Weekend, cryptocurrency The market experienced a decline as the leading cryptocurrency Bitcoin fell below. Supply pressure over the last three days has seen a 7-8% decline in Ethereum and XRP, a 5% decline in Cardano, and a 9-11% decline in Dogecoin and Shiba Inu, the most popular meme coins. concluded. This pointed to a market-wide correction.

However, industry experts see this decline as a common pullback for buyers to regain strength. Moreover, this correction can confirm the sustainability of an asset at higher levels and present favorable entry opportunities ahead of the next upward wave.

Additionally, according to ETF movements noted by Wu Blockchain on March 15, it was reported that there was a total net inflow of $198 million into Bitcoin spot ETFs. Bitcoin price continues to witness significant inflow through ETFs. Grayscale’s GBTC faced a net outflow of $139 million, while Fidelity’s ETF stood out with a net inflow of $155 million, contributing to a total historical net inflow of $6.87 billion. found.

On March 15th, the total net inflow of Bitcoin spot ETFs was $198 million. Grayscale ETF GBTC had a net outflow of $139 million for the day. The Bitcoin spot ETF with the highest net inflow for the day was Fidelity’s ETF FBTC, with a net inflow of approximately $155 million.… pic.twitter.com/5Rh3KznqCf

NEWS CONTINUES BELOW— Wu Blockchain (@WuBlockchain) March 16, 2024

Ethereum (ETH)

Ethereum (ETH) is positioned as a leading force in the blockchain industry by providing a platform for decentralized applications (dApps) through smart contract functionality. It forms the basis of many crypto projects and the Decentralized Finance (DeFi) ecosystem.

Ethereum, with its current market value of $445.7 billion, ranks as the second largest cryptocurrency. However, the recent market downturn caused the ETH price to lose 9.3%, falling from $4091 to $3709.

The daily time frame chart shows that Ethereum price is seeking support at the 23.6% Fibonacci retracement level, which helps identify a potential demand zone for buyers to regain control.

If supply pressure continues, coin holders could see a decline towards $3360 or $3135, which are horizontal support levels corresponding to the 38.2% and 50% Fibonacci levels.

Solana (LEFT)

solana (SOL) is a blockchain platform known for its features such as low transaction costs, scalability, and fast transaction speed. Its unique hybrid protocol enables significantly reduced verification times for transactions and smart contract execution.

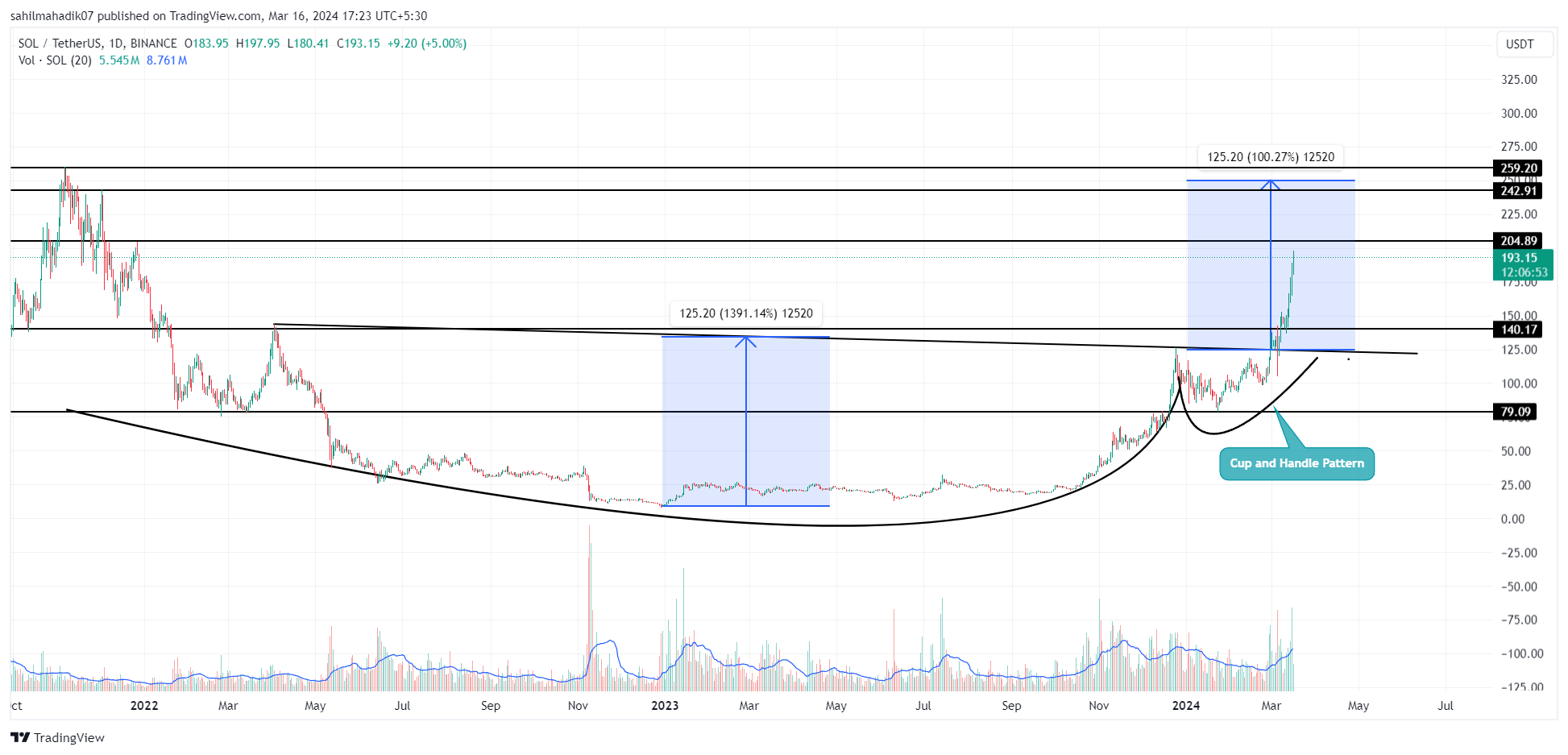

Despite the current market correction, Solana price has outperformed its peers, exhibiting a steady recovery evidenced by the six green candles on the daily chart. This rise increased SOL’s value to $196, bringing its current market cap to $86.6 billion, indicating growth of 45%.

The recent positive momentum in SOL price is supported by significant trading volume, currently around $11.3 billion. This intense trading activity could push the price closer to the resistance levels between $205 and $243.

On the other hand, key support levels exist near $169 and $140.

Chainlink (LINK)

LINK stands out in the crypto space as an ecosystem of decentralized oracle networks that act as a bridge between blockchain smart contracts and external data sources, increasing their applicability in the real world.

Chainlink LINK, the native cryptocurrency of the network, has recently experienced a significant increase in volatility, highlighted by the sawing movement seen on the daily chart. LINK price is currently trading at $19.33 with a trading volume of $1.16 billion and a market cap of $11.36 billion.

If a broader market correction extends the downward momentum in Chainlink price, coin holders could look for support at the $17.5 and $16.6 levels. Alternatively, buyers could face significant supply pressure near the $17.5 and $16.6 levels.

The current Bitcoin price corrective trend is seen as a post-rally correction aimed at regaining depleted bullish momentum. Major altcoins are affected by supply pressure, which is retesting local support and offering a discounted value to potential traders.