Bitcoin ETF approval, which is eagerly awaited by participants in the cryptocurrency market, continues to be the number one item on the agenda. ETF approval continues to be the number one item on the agenda. As the deadline for several filings approaches in January 2024, the question on everyone’s mind is: Will ETFs succeed in restoring crypto liquidity to pre-FTX crash levels?

In a published report, Kaiko cited ETFs as the “biggest catalyst” in revitalizing market depth and trading volumes, two measures of liquidity.

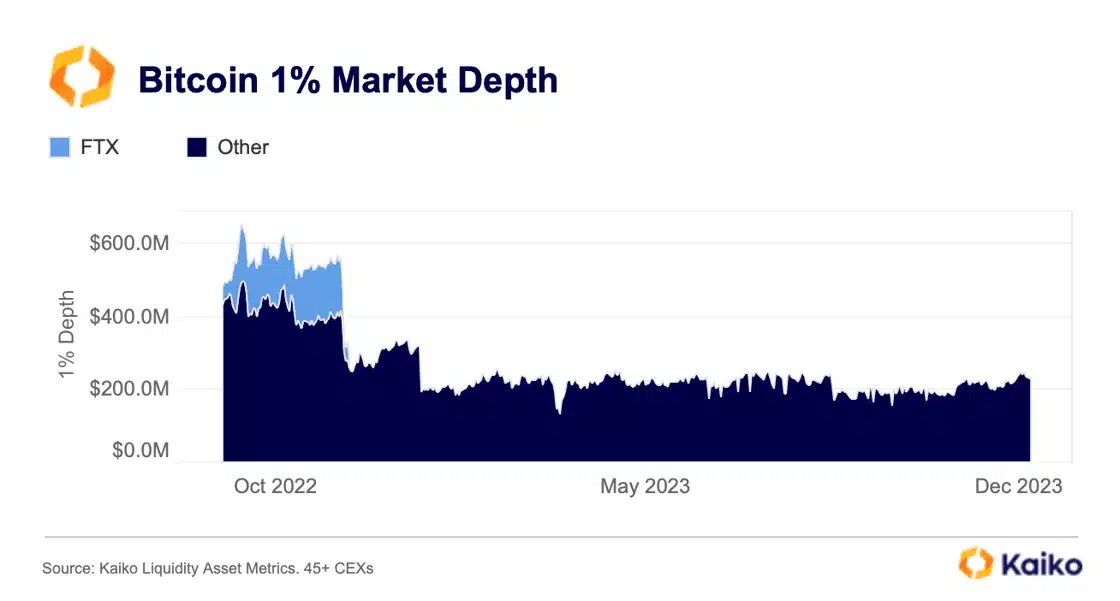

As seen in the chart below, the market was hit hard after the FTX crash and remained under pressure for most of 2023. Even the ongoing market rally was not enough to produce a meaningful recovery.

Possible spot Bitcoin ETF approval may encourage many large investors to step into the sector. Since these ETFs are expected to be very close to the BTC price, it seems clear that they will attract the attention of investors.

Kaiko therefore thinks that liquidity in the market is more likely to increase once spot ETFs are given the green light.

As we reported as Koinfinans.com, after the launch of ETFs, a capital inflow of $155 billion is expected into the Bitcoin market, which represents a strong capital inflow that could move the price per BTC to the range of $50,000 to $73,000.