Richard Cantillon, one of the most important economists in history, revealed the effect of how money is distributed in the market on people’s purchasing power. Let’s take a look at this effect, also known as the Cantillon Effect.

Even though the number of minimum wage workers is no longer disclosed Almost half of Turkey Works for minimum wage or slightly above minimum wage. Naturally, minimum wage negotiations held at the end of each year take up a large place on the country’s agenda.

Negotiations on next year’s minimum wage have also begun. Some of the people want the minimum wage to increase, while others say, “The minimum wage should hardly increase at all, minimum wage increases trigger inflation.” says. For some reason, that inflation doesn’t hit everyone the same way. There’s a name for this, Cantillon Effect.

First of all, who is this Cantillon?

Richard Cantillon is a half-Irish, half-British economist. He was born in 1680, literally book of political economy He wrote and put forward ideas that are valid even today in entrepreneurship, while making a lot of money and making investments in Europe and America. His name is not well known today, though.

So what did Cantillon say?

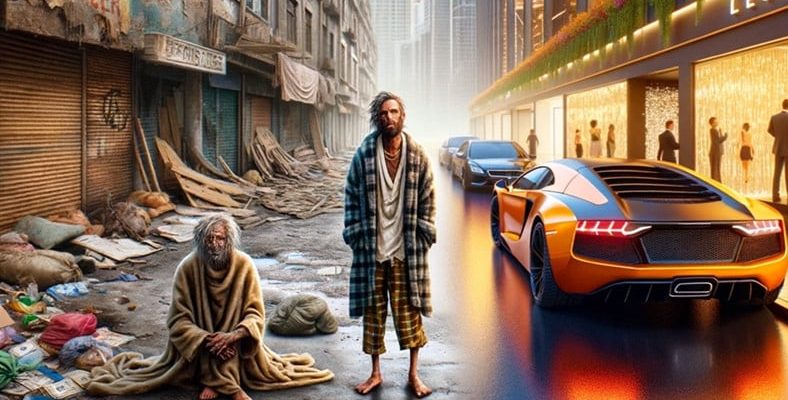

Although Cantillon has many important views, the one we will focus on today is this: When the government prints new money, this The circulation rate and amount of new money are important, Since it creates gradual inflation, it causes income inequality to widen.

In fact, we have seen this situation globally, and we see it in our country as well. During the pandemic, economic aid was provided directly to the public in countries for perhaps the first time, but The main money again flowed into turning the gears of big companies. Almost every country did this by printing money.

This money is technically what big companies announced after the pandemic. record turnover and profits transformed. How Does? Let me explain this with an example.

Let’s say Webtekno is a closed economy.

In this example Webtekno a closed economy And we assume that we spend the money we earn on Webtekno. We get everything from here. Think of it more like a country.

- Initially, the amount of money in the market is fixed. The boss, by introducing new money into the system (if we consider Webtekno as a country, by becoming a state and printing money) increase the amount of money available decides.

- Instead of distributing the money to everyone, the boss to people he trusts, for example, gives it to one of our content producers, Erkan Ceylan. At this point, other employees are unaware of this situation.

- Erkan Ceylan comes to Webtekno. money to spend starts. He buys whatever he wants at the current price and makes investments. We also become aware of monetary expansion.

- PricesTo keep up with the new demand to increase starts. If demand is high and supply is limited, the price rises. this too monetary inflation gives birth.

- While prices are rising, low- and middle-income earners and people on a fixed salary have to pay for anything. He started paying more money.

- Our friend Erkan Ceylan collected everything at low prices, and the value of his assets increased. If it’s ours to buy something It has become even more difficult now.

The important point here is How money enters the market is happening. If money enters the market through a certain group or the rich, the group that first accesses the money gains from the purchase; More importantly, it can buy at prices that are not affected by inflation. If he is lucky enough, he can use economies of scale to find the lowest prices. The poor citizen, whose income is fixed, becomes even poorer with inflation.

Of course, while the rich are rich, the expenses of the richer class stimulates the economy and average incomes are rising. The increase in demand makes it easier to find a job. These demands enable the rich to sell more. The rich are getting richer again, while the poor are trying to exceed their old purchasing power.

Whereas The price of everything does not change the same, the price of some products increases earlier. Because of this imbalance, things begin to be seen as more valuable even if they do not produce added value. The Cantillon Effect reveals exactly the impact of this unequal inflation and money flow on income inequality.

So what is the connection between this effect and the minimum wage?

Cantillon Effect After it was brought to the agenda, it was stated that employees should have a minimum income that would enable them to continue working. To explain the article without turning it into the Epic of Manas, the money entering the system first goes through an initial cycle in which the people closest to the money become better off. The further away we are from the source of money, the more difficult our situation becomes.

When determining the minimum wage latest minimum wage will benefit. In fact, many minimum wage earners will start to buy more expensive products produced by other minimum wage earners like themselves, before they receive the increased salary. The new money entering the market will reach the poor last, and the one who collected the parcel first will collect it. Even when asked “The minimum wage has increased, so prices are increasing, salary costs have increased.” It will be said. They are not wrong either. At the end of the day, with the minimum wage increase, it will be possible for minimum wage earners to commute to work. The money entering the system will not contribute much to those who are far from the source.

us too “We will say what Cem Yılmaz said in the movie “Everything Will Be Fine”: “At least we’re alive, that’s something bro!”

For our other like-minded content, here’s how:

RELATED NEWS

Despite Economic Growth, Why Can’t Citizens Feel It Positively?

RELATED NEWS

If the Economy is Bad and Everything is So Expensive, How Can Everyone Spend Money Like Crazy?

RELATED NEWS

What happens if a new customer comes to a town where everyone owes money to each other and contributes 500 TL to the economy?

RELATED NEWS

What are the Positive and Negative Sides of the Minimum Wage Increasing Too Much Suddenly?

RELATED NEWS