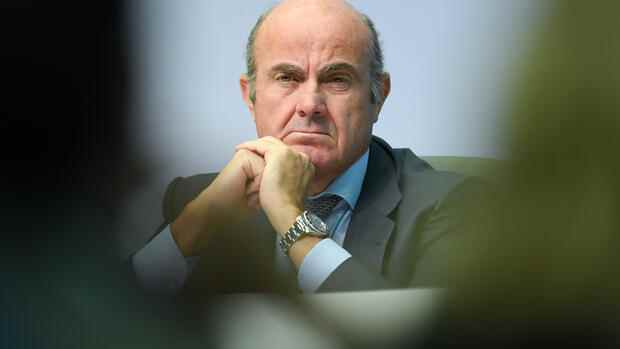

The Spaniard and the heads of the ECB banking supervision and the EU banking authority Eba, Andrea Enria and José Manuel Campa, warn of undesirable side effects if the EU adopts capital regulations that are too lax for banks.

(Photo: dpa)

Frankfurt In a joint blog post, the most important financial supervisors in the European Union warned against watering down the planned banking reforms of the European Union. “We are very concerned that in the current legislative debate in the EU Council and European Parliament on the EU banking package, there are many calls to deviate from international standards,” says a blog post by the Vice-President of the European Central Bank (ECB). , Luis de Guindos, the head of ECB banking supervision Andrea Enria and the head of the EU banking regulator Eba, José Manuel Campa.

After the global financial crisis 15 years ago, regulators tightened banks and demanded higher capital standards and more stringent risk management. This is intended to prevent banks from getting into trouble due to speculation, for example, and that the state has to save them again with a lot of money in order to avert greater damage to the economy as a whole.

After the bankruptcy of the US bank Lehman Brothers in 2008, governments around the world had supported the financial sector with trillions of dollars, but the economy had nevertheless slipped into a severe recession.

The financial supervisors de Guindos, Enria and Campa criticize in their blog post that the reform proposals made by the EU Commission already contain deviations from the internationally agreed rules, which are called Basel III in technical jargon. The ECB had previously criticized this. The three financial supervisors are now opposed to further standards being softened as part of the EU legislative process, in which the EU Council and EU Parliament are also involved.

Top jobs of the day

Find the best jobs now and

be notified by email.

According to Eba estimates, the EU Commission’s proposals would already ensure that the increase in additional capital requirements would remain 3.2 percentage points below the level that the Basel III agreements would actually provide for. However, these are only cautious estimates, the actual extent could be even higher, the top supervisors warn in their contribution.

Supervisors warn of negative effects for banks

If all other deviations that are under discussion are now also taken into account in the final body of legislation, it can no longer be ruled out that the Basel Banking Committee, in which bank supervisors and central bankers from the most important industrialized and emerging countries sit, is the EU with the worst grade “non-compliant”. In doing so, the international regulatory body would express that the EU has not really implemented the reform. In the past, Europeans liked to blame the United States for this.

“At stake are the reputation, competitiveness and ultimately the funding costs of the EU banking industry,” warn the authors. In doing so, they are suggesting that investors could demand higher interest rates from EU institutions because they might consider the banks to be more risky due to laxer regulations.

Capital standards are not the only concern for top regulators. They also warn that the rulebook would become more complex as a result of all the planned exceptions. Not only would this increase costs for banks, which would make it more difficult for them to comply with all the rules, but it would also complicate the work of supervisors.

In recent years, banks have repeatedly called for regulatory easing with reference to their competitiveness. Deutsche Bank boss Christian Sewing repeatedly advocated that the institutes should make lower contributions to the EU resolution fund. This fund is intended to ensure that possible bank transactions can take place without tax money. Industry representatives had argued that banks could use the funds released to increase lending.

Lindner criticizes overly strict regulation

Most recently, statements by Federal Finance Minister Christian Lindner (FDP) indicated that he was critical of strict regulations for banks. After years of low profitability, Germany needs better financial market regulation so that the country’s banks can compete globally, he said at a conference on Wednesday. Since the financial crisis more than a decade ago, the US competition has increased its stock market value and market share, while the German institutions have lagged behind in all areas, he said at the International Bankers Forum in Berlin.

The minister partly blamed banking regulation for the malaise. This focuses too much on stability and consumer protection and too little on competitiveness and profits. In addition, locational weaknesses such as poorly developed internet, dilapidated schools and excessive tax rates deterred highly qualified workers from the financial sector.

More: ECB criticizes EU Commission’s plans for exceptions to global banking rules