For the first time, the Italian presented the annual figures for the major Milan bank.

(Photo: Bloomberg)

Rome The major Italian bank Unicredit slipped into the red in the fourth quarter due to special effects. Despite the loss of 1.4 billion euros, the bank managed to return to profitability over the year as a whole. The bottom line is that around 1.5 billion euros will remain in 2021, as Unicredit announced on Friday. In 2020, the loss was just under 2.8 billion euros.

Adjusted for special effects, such as the costs for a group-wide job cuts, which also affects the German subsidiary Hypo-Vereinsbank, the profit was 3.9 billion euros. In the previous year, the adjusted profit had amounted to 1.3 billion euros.

All regions contributed to the surplus, led by Italy with two billion euros. Germany has a value of 800 million euros here. The German share was thus on par with Unicredit’s surplus in the Eastern European markets and just below that of the subsidiaries in Central Europe (900 million euros).

The Hypo-Vereinsbank in particular has gone through a significant process of change over the past year. This was particularly evident in the net sales, which increased by 29 percent to 4.3 billion euros compared to the first Corona year 2020.

Top jobs of the day

Find the best jobs now and

be notified by email.

A large part of this was due to the strong growth in corporate loans. Last year, the bank rolled out the so-called smart banking service model for around 1.5 million private customers.

The different sales channels were interlinked so that, for example, there is no longer a difference in customer contact between online banking and the branch. Overall, Hypo-Vereinsbank has recently been positioned much more efficiently than it was in 2020. The total costs of HVB fell by four percent last year.

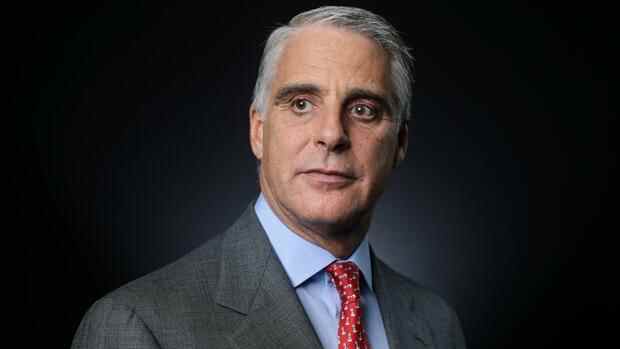

These are the first annual figures presented by the new Unicredit CEO Andrea Orcel. The former investment banker has been in office since April 2021 – and was proud of the numbers. All goals for the past year have been achieved, he said in an investor call on Friday morning.

“This achievement is the blueprint for what our new target model can deliver in 2022 and beyond to the benefit of all our stakeholders.” The result was slightly better than the bank had last promised. In addition, revenues increased by five percent to 18 billion euros – more than expected by analysts.

For Orcel, this is all tailwind for its new strategy, which it only unveiled in December. He wants to significantly increase sales and profits in the coming years and at the same time distribute more money to shareholders.

More money for digitization, no takeover in Russia

He also plans to invest significantly more money in the digitization of the group. Orcel wants the same technologies and data platforms for all 13 banks in Europe, and customer service is to be standardized. Unicredit intends to invest around 2.8 billion euros in the ambitious project.

Orcel also intends to grow through acquisitions. A few months ago, however, the long-planned purchase of the nationalized crisis bank Monte dei Paschi di Siena failed. The Italian Ministry of Finance and Unicredit could not agree, the risks of the takeover were apparently too high for Orcel.

Another takeover candidate was the Russian bank Otkritie – until today. Because of the Ukraine crisis, Orcel dropped out of the bidding process, as he explained in the investor call. “Given the geopolitical environment, we have decided to withdraw from the data space.”

More: Up to 18 percent upside potential: European bank stocks are back on investors’ buying lists