Bitcoin wind is blowing in the cryptocurrency world. There are expectations regarding the approval of the Spot ETF. BTC has rallied 12% in the last 24 hours. Of course, this rally has repercussions on the bears’ side. Let’s look at the details.

Bitcoin exceeded 35 thousand dollars after 1.5 years

Bitcoin (BTC), the world’s largest cryptocurrency by market value, exceeded $35 thousand. It turned out to be a complete defeat for the Bears. Accordingly, the latest increase caused the liquidation of approximately $ 399 million in cryptocurrency derivative positions. Approximately 75% of this significant amount was attributed to short positions. Among these, a short position worth a total of $298 million was liquidated. This liquidation represents the biggest liquidation for Bitcoin (BTC) bears.

According to data from Coinglass, the single most significant liquidation amounted to $10 million. This liquidation is also linked to BTC/USDT short positions on Binance. On BitMEX, another major cryptocurrency exchange, the rate of liquidations initiated by bears was a staggering 99%. On the other hand, Ethereum liquidations also attract attention. Accordingly, liquidations of 60 million dollars were in question. When there were such big movements, BitMEX founder Arthur Hayes made a statement. Accordingly, he pointed out that this significant run could be an indicator for the beginning of the upward phase.

Significant increase before Token Unlock

While Bitcoin is experiencing price growth, there is a significant development in Optimism (OP), a leading Layer 2 scaling solution for the Ethereum network. Accordingly, the market is preparing for the token unlocking event scheduled for October 30. A significant amount of tokens worth $32 million will be released at this event, matching the previous token unlock. Notably, the OP token price has already experienced a 5% increase in anticipation of this event, which will significantly impact approximately 2.74% of the token’s circulating supply.

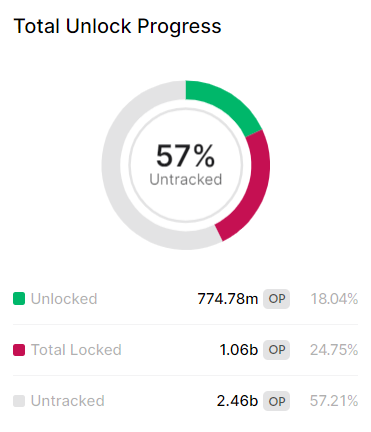

It is noteworthy that the price of the Optimism (OP) token increased by 5% before the event. Accordingly, it reflects the positive atmosphere prevailing in the Bitcoin and cryptocurrency market in general. According to data provided by Token Unlocks, approximately 18.04% of the total OP tokens have already been unlocked. Accordingly, this corresponds to a total of 774.78 million OP tokens.

MINA, the leader of the rise

Often praised as the world’s lightest Blockchain network, Mina Protocol (MINA) has taken center stage in the ongoing altcoin resurgence. Over the past 24 hours, MINA has gained a remarkable 88%. Accordingly, it increased its price to $0.7712. It aims to revisit $1.17, its biggest target since the beginning of the year. MINA seems to have received the biggest share from the increase in Bitcoin price.

MINA’s recent resurgence shows that an altcoin’s rally is influenced by the performance of Bitcoin BTC. On the other hand, it reminds us that it often depends on its unique foundations and strong community support. When we look at it as Kriptokoin.com, MINA has not only kept up with the major altcoins. It has also made significant gains of up to 109% in the last seven days. It has also emerged as one of the best performers for altcoins.

To be informed about the latest developments, follow us Twitter’in,Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.