The inventiveness of the rich in paying taxes has reached such a level that even tax experts are surprised. Opening an account in tax havens, not paying taxes on companies, taking money abroad with offshore accounts is just the beginning. But what about virtual currencies or shopping in the virtual world?

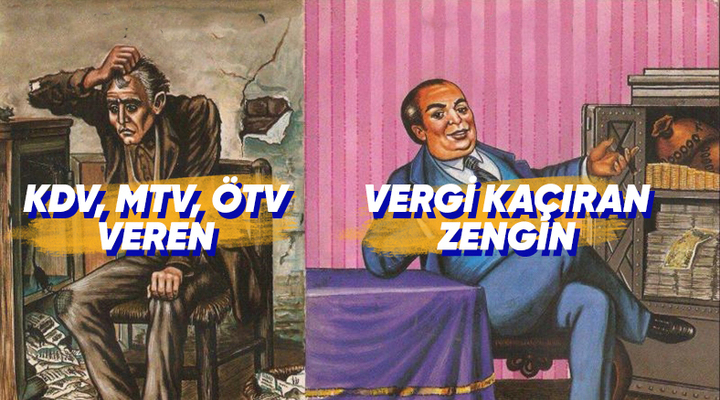

While we pay our taxes “willingly”, incomes we can’t even imagine Unfortunately, it hits us like a slap in the face that the wealthy people who own it have done a thousand somersaults to avoid paying taxes and are successful in this regard.

Our innocent rich people, who can’t bear to give up some of their income, have found many ways to escape from these taxes, which are a hump on our backs, with all kinds of cunning. like art started to see.

Let’s start the list with tax haven countries that shine the eyes of the rich!

Rich people in tax havens low or zero tax rates they aim to minimize the tax burden with the accounts they open in these countries.

Countries called ‘Tax Paradise’ also have to fulfill certain conditions in this regard. Of course, these conditions vary from country to country. Among the so-called tax havens Switzerland, Cyprus, Singapore, Bahamas, Cayman Islands, Luxembourg and BVI countries such as

Financial institutions in these countries specialize in offshore accounts and other forms of tax evasion and offer their wealthy clients. They help with tax evasion.

Offshore accounts and offshore companies that we always hear about are usually established in tax havens.

If we make a clear translation, “offshore” meaning “away from the coast” is roughly used in the financial sector. “tax free” used in the meaning.

Offshore accountsare bank accounts opened by a financial institution outside the person’s country. These accounts are used for purposes such as protecting the confidentiality of assets, taking advantage of tax benefits, or accessing various investment opportunities. Some countries have banned or restricted offshore accounts as it is a method used by the rich to evade taxes.

If they are offshore companiesSimilar to offshore accounts, companies are established outside of the country in which a company operates, often in a country that offers low or advantageous taxes. Similarly, it is preferred because of its advantages such as providing privacy, protecting assets or facilitating international business activities.

That is, the rich direct their money through these companies and accounts. tax advantage they manage to achieve…

Among the celebrities with offshore accounts, there are many names that you can say “no more”.

Lionel Messi, Madonna, Wesley Snipes, Eduardo Saverin Names such as are known to be accused of tax evasion.

For example, Footballer Lionel Messi in Spain in 2016 accused of tax evasion and was sentenced to 21 months in prison. In addition, allegations were made about Messi’s offshore accounts and transactions in tax haven countries.

Our rich people, who do not skip benefiting from the company’s meat and milk, can also evade taxes through their companies.

For those of us who want to make things a little more complicated, to transfer pricing is applying.

With this tactic, they by transferring between different countries They are trying to reduce the amount of tax they will pay. In this way they inflate costs and lower the tax base. In other words, they avoid the tax burden by underestimating the company’s profits.

Not to mention those who try to deceive the tax administration…

Some of our rich people who do a thousand and one tumbles like a tumbler stew. illegal he is trying to avoid paying taxes by hiding his assets with misleading statements.

They can hide their assets in bank accounts abroad or in fake companies.

They’re doing charity work to make the costs go up!

Another pillar of the art of tax evasion is inflate the expense. Our wealthy lower their tax base by making personal spending look like corporate spending, adding fake expenses to the balance sheet, and making fake donations to charities.

Let’s add the following to draw attention to the ethical and moral deficiency in charity work. In addition to the tax deductions they provide with their fake donations, companies also pretending to help society It enables to draw a conscious image of social responsibility in the eyes of the public and get another win. Your comment is…

Finally, cryptoassets play into the hands of the rich.

Virtual currencies, currencies that are not dependent on a central authority and can only be used in digital environment, and transactions carried out in these currencies, may not be monitored by tax authorities.For this reason, it can be used for tax evasion.

Similarly, shopping in virtual worlds It can also be used for tax evasion. In the virtual world, shopping can be done using virtual currencies instead of real currency, and these transactions cannot be monitored by tax authorities.

These are just the ones we count tip of the iceberg Unfortunately, tax evasion is still common practice among the rich and famous. It is clear that this behavior creates a sense of injustice in society.

So, let’s end our content with the words of Leona Helmsley, an American business woman, and then drink a glass of cold water: “Only little people pay taxes.”

RELATED NEWS

The Government Shouldn’t Hear: The Strange Taxes We’d Have to Pay, Most of them Today

RELATED NEWS