In the crypto money world, altcoins are on the agenda with price volatility. They specifically follow the price action of Bitcoin. If BTC falls, altcoins fall more. If BTC increases, altcoins increase more. So, how did they perform this week? We look at the top losers.

Most falling altcoins

Let’s take a look at which altcoins fell this week. First up is Optimism (OP). The drop is at 13.40%. Accordingly, OP has been in decline since Feb 24. This move led to a low of $1.34 on May 31. During the downside move, the price declined below the $1.85 horizontal area. Confirmed as resistance on May 7 (red icon). After that, it dropped to the minimum level mentioned below. If the OP price rises, it will come back to the $1.85 region. However, if a breakout occurs, the price could drop to the next support, $1.

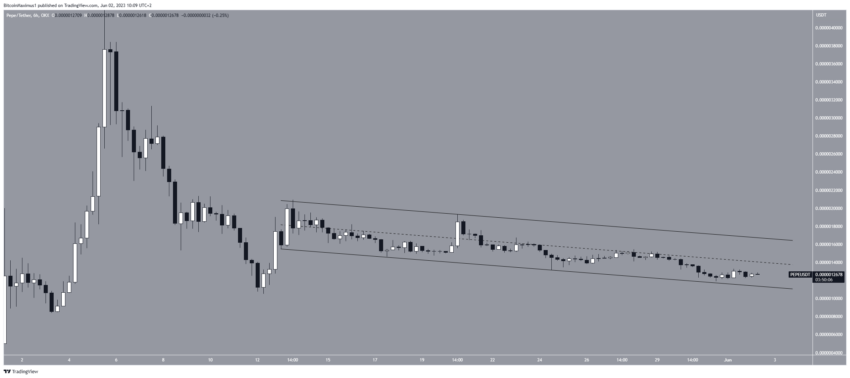

PEPE coin drops

Second among altcoins is PEPE. Pepe (PEPE) fell 12.96%. Memecoin PEPE is also on the list of worst cryptocurrencies this week. Its price has fallen within a parallel bearish channel since May 13. This channel is considered a corrective pattern. In this case, it often leads to breakage. On May 31, the price bounced off the support line of the channel. Accordingly, it started an upward movement. The meme cryptocurrency will move to the channel resistance line if the current move continues. However, if a breakout occurs, the price will drop to the nearest support at $0.0000008.

Other altcoins

Among altcoins, Flare (FLR) is down 9.61% this week. The FLR has been below the bearish trend line since January. The line caused numerous rejections, most recently on April 14. Currently, the price is at risk of falling from the $0.024 horizontal support area. If this happens, there could be a sharp drop to $0.016. However, if the FLR bounces, the price will move to the resistance line at $0.030.

One of the falling altcoins is TON. Toncoin (TON) is down 6.10% this week. It has fallen into a falling wedge since December 2022. Es wedge is considered a bullish pattern. However, this often means that it leads to price breakouts. Currently, the price is trading at the confluence of the $1.80 horizontal support area and the wedge support line. If the price rises from there, it could reach the $2 resistance line. However, if TON is broken, it is likely to drop to the nearest support at $1.37.

cryptocoin.com The last coin we will look at as altcoins is Conflux (CFX). The cryptocurrency is down 6.04% this week. CFX has been trading below the bearish trendline since March 19. Accordingly, it fell to $0.22 on May 12. This apparently caused the $0.27 horizontal area to break. However, the price soon regained the territory and attempted to break the line. Accordingly, if the price breaks, it could move to the next resistance at $0.43. However, if a breakout occurs, CFX could drop to the next support at $0.14.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.