Rising up to $48,000 last week BitcoinIt fell to $41,000 due to the sales pressure it experienced afterwards.

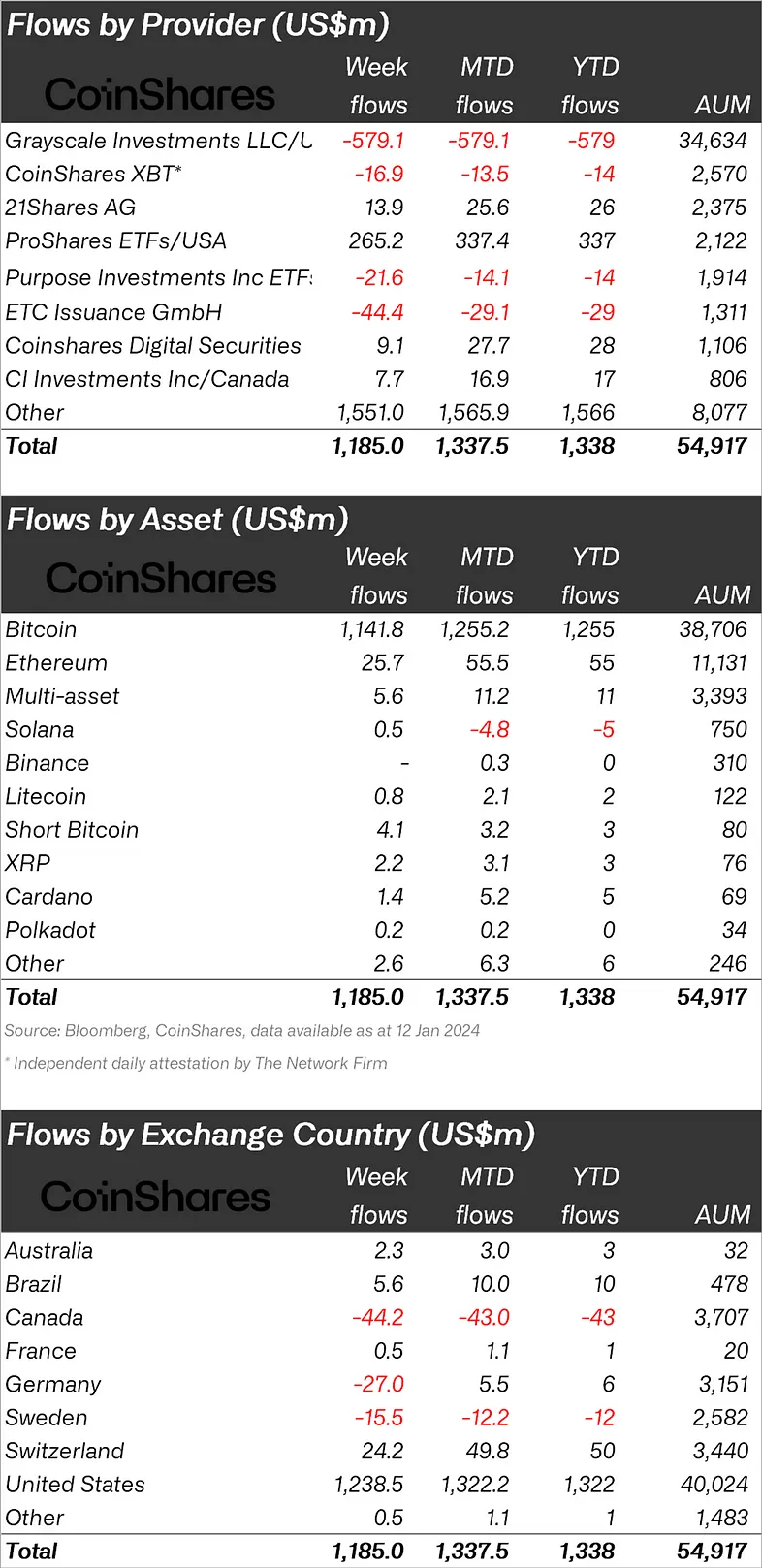

BTC While it is currently trading at $42,000, CoinShares published its weekly cryptocurrency report and said there was an inflow of $1.18 billion last week.

“Cryptocurrency investment products saw inflows of $1.18 billion after the spot Bitcoin ETF approval launch last week, but this did not break the record set at the launch of futures-based Bitcoin ETFs.”

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

BTCexperienced an inflow of 1.14 billion dollars last week, the largest altcoin Ethereum‘in (ETH) An inflow of $25.7 million was seen.

Indexed to the decline of BTC Bitcoin Short It was seen that there was an outflow of 4.1 million dollars in the fund.

When we look at other altcoins Solana (LEFT) 0.5 million dollars, XRP 2.2 million dollars, Litecoin (LTC) 0.8 million dollars, Cardano (ADA) It experienced inflows worth $1.4 million.

“Bitcoin saw $1.14 billion in inflows last week; The short Bitcoin fund saw a small inflow totaling $4.1 million.

A total of $26 million was seen inflows into Ethereum and $2.2 million into XRP.

A notable exception was Solana, which saw just $0.5 million in inflows last week.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 1.24 billion dollars.

After the USA, Switzerland ranks second with 24 million dollars; Brazil ranked third with 5.6 million dollars.

Against these inflows, Canada received 44.2 million dollars; Germany experienced an outflow of 27 million dollars.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!