On Friday, US National Security Advisor Jake Sullivan said in a briefing at the White House that tensions between Ukraine and Russia were escalating and that an invasion might take place soon, which led to an increase in sales in the markets.

While the tension between Russia and Ukraine continued, the phone call between Putin and Biden at the weekend did not yield a positive result.

While some airlines stopped flights to Ukraine, the Pentagon ordered US troops to leave Ukraine.

We see that there is an expectation that Russia can invade Ukraine at any moment. This reduces the risk appetite in the markets.

Latest Situation in the Markets

When we look at the markets that are preparing to start the week with the Ukraine agenda, we see that the US 10-year figures, which rose to 2.06% after the inflation data last week, decreased to 1.913%.

The dollar index continues to rise above the 96 level.

On the US futures side, we see that the losses are above 1%.

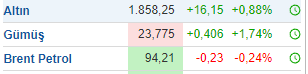

The winner of the Russia Ukraine crisis was Gold and Oil. Gold remains above $1850, while Brent Oil is trading at $94.

Despite the losses in the US futures, the preservation of the $42,000 level in Bitcoin shows that there is a positive expectation from the stock market opening in the evening.

Bitcoin continues to move sideways for 3 days after losses on Friday. The course of the US stock markets, which will be opened at 17.30, will also be decisive for the direction in Bitcoin.

Technically speaking, we remain in the $43100 and $41800 bands.

*Not Investment Advice.