Although the cryptocurrency market has lost its upward momentum, it resists the decline. Some analysts are predicting further declines for Bitcoin and altcoins. However, there are also many analysts who are hopeful about the future of the market. In this context, QCP Capital recommends taking long positions in Bitcoin and Ethereum at current levels. He sees the launch of spot Bitcoin and Ethereum ETFs trading in Hong Kong as an important catalyst.

The decline in the prices of two leading cryptocurrencies raises questions

Bitcoin and Ethereum prices are currently consolidating at the $63,000 and $3,100 levels. QCP Capital, a Singapore-based digital asset trading firm, noted in a new trading opinion on April 27 that volumes in Bitcoin and Ethereum options are largely compressed. This week, heavy selling of BTC options indicated that the vol curve has collapsed. He also noted that Bitcoin vols dropped from 70% to 50%. The company added that if people want to buy BTC and ETH, this consolidation market is the best time to accumulate for the long term.

On the other hand, QCP Capital said that the downside skew in Ethereum (ETH) risk reversals has also decreased to -13%. This is likely due to recent reports of the SEC rejecting or further delaying the spot Ethereum ETF. The SEC and its staff have shown no interest in the spot Ethereum ETF and its potential, according to people familiar with the matter. Four people who attended said the discussions were one-sided.

““When FUD starts to sneak in, the likelihood of a recovery increases.”

Meanwhile, the performance of Bitcoin (ETH) and Ethereum (ETH) prices post-Bitcoin halving has raised questions about whether the market has lost faith or whether this is just a brief pause in a long-term bull run. Santiment reported that Bitcoin active wallets are rising rapidly despite fluctuating prices.

Santiment also stated that the price of Bitcoin falling to 63.4 thousand dollars frightened crypto investors. The analysis firm stated that ‘buy statements’ increased at a low rate and ‘sell statements’ increased at a high rate on social media. “At this level, as FUD starts to sneak in, the possibilities of the market rebound increase,” Santiment said. said.

Hong Kong’s Spot Bitcoin and Ethereum ETF goes live

cryptokoin.comAs you follow from, Hong Kong has approved spot ETFs for two cryptocurrencies. In this context, spot Bitcoin and Ether ETFs will begin trading in Hong Kong on April 30. QCP Capital says this is a potentially big positive catalyst next week as the Hong Kong financial sector joins other financial markets such as the US and Europe in investing in the spot Bitcoin ETF.

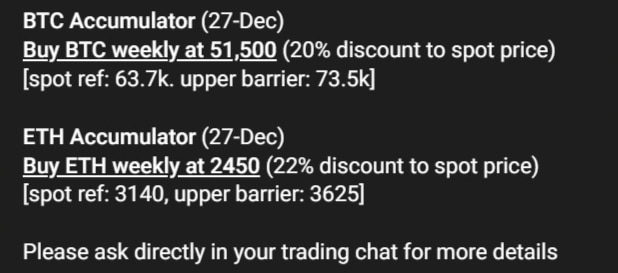

Experts predict a market reaction similar to the US, where institutional investors are buying heavily. QCP Capital says there is growing interest in this area, which could be a gateway for Asian institutional capital to enter. Additionally, QCP Capital recommends the BTC Accumulator and ETH Accumulator strategies for options traders, which place a weekly call for BTC and ETH at a discount to their spot prices.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!