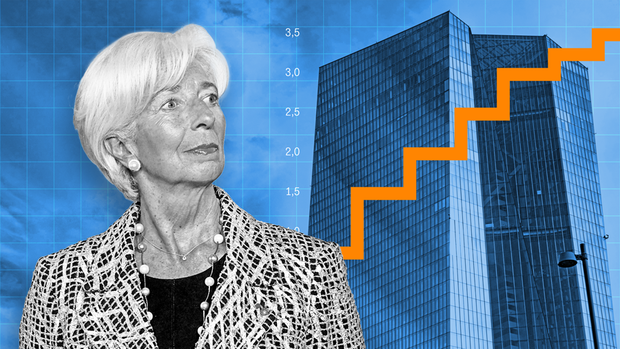

The central bank has raised interest rates in the euro area eight times since July 21, 2022.

(Photo: AP, Imago [M])

Dusseldorf, Frankfurt A year ago, Christine Lagarde announced a paradigm shift for the markets. The President of the European Central Bank (ECB) and her Council colleagues decided to raise interest rates in the euro area for the first time in over a decade.

What followed was a radical change in monetary policy, the effects of which caused severe turbulence and the long-term consequences of which still cannot be assessed. Overall, the central bank has raised interest rates by four percentage points within a year, and at least one more hike is likely to follow. The effects have been felt differently so far. The stock and bond markets have reacted quickly, but not much has changed on the labor market so far.

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Further

Read on now

Get access to this and every other article in the

web and in our app.

Further