As Iran-Israel tensions escalate, the global crypto market has suffered a major loss of value. These developments triggered panic selling in the markets, reducing the value of the global crypto market by 20%, from $2.64 trillion to $2.21 trillion. The market’s reaction on Monday will be important. Because the flash crash has eroded confidence and investors will be watching to see how they react. On the other hand, this negative atmosphere in the crypto market was welcomed by some with the thought that Bitcoin could experience a correction similar to the halving events in the past. Bitcoin The price dropped as low as $60,660 but rose again to the $64,300 resistance level within a few hours. Currently, BTC price is trading around $64 thousand. This shows that Bitcoin remains relatively calm despite the fluctuations in the market.

As we reported as Koinfinans.com, Rekt Capital argues that the current Bitcoin cycle is progressing faster compared to previous cycles. “Reaching all-time highs before the halving is a clear indication of this acceleration. But the current pullback and sideways movement is exactly what is needed to slow and stabilize the cycle.” Rekt Capital adds that these pullbacks and periods of consolidation will help resynchronize the current cycle with historical cycles.

ETH The price dropped by 9% to below $ 3,000, causing other altcoins such as SOL, XRP, ADA, DOGE, SHIB to fall between 20% and 50%.

While the ETH/BTC rate will decline to 0.46 levels in 2021, analyst Benjamin Cowen predicts that ETH/BTC may bottom this summer. In the past cycle, the ETH/BTC rate fell to the bottom after the first interest rate cut after breaking the support, and “it fell for 2 months, then hit the bottom.” he stated.

As whales buy at these lows, a huge risk arises in the DeFi market. As the CRV (Curve DAO Token) price drops to $0.42, Curve founder Michael Egorov is facing liquidation of his credit positions. Michael borrowed $92.54 million in stablecoins by pledging a total of 371 million CRV (worth approximately $156 million) through 5 addresses on 6 different lending platforms. It is currently at risk of liquidation, with its health ratio falling around 1.1.

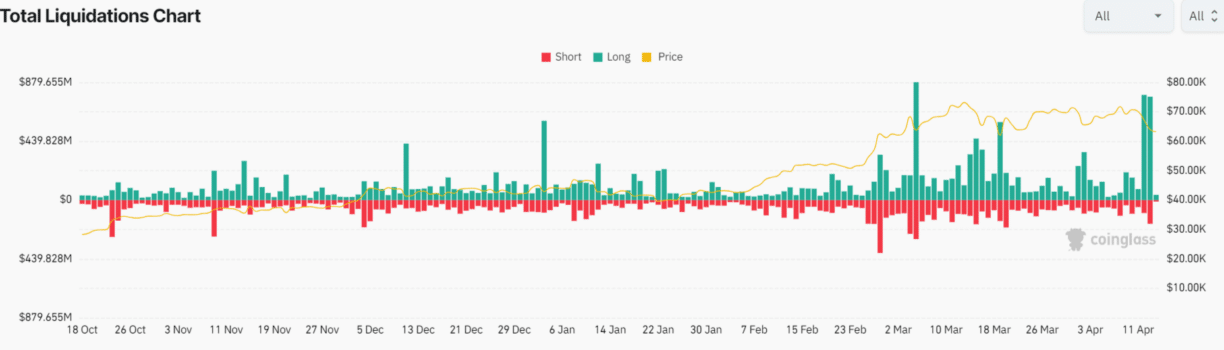

Coinglass data shows that more than $2 billion has been liquidated in the crypto market amid this strong panic selling. Of these, approximately $1.5 billion in long positions and approximately $500 million in short positions have been liquidated since Friday. Saturday, crypto- The market witnessed another liquidation of $950 billion.

More than 252,000 traders were liquidated in the past 24 hours, with the largest single liquidation order occurring on crypto exchange Binance, when one person sold $8.46 million worth of BTC.

Traders and investors should remain cautious ahead of the latest data on the US dollar index (DXY) and US 10-year Treasury yield.