Bitcoin’s price recently came very close to psychological levels and tried to break important support levels. This sudden drop in Bitcoin and fluctuations in the global markets negatively affected the cryptocurrency world. The dreaded big drop didn’t seem to happen this time and Bitcoin bulls started the recovery process again.

Here are Bitcoin, Ethereum and Ripple analysis and key support levels.

Is Bitcoin Waiting For A New Uptrend?

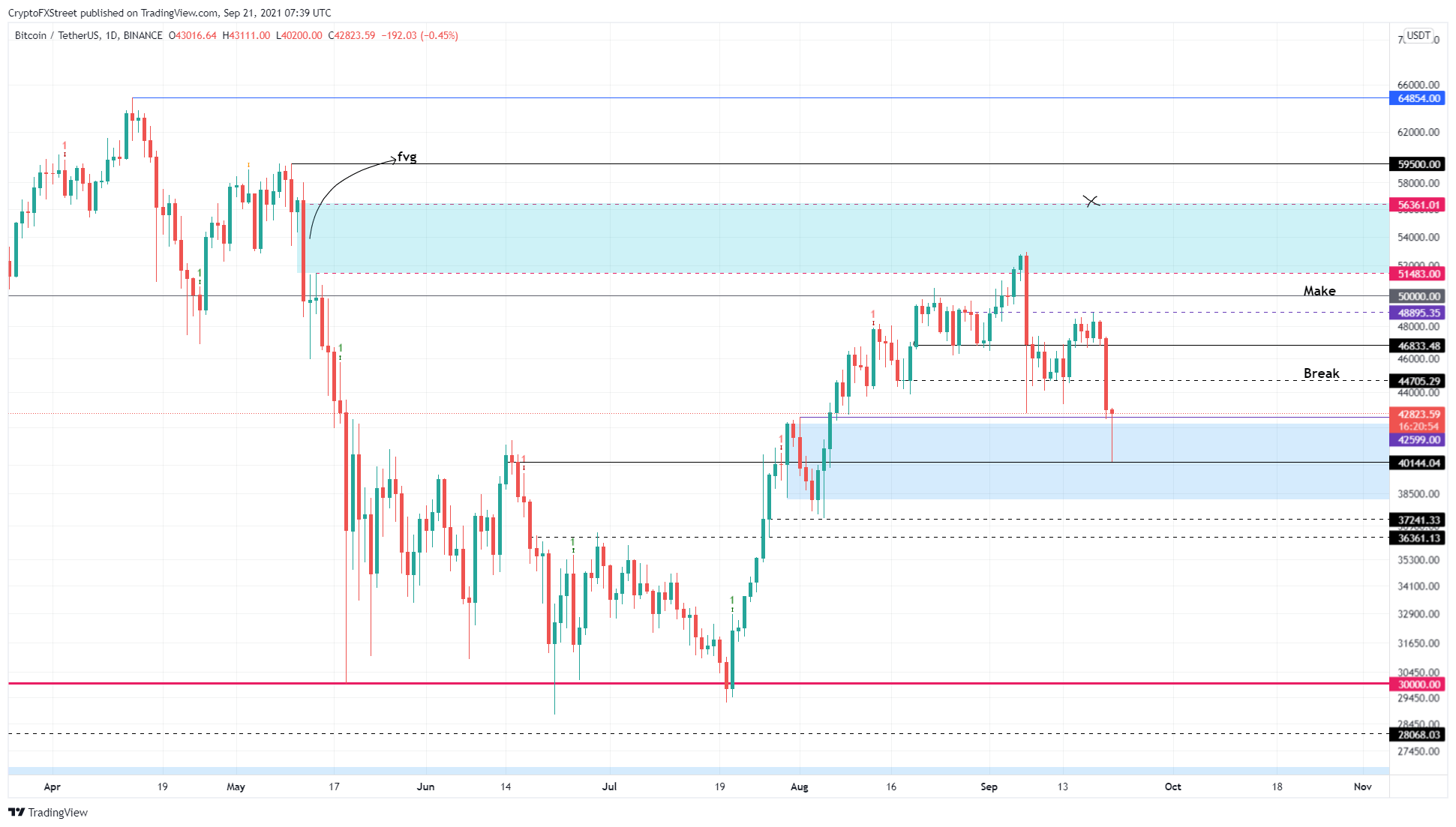

Bitcoin’s price September 21, 2021 on $38,207 to $42,206 However, the buying pressure in Bitcoin pushed prices up again. Bitcoin at the time of publication $42,000 It is hovering above the levels and trading above the expected support area.

With the increase in purchase demands, it is predicted that the price of BTC will easily rise towards the $44,705 levels, that is, towards the resistance level. If this resistance level is exceeded, the next important level is $46,833 appears as. Of course, it will not be easy for BTC to reach these levels, but if there is an increase to these levels. $50,000It will now be possible to talk about psychological levels.

If Bitcoin $42,206 If there is not a one-day close at the levels, then there may be a decrease in the demand for Bitcoin, and following this decrease, Bitcoin prices are in a sub-region. 38,207 dollar with $42,206 levels can be consolidated. According to many analysts, it is much more realistic to expect a sharper decline from Bitcoin, which has fallen towards these levels, instead of waiting for an upward trend.

Ethereum Price Tries To Rise To “Safe” Zone

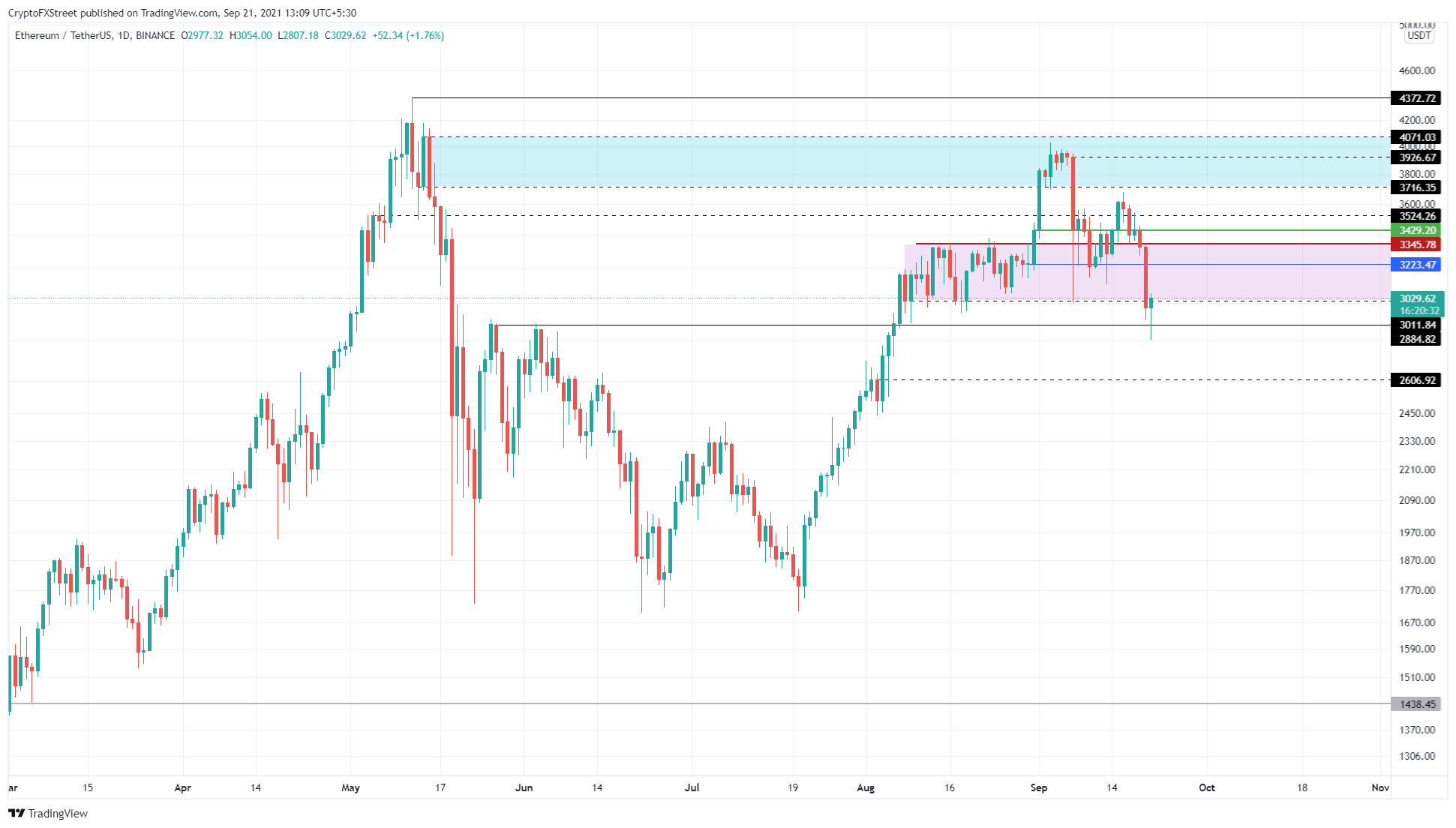

ETH, which showed an upward graph after its fall on September 7, 2021, was affected by the sharp drops in Bitcoin and momentarily lost this upward graph. These drops quickly brought down ETH demands and 3015 dollars regress to levels and reappear after a while 3338 dollar levels rose back.

Ethereum is 3015 dollars closed below levels and frightened investors. ETH is trying to catch a bullish chart again, but when we examine the candles on the chart, we can see that the candles contain huge consolidations. Short-term buying pressures in ETH are insufficient to sustain this rise on its own.

in ETH 3223 dollar Exceeding the dollar level will be the first signal that will herald the next uptrend. If ETH 3338 dollar If it closes above the levels, then a major uptrend can be expected from ETH.

In case the smart contract token persists, 3429 dollars will meet the ceiling. Following this, ETH’s competition and September 16 high 3676 dollar it has to pass. If buying pressure continues, investors can expect Ethereum price to operate in the Fair Value Gap (FVG), which ranges from $3,716 to $4,071.

Things Are Not Different From ETH At Ripple

During the crash on September 20-21, Ripple price also broke out of a demand zone ranging from $1,012 to $0.964. At the time of writing, XRP price is trading just above the lower boundary of the said support area at $0.964. With Ripple’s definitive closes above the $1,012 levels, a sharp increase in buying pressure may be felt and the bulls may revive. Ripple rising to these levels could trigger a FOMO and the price could suddenly test the $1.09 levels.

Clearing this level will allow the bulls to retest the $1,267 resistance ceiling. This ascent will constitute a 35% rise from the current position.

But while many altcoins are recovering quickly, things are not looking very positive for Ripple price. A continuation of the downtrend leading to a break of the $0.846 support base will create a lower low and invalidate the bullish thesis. Such a move would allow the bears to lower the XRP price to $0.771.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.