 followers twitter Commenting on his account, the analyst says that Bitcoin’s NVT (network value for transaction) has historically been at a point where he thinks it has led to rallies.

NVT, a metric that measures the volume of on-chain investors. The metric is the total value of the BTC network, BTC It is based on correction by a moving average after dividing by the total transaction volume flowing through the blockchain. Analyst Woo also thinks that based on this metric, BTC is not “overheating” in terms of price.

“The tuned NVT signal is still in the mid-range.” If we assume that the price has not increased much anymore, that is, it is a bull market, we can deduce that historically this is a region where the price is ready to rise. The price is still below the desired level.

Focusing on a different indicator showing that Bitcoin will be bullish in the long run, the analyst claimed that the market value of BTC is related to the total supply of the US dollar (M2). According to Woo’s chart, Bitcoin could continue to rise as the USD supply increases.

“BTC vs USD (M2) as a global monetary base. Things are going to get really interesting in the next 5 years.”

Woo recently predicted that a major rally for Bitcoin (BTC) would begin in Q4 and possibly extend into 2022.

“Whatever happens in the next few weeks, we will be in a good rally by the end of the year. The fourth quarter is going to be great and this thing will probably last until the first quarter of 2022.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.