US inflation data was released at 15:30 today. The latest situation in Bitcoin and gold markets after the annual inflation that came below expectations is as follows…

June 13 US inflation data

Inflation in the US continues to fall as it has in recent months. The US annual inflation data (CPI) announced today was determined as 4%. Expectations were 4.1, the previous CPI was 4.9. Thus, the monthly inflation data came in as expected, while annual inflation of 4% was the lowest level in nearly two years.

Market participants expected prices to rise by 0.1% compared to the 0.4% increase in April 2023, while CPI data were expected to give signs of easing inflation. Investors are now waiting for a pause in rate hikes from the June 14 FOMC meeting. Before that, the reaction of the Bitcoin and gold markets to the inflation data of the day was positive…

Bitcoin price rises on inflation data

Bitcoin price has seen a bounce in the last 24 hours ahead of the CPI data. It reached the $26,000 range during the day. Following the release of the data, it jumped 3% compared to the daily low of $25,700. Then came some correction. The leading crypto is hovering just below the $26,000 region, which is the intraday high at the time of writing. In general, it reacted positively to the inflation data.

Ounce gold price rises to test $1,970 after inflation data

The gold price made a sharp jump from $1,950 to the $1,970 region after the release of inflation data. However, it was unable to reach higher levels afterward and was harshly withdrawn. If it breaks above $1,970, it will target $1,975 initially and then $1,985, the June high. On the downside, support emerges at $1,950 followed by $1,938. Gold price is currently gaining momentum on the downside from the first critical support at $1,950.

US markets overview

After the CPI figures, US yields fell sharply and the US dollar fell. The 10-year return fell from 3.74% to 3.69%. DXY hit a three-week low near 103.00.

What’s next?

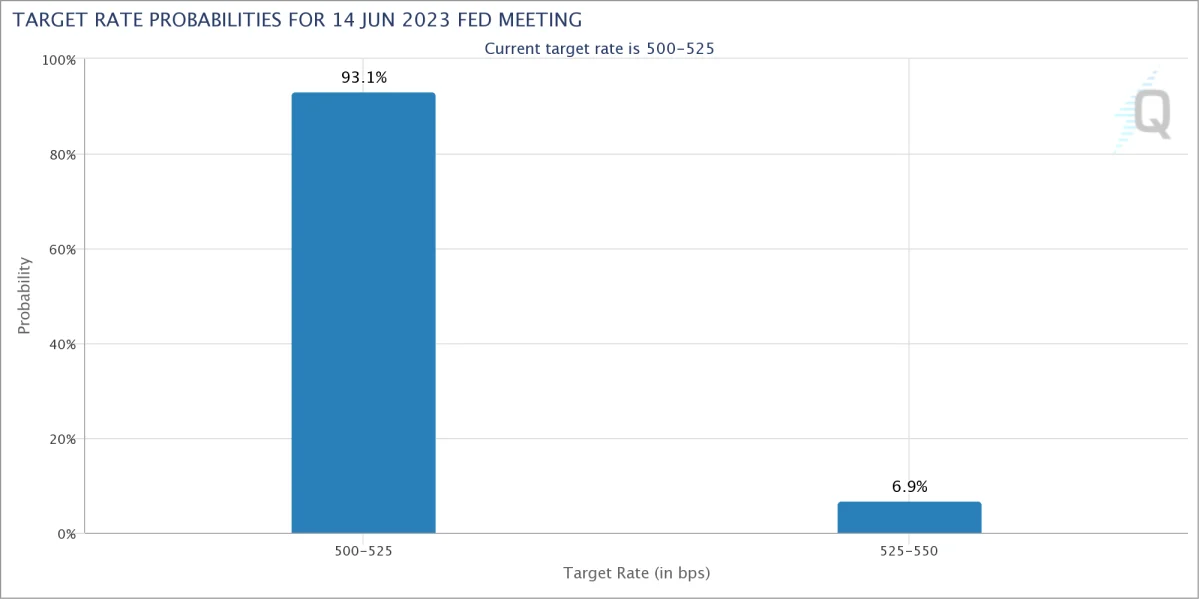

After the Federal Open Market Committee (FOMC) meeting, the Fed will update its interest rate outlook on June 14. According to CME Group’s FedWatch Tool, rates that started the day at 75% at the time of this writing have risen to over 90%.

Meanwhile, multiple commentators noted that BTC/USD has closed the gap in CME Bitcoin futures since the weekend. On what’s next for BTC, Michaël van Poppe stated that $25 offers an opportunity to buy.

Finally, Binance order book data from Material Indicators clearly shows a lack of liquidity near the spot price with support and resistance before printing.

cryptocoin.com As we have reported, the inflation data of the day combined with more than one event. XRP price gained more than 7% after the Hinmann documents.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.