Ethereum founder Vitalik Buterin presented a three-step migration plan to maximize the success of the ETH network. Meanwhile, ETH price is testing critical technical levels under selling pressure.

Vitalik Buterin highlights three key transition keys for Ethereum’s development

Buterin has proposed a major transition for Ethereum that is likely to change the relationship between ETH users and wallet addresses. Buterin’s proposal addresses the issue of scalability and high transaction costs. The main lines are as follows:

- The first transition is on ‘scalability’, one of the major challenges facing the Ethereum network. Buterin advocates moving to rollups and L2 scaling solutions to address this limitation.

- The second pass draws users’ attention to wallet security, proposing more secure smart contract wallets. Buterin noted that at this point, distrust will likely lead users to centralized solutions rather than decentralized solutions.

- The third pass was on secrecy. Buterin underlined the need to develop necessary tools such as social healing, identity and reputation systems, especially drawing attention to transactions.

These developments from Buterin are expected to increase the utility of Ethereum and its adoption among users. This feeds the bullish thesis for the ETH price. It also presents factors that will catalyze the recovery of ETH price in the long run.

However, the ETH price has been on the decline with the week’s SEC lawsuits. The leading altcoin slumped from $1,916.67 to $1,752.99 on June 11, down nearly 4% since June 4, according to data from the daily chart of ETH/USD on Binance. Weekly depreciation exceeded 5%.

ETH crashes under selling pressure

Ethereum price is struggling with intense selling pressure, particularly from regulatory pressure from the SEC. cryptocoin.com As we have reported, the news of the lawsuit drives the investors away from the market.

The altcoin dropped below the key support level of $1,800 this week. According to data from IntoTheBlock, the $1,500 level is the next major support for Ether. Here, 1.91 million wallet addresses have accumulated between $1,509.38 and $1,566.68. At the current price, 40.11% of wallet addresses currently holding Ethereum are profitable.

If the selling pressure on Ethereum intensifies, the bears will head towards $1,500 as their next target. A drop below critical support will signal a long-term bearish bias for ETH. Also, the falling ETH price poses some problems within the DeFi market.

Falling Ethereum also puts DeFi industry at risk

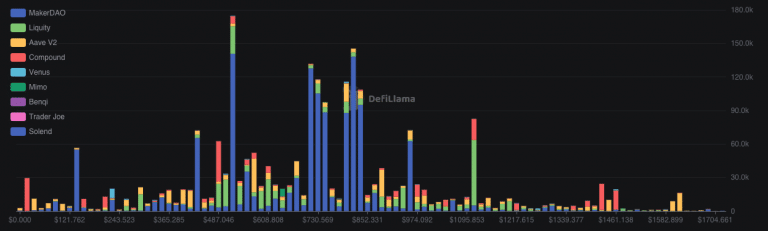

At the time of writing, data shows the total assets at risk of liquidation across different DeFi networks to be $1.7 billion. This metric describes the overall value of DeFi assets with open futures or contract positions that will incur losses depending on the market direction.

According to data from DefiLlamas, most of the liquidation in the last 24 hours has occurred through the MakerDAO (MKR) protocol. However, there were several open Ether (stETH) and Wrapped-Bitcoin (WBTC) positions that risked the same fate.

This will therefore prompt market participants to carefully consider the risks associated with their emotions. Additionally, there is a risk that a 20% drop in total value will draw another $161 million from the market. While 20 percent may seem like a lot, the state of the market at the time of writing does not rule out the possibility. This is because more than half of the biggest altcoins have experienced double-digit drops on a weekly scale.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.