Cryptocurrency markets have been shaky for a while. Bitcoin, which has been in a downtrend since the beginning of 2022, has almost collapsed after the UST crisis that broke out recently. So what exactly happened? How did the chain of mistakes that made the crypto money markets happen?

It has been one of the most discussed investment instruments since the first day. cryptocurrenciesis going through one of the most tumultuous periods in its history. All cryptocurrencies in the market, especially Bitcoin, are experiencing an unprecedented ‘collapse’. It is not possible to predict when the decline will end. So what happened to the markets? Let’s go to the cryptocurrency markets the latest situation, events, details and forecasts for the future. Let’s take a closer look together.

In fact, Bitcoin is still at a fairly high level. coinmarketcapAccording to the data we received from , the cryptocurrency is hovering above $ 28 thousand as of now. After all, you cannot buy any other investment instrument as a unit at such a high price today. But when we look at the big picture, that is, the long-term situation, The drop in Bitcoin is eaten and swallowed We can see that it is not level. Let’s take a look at what kind of picture Bitcoin has been painting since 2021.

We were discussing $70,000 for Bitcoin in November 2021

*Bitcoin price chart. Source: Coinmarketcap

Bitcoin was trading at $ 29,000 on the last day of 2020. 2021 was quite active for the markets. Even when we come to November 2021 70 thousand dollars we started talking. But now the situation is reversed. As of the date and time this article was written, Bitcoin is trading at $28,350. In other words, a person who bought 1 Bitcoin on December 31, 2020, first increased his money by 2.4 times, and then lost this money.. In fact, as of now, this ‘fictitious investor’ has made a loss. Of course, this was true of all altcoins. So how did things turn around when everything was going well?

Actually, the arrival of Thursday was obvious from Wednesday.

The COVID-19 pandemic has affected the whole world economically. The downsizing due to curfews, the loss of businesses come to a closing point, disruptions in supply chains… All of these put governments in trouble. Even the ‘super power’ USA announced record inflation in this process. It was not possible for everything to go smoothly in the crypto money markets when there were such large-scale problems in the global sense. Yes, the decentralized nature of Bitcoin was not affected by the pandemic, inflation figures and crises, but those who set the markets were also affected by them. were people. So actually, the arrival of Thursday was obvious from Wednesday…

Governments for their citizens in the early part of COVID-19 support packages they announced. Many analysts attributed the rise in the cryptocurrency markets to this first. The prevailing view was that the support people got when they had money in their pockets flowed to cryptocurrencies. This was a guess that sounded plausible at first glance because the size of the total money in the cryptocurrency markets, By the end of 2021, it had reached $3 trillion. So money was pouring into the market, flowing into Bitcoin and all other cryptocurrencies.

RELATED NEWS

Binance Stops Withdrawals for Terra (LUNA)

Safe harbor issue and rising interest rates

Cryptocurrencies have been considered ‘risky’ by analysts since the first days of their release. The biggest reason for this is that cryptocurrencies are not connected to any center. In addition, the status of any country’s currency is not important for cryptocurrencies. This situation has always frightened investors. So much so that many people use cryptocurrencies “unreliableInvesting in technological currencies was insane for many economists when there were traditional, ‘safe haven’ investment instruments such as gold, silver and even oil. , they were waiting for an opportunity to escape. The decision to increase the interest rates of the countries was seen as a sufficient opportunity for the money to be withdrawn by the investors looking for a safe haven and therefore to devalue Bitcoin. But that wasn’t the only reason.

Whale hits and scams

The unsupervised and decentralized structures of the crypto money markets, most of all.whaleWhales, which have been in existence since the first day of cryptocurrencies, can play with the ‘settings’ of the markets as they wish. Whales, which sometimes put selling and sometimes buying pressures, annoyed small investors with their surprise moves, so to speak. In fact, if you look at the social media accounts that post about cryptocurrencies today, you can see that this is the case. crypto- even the phenomena you can see. Of course, there is also the fraud dimension. With the spread of cryptocurrencies, there have been numerous hijacking events. sometimes of the stock markets with money from investors none We witnessed that. These two reasons have opened Bitcoin, whose reliability has already been questioned, to the discussion.

RELATED NEWS

Cryptocurrencies Lost $275 Billion In Just The Last 24 Hours

Meanwhile, the negative news spread by traditional finance advocates should not be overlooked. According to them, both Bitcoin and other cryptocurrencies from fraud it consisted of Basically, that wasn’t true because most cryptocurrencies had a specific project behind them. However, rumors that the digital financial system will overtake the traditional financial system and a new world order will be established have caused negative news to be constantly pumped. While these were happening, small investors either lost their money or couldn’t handle the stress.to safe harbors was heading. This meant a drop for Bitcoin.

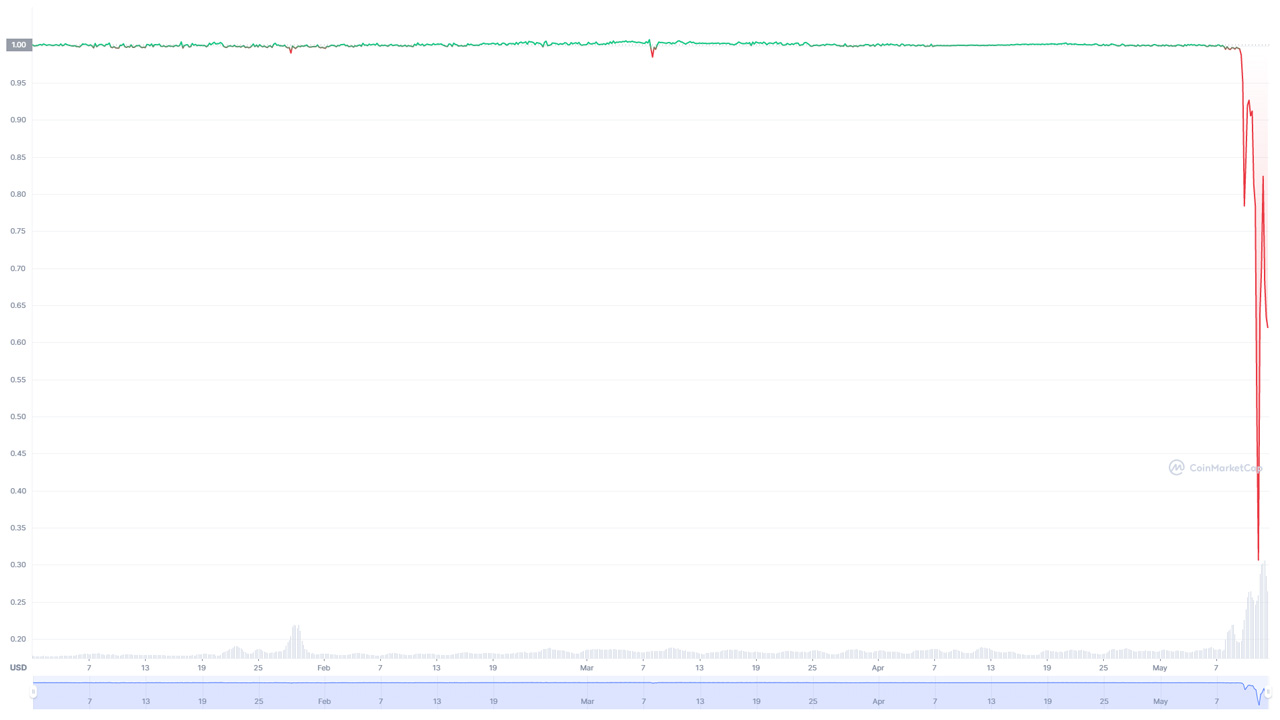

The markets that have fluctuated since the beginning of 2022 almost collapsed with the Terra (LUNA) and TerraUSD (UST) crisis.

*UST price chart. Source: Coinmarketcap

Everything we’ve talked about so far has been about Bitcoin and other cryptocurrencies entering a downtrend. by 2022 47 thousand dollars Bitcoin, which entered the levels, fell swayingly with one-and-a-half movements. While small and medium-sized investors and many crypto money phenomena were waiting for this decline process to end, an event that no one expected happened. A stablecoin indexed to the dollar TerraUSD (UST)allegedly fell victim to an ‘operation’. The price of UST, which should always be close to $ 1, fell to the level of $ 0.2 the other day. The fact that even a dollar-indexed crypto currency depreciated like this, the markets “your downfall” was another factor that triggered it. Right here is another point that millions of investors missed:

There are many different stable coins on the market. For example Tether (USDT) and USD Coin (USD). The projects behind these cryptocurrencies are trying to keep the cryptocurrencies stable. direct dollar reserve they are holding. This means exactly real security for the constant value. In UST, the situation is different. The team behind this cryptocurrency also supports LUNA, an altcoin on the Terra network. So UST with LUNA brother and they work together. In order to keep the UST around $1, LUNA was traded, sometimes burned, with a certain algorithm. This is exactly why the events are described as “operation”. The algorithm for keeping the UST at $1 is so to speak “be overthrown“It turned things upside down on behalf of Terra. The fact that the team behind LUNA and UST sold Bitcoin, the investor’s fuss, and the negative statements from names such as the US Treasury Secretary, first affected Terra and then the whole market. brought it to where it is today. it happened…

What awaits the investor?

The question that everyone is wondering right now is what or what awaits the market in the future. At this point concrete no information we can say. When we take a look at the statements made by crypto money phenomena, we see that there is a difference of opinion. While some think that the markets will recover, others say that the downtrend will deepen and these are good days. According to some, both Bitcoin and other cryptocurrencies, best buying opportunity in history and this opportunity should not be missed. What will happen in these conditions where technical analysis and forecasts are opposite corners? we will watch and see together…

This content is not investment advice…