Bitcoin price witnessed a rally on Tuesday with news that Fidelity is preparing to apply for a spot Bitcoin ETF soon. The momentum has continued since BlackRock’s June 15 ETF move. Analysts point to technical moves for the next price levels.

Jim Wyckoff attributes recent rise for Bitcoin price to ETF news

According to Kitco senior technical analyst Wyckoff, continued positive developments for BTC caused July Bitcoin futures prices to soar in the early hours of Tuesday. Wyckoff said, “Bulls have an overall short-term technical advantage as there is a steep price rise on the daily chart. A bullish pennant is now forming on the daily chart,” he summarized.

Matteo Greco, research analyst at Fineqia, said, “BTC has traded around $30,000 in the last five days. In Friday’s trading session, it hit nearly $31,500, its highest price of the year to date. More importantly, it shows positive delta in the annual price metric for the first time since February 2022.”

This development alone “doesn’t tell us whether the bear market is over and whether we’re at the start of a new uptrend,” Greco said. But he said it was a “combination of good news at the macroeconomic level and news about BTC adoption by institutions.”

Matteo Greco drew attention to the trend of miners and investors

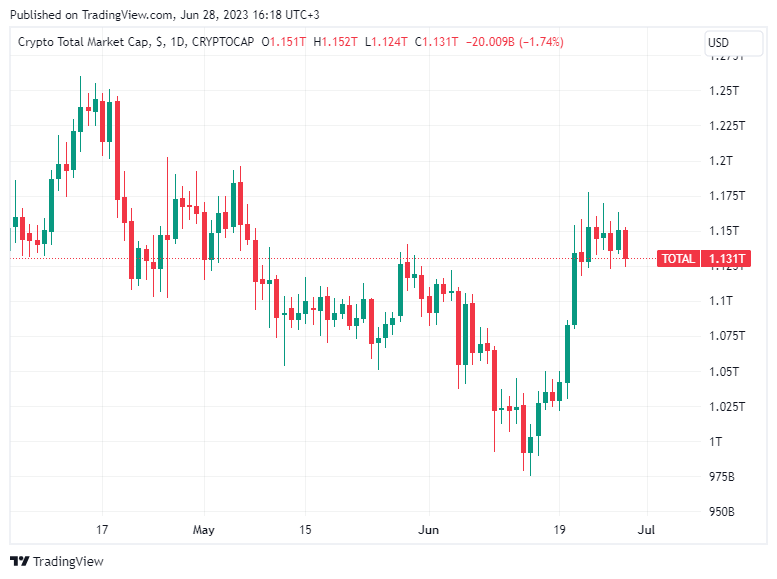

Greco also took a look at the increasing Bitcoin dominance, which has recently reached 51.5%. He said that for now, BTC is leading the uptrend in the market. “The data, coupled with the lower trading volume in 2023, confirm the trend of less speculative environment over the past few months. Investors are rebalancing their portfolios towards a greater BTC exposure. It also reduced the volatility and risk of their portfolios,” he added.

Greco also touched on the Bitcoin mining difficulty. At this point he noted:

Since October 2022, the increase in mining difficulty and difficult market conditions have caused the mining price of BTC to be higher than the market price of BTC. What this tends to do is force miners to sell most of the BTC they mine to keep their mining facilities running. However, we are currently seeing a BTC price premium compared to BTC mining costs for the first time. If this trend continues, it could reduce the BTC selling pressure from miners and potentially lead to the continuation of the current uptrend.

Justin Bennett warns Bitcoin bulls of a potential correction

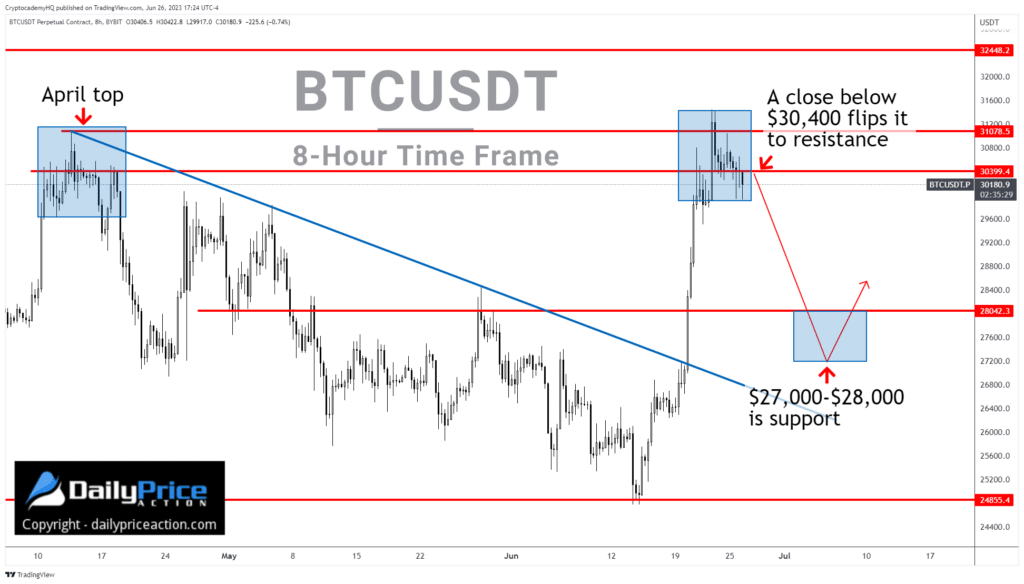

The popular crypto analyst said that the Bitcoin correction is imminent. Bennett noted that BTC has started an “impressive” rally since June 15. BTC has gained nearly 25% in less than two weeks.

However, Bennett says the crypto king may give up some of his gains. In their analysis, BTC A pullback to the $28,000 area seems likely to clear long positions. The $27,000-28,000 zone will determine where BTC will trend in July,” he wrote.

According to the analyst, if Bitcoin manages to break the $31,000 resistance, the short-term bearish view will be invalidated. According to their analysis:

Alternatively, a sustained break above $31,000 indicates that the bulls are in control, exposing $32,500.

Bitcoin price ready for second run targeting $35,000

According to crypto analytics firm Matrixport, BTC tends to outperform in July overall. According to the report, Bitcoin’s performance over the past decade has been increasing at an impressive 11% average each July. Thus, it provides positive returns in seven of the last ten July.

The study also revealed significant returns in July of the previous three years, with increases of approximately 27%, 20% and 24%, respectively. “Summer tends to be a period of consolidation for bitcoin,” Markus Thielen, head of research, said in the report. Meanwhile, there is a strong July, a mediocre August and a sale in September,” he said.

The Matrixport report predicts that the Bitcoin price will rise to $35,000. However, it warns of a pullback to $30,000 ahead of the extreme bullish cross above $40,000. The firm estimates that the Bitcoin price will be worth $45,000 by the end of 2023.

Raoul Pal predicts cryptocurrencies will be the top-performing market

The former Goldman Sachs executive said in a new post that cryptocurrencies will outperform even what he calls Exponential Age stocks and tech company stocks.

The macro guru indicates that the crypto market is experiencing greater volatility than the traditional market. cryptocoin.com As we have reported, it has recently made a purchase call.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.