The Omicron variant caused us to watch a red market in the first half of December, as new Covid measures in countries, rising inflation in the USA and around the world suppressed the risk appetite of buyers.

Now, what kind of position the FED will take in all this fluctuation is eagerly awaited.

Will tapering be accelerated? Can the rate increase be made earlier than expected? Will global markets continue to be supported by the FED? Investors, who are preparing to complete 2021 among many question marks, focused on today’s meeting.

According to Investing’s data, the FOMC decisions will be announced at 22.00 TSI. At 22.30 FED Chairman Jerome Powell will make a statement.

It will not surprise anyone to see volatile market movements before the decision. At this point, we observe that before the FOMC decisions, investors are risk-averse and red is dominant in all products.

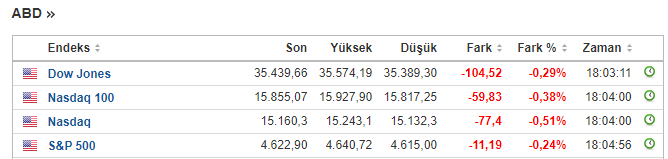

US stock markets started the day with sellers, Dow Jones continued to trade with -0.3%, Nasdaq -0.5% and S&P 500 -0.2%.

We observe that sales are ahead in the Emita group as well.

While eyes are on the decision to come out of the FOMC meeting, Bitcoin continues to trade at $47,200 with a loss of -2.2%. Depending on the withdrawal in Bitcoin, we see that there is a negative premium of 5-10% in altcoins.

Falcon? Pigeon?

At this point, although a decision to raise interest rates is not expected, is it a pigeon against inflation data? is it a hawk? A FED will determine the direction of the market we follow.

As in Powell’s previous statements, using his communication skills and giving messages that will not disturb the markets can turn the risk into positive. This, with great relief, can ignite the first wick of an upward move in the markets.

Decisions such as prioritizing interest rate hikes or accelerating tapering transactions will have an increasing effect on sales in the market.

The market has been talking about the Fed’s decision for a while. Experts think that the risks related to the decisions to be taken by the FED are priced in to a large extent. Although we see volatile movements before and after the decision, it is thought that the disappearance of the risk will be positive for the rest of the week.

*Not Investment Advice.