Artificial intelligence bot ChatGPT produces a vertical forecast chart for Bitcoin. However, according to some analysts, the possibility is flashing that with the new price action, Bitcoin resembles the 2018 price action that plunged it into a steep bearish well. We have compiled analysts’ BTC price predictions for our readers.

Analyst predicts Bitcoin price will fall

cryptocoin.comAs you follow, Bitcoin price is trading around $28,000 and is approaching $30,000, a crucial psychological resistance level. Investors expect BTC to be at this point by next month. However, some analysts predict that the coin is heading in the opposite direction, potentially even falling by 45%.

In this direction, Crypto analyst Capo suggests that the price of Bitcoin will fall to $ 16,000 and below in April. When asked about the rationale behind this forecast, the analyst states that worsening macroeconomic conditions will have a significant impact on the price. Describing the last BTC rally as a dead cat bounce, Capo of Crypto also notes:

The main reason for this bounce from the lows is a liquidity gap after the FTX crash, which was filled by the initial bounce from the BUSD + USDC mint and the squeeze of late shorts and the recovery of traditional markets. Smart money does not buy. Bitcoin is not yet a hedge against inflation or disasters. This is why BTC crashes when the market enters a bear market (2022) and also during black swan events like in 2020 (Covid crash).

Bitcoin prediction from billionaire Mike Novogratz

Galaxy Digital CEO Mike Novogratz speaks to the bullish trend about crypto as Bitcoin, Ethereum, and other digital assets have recorded massive rallies since the start of the year. In a Galaxy Digital earnings call, Novogratz says that ‘the market is strong’ and that crypto prices are likely to rise in the coming months.

According to Novogratz, individual investors are continuing the rally as the two blue-chip cryptocurrencies outperform other asset classes. In this context, Novogratz says, “Again, Bitcoin and Ethereum have been the best risk-adjusted investments for two, three, four years since this year and individuals are taking it.” In addition, Novogratz makes the following statement:

This has been one of the ways or means for them to participate in the financial markets. Most of the price increase comes from the individual and so we see it directly not because we are doing it individually but because we are doing a lot…But the market looks strong and when I look at the charts technically, our weekly closes are big…Significantly higher three months, six months, nine months from now If so, don’t surprise me.

Bitcoin deja vu moment in Play-A confirmation could lower price

According to crypto analyst Sahana Vibhute, the recent surge in Bitcoin price is giving bullish signals as the bearish momentum appears to have stalled. Bitcoin price is moving towards $29,000 while the global market cap is also approaching critical regions around $2 trillion. A spectacular bullish pattern appears to be orchestrating over the crypto space, and most of the tokens could see a major price action at the earliest following that.

Meanwhile, some downtrend is also expected as the price pattern seems to repeat the previous trend. Throughout 2018, BTC price formed a triple pattern that emerged around 2018 highs, resulting in a massive downtrend. The price fell further sharply and saw a drop from around $19,000 to near $3,000 to mark the bottom of the rally.

The pattern is believed to be validated if the price drops and hits the initial target between $24,600 and $25,000. However, if the 2018 fractals hold, the BTC price is expected to drop to around $ 20,300. Interestingly, there is a CME gap that can be filled at these levels.

Banking crisis could ignite Bitcoin’s next bull run

Mike McGlone, product strategist at Bloomberg Intelligence, predicts that Bitcoin could potentially rise if the recession deepens in 2024. McGlone believes that traditional financial investors and institutions are realizing the need to add Bitcoin to their investment portfolios. He also thinks that if the S&P 500 index drops to 3,000 points, the Bitcoin price will not fall below $20,000 and has the potential to rise.

McGlone emphasizes that if Bitcoin stays above $25,000 and the S&P 500 index falls below 4,000, it will indicate that Bitcoin is ready to rise. This prediction is based on his analysis of the current economic environment and his belief that investors are becoming increasingly interested in Bitcoin as a potential investment option. In conclusion, while no one can predict the future with certainty, McGlone’s prediction that Bitcoin could potentially rise in 2024 if the recession deepens is a notable development in the cryptocurrency world.

What is the source of Bitcoin’s rise in 2023?

Arthur Hayes, the co-founder and former CEO of BitMEX, made a recent statement explaining why Bitcoin has recorded the uptrend it has recorded so far this year. According to the veteran crypto trader, Fear, Uncertainty and Doubt (FUD) seems to be powering the current bull market.

Bitcoin price projection to 2030 from ChatGPT

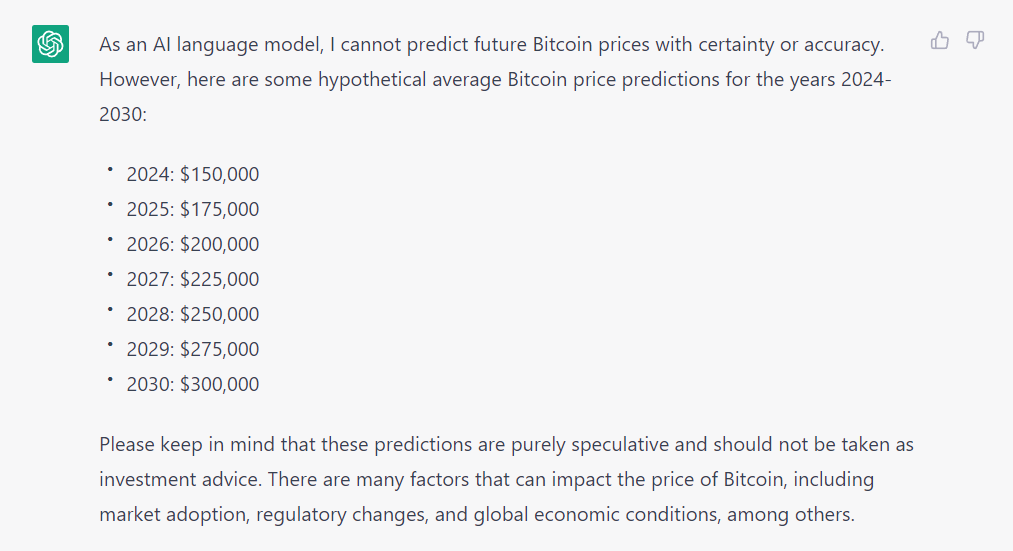

While Balaji Srinivasan, a venture capitalist and former CTO of Coinbase, makes a startling claim that the price of Bitcoin could reach $1 million in the next three months, many in the cryptocurrency industry are wondering if his prediction will come true. As the speculation continued, several analysts turned to ChatGPT for advice, and the results were positive, though far from the $1 million claimed by some.

When asked to provide hypothetical average Bitcoin forecasts for each year in the 2024-2030 range, ChatGPT emphasized that this is just an AI language model and that it ‘cannot predict future Bitcoin prices with precision or accuracy’. Still, it produced some fascinating rounded statistics. According to the forecasts offered by the AI tool, Bitcoin is projected to reach $150,000 in 2024 and increase by about $25,000 a year until it reaches the very attractive $300,000 in 2030.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.