The US Securities and Exchange Commission failed to provide sufficient clarity for altcoins. Which altcoins will you say now? You may recall that in the past weeks, the SEC used the term securities for a number of cryptocurrencies.

What’s next for altcoins?

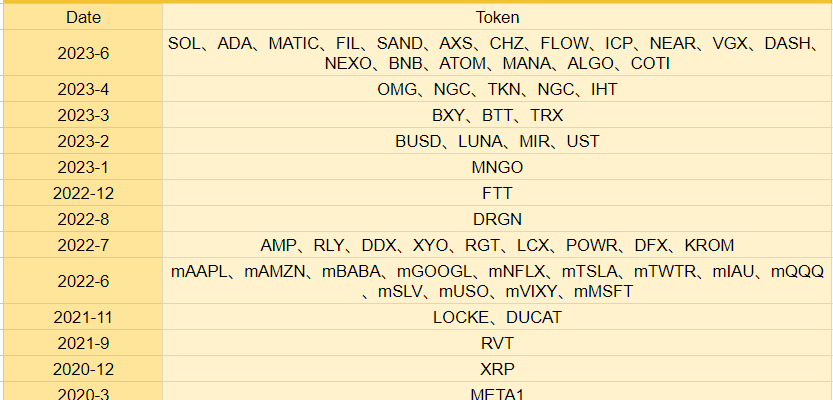

Crypto investors are wondering what the next step will be. Others question whether these assets can be registered as securities. It also asks if it can be traded on the Nasdaq. Researchers believe that the SEC’s classification will end the existence of several altcoin pairs. On the other hand, it is among the statements that it will cause it to be removed from the list on crypto exchanges. The SEC has labeled cryptocurrencies with a total market capitalization of $100 billion as securities. The initial impact of the SEC’s actions was a large-scale outflow of capital from altcoins and a drop in their prices.

Exchanges and social trading platforms like eToro and Robinhood have made strides. They delisted assets that the SEC labeled as securities. Market participants are speculating on what’s next for these cryptos.

A crypto trader named @javacrypto_ is questioning whether these assets can be registered as securities. Examining the content of Hinman’s emails and SEC executives’ internal messages revealed a lack of clarity in testing or analysis that helps decide whether an asset is “decentralized enough”. The publication of the documents increased confusion among experts and analysts.

Securities classification that will affect US-based crypto exchanges and traders

K33 Research senior analyst Vetle Lunde states that securities classifications will affect all US-based crypto exchanges. She also emphasizes that the end will come for various altcoins, she says. So the SEC’s move becomes expensive for both the tokens that are considered securities and the crypto exchanges that list them. Moreover, securities can only be traded by clearing houses and transfer agents and regulated exchanges with physical certificates. This increases the barriers to registration of tokens as securities. On the other hand, it creates new challenges for investors who want to access and trade them.

Also, the SEC’s classification may block DeFi ecosystem tokens, which are Ethereum alternatives such as Solana and Cardano, which support various assets on their blockchain. According to CoinGecko data, there is a decrease in the total market value of Bitcoin and altcoins group. Accordingly, it has decreased by 2.65% since June 5th.

Altcoins are suffering under selling pressure from regulatory pressure. Because cryptocoin.com As a result, the market value is likely to decline further.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.