Ethereum has surpassed Bitcoin (BTC) by more than 230% this year, and derivatives data shows that traders are expecting much more from the altcoin project. In this text, cryptocoin.com We take a look at the analysis of Marcel Pechman, who examines the futures movements of whale-sized active traders on the stock markets.

Futures premium supports Ethereum

Quarterly futures are the instruments of choice for whales and arbitrage desks, but they can seem complicated to individual traders due to the clearing dates and price difference from the spot markets. However, the key advantage of these quarterly contracts is the absence of a floating funding rate. As a result, futures trade in healthy markets at a premium of 5% to 15% per year. This situation is known as “contango” and is not exclusive to the crypto market.

- The chart below compares the futures of BTC and ETH by exchange. From here, it turns out that whales and arbitrage tables charge a larger premium for ETH and is considered a bullish indicator.

Bitcoin (BTC) long-short ratio

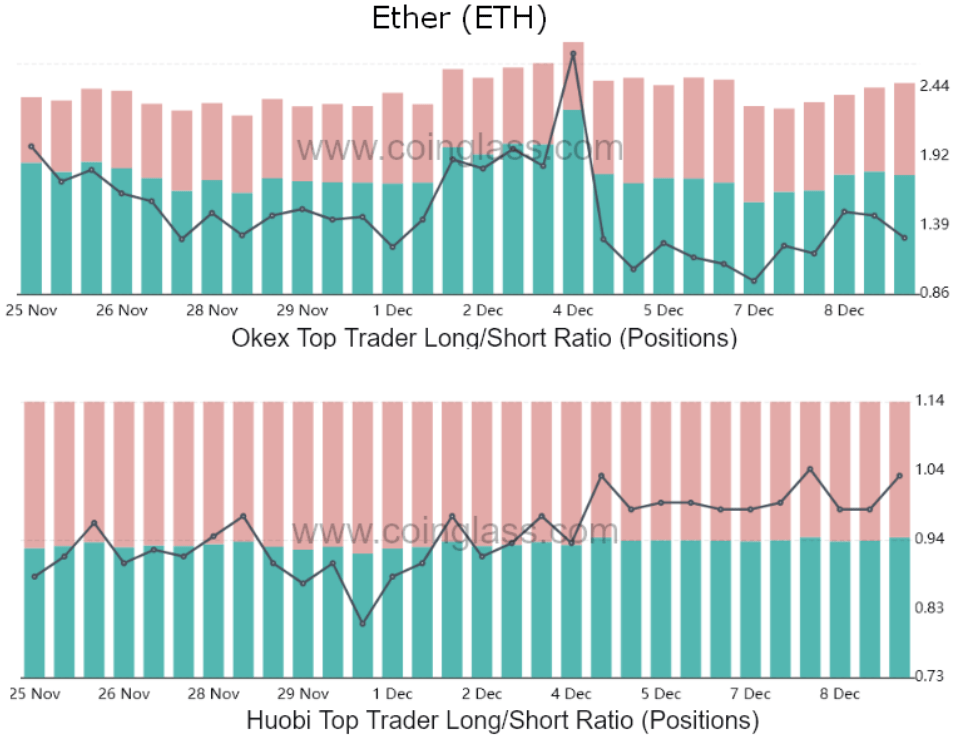

The long-short ratios of top traders on crypto exchanges can be tracked to effectively gauge how professionals are positioned. This metric provides a broad market view. Below is the BTC long-short ratio on OKEx and Huobi exchanges.

The same table is below for Ethereum. By comparison, the long to short ratio of Bitcoin traders averages 1.21. Ethereum, on the other hand, turned to the positive side on December 5, after going from 1.0 to 1.16. When comparing the average data for November 25, the long-short trades of the largest Ethereum traders fell 20% from 1.43.

Data shows Ethereum investors are more confident

Current derivatives data supports ETH as Ethereum is currently showing a higher futures fundamental rate. Moreover, the recovery from long to short by top traders since October 5 signals confidence at a sensitive time when ETH price has dropped 16% from the ATH level of $4,870. Still, judging by the futures premium and long-to-short data, Ethereum seems to have enough momentum to continue to outperform, according to analyst Marcel Pechman.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.