The Render price has seen a huge increase in the excitement around AI coins, fueled by the NVIDIA earnings report and due to the recent enthusiasm in the OpenAI ecosystem. The pump in the altcoin price was also supported by the listing of the token on Binance’s Japanese branch. However, crypto analyst Lockridge Okoth says RNDR is at risk of a sharp correction.

RDNR price responds to the latest developments

The altcoin is preparing for a collapse as investors cash in on nearly 70% of the profits made since November 15. Following the NVIDIA earnings report and the Q3 report, there was a decline in shares. AI coins had rallied ahead of the report, fueled by a ‘buy the rumor, sell the news’ sentiment as the company monetizes AI entirely. Statements in the reports suggest that NVIDIA has definitely knocked its earnings out of the park.

Additionally, discord in the OpenAI camp appears to be calming after Sam Altman was reinstated in the top job as CEO alongside a new initial board of directors. Altman has committed to a strong partnership with Microsoft Corp despite its presence in OpenAI.

Altman’s reinstatement followed intense pressure from OpenAI’s investors and stakeholders, as well as employees who threatened to quit if Altman was not reinstated. According to Bloomberg: “OpenAI will bring back Sam Altman. It will also overhaul the board to bring in new executives. “This is a stunning reversal in a drama that has roiled Silicon Valley and the global AI industry.” The excitement around these two waves is diminishing. RNDR and other AI coins are at risk of crashing after recording profits of up to $7.5 million.

Altcoin price is preparing for a 30% crash!

Render is poised for a crash, with both technical and on-chain metrics supporting the thesis. First, RNDR is already overbought. Moreover, the position of the Relative Strength Index (RSI) above 70 proves this. The token is facing a rejection from the resistance level at $3,451, which is the average threshold of a supply zone extending from $3,158 to $3,725. The supply zone is an area characterized by aggressive sales. This order block is likely to remain a resistance. Therefore, it is possible that the altcoin price may decline to test the nearest support at $2,825.

If the aforementioned base fails, the decline may extend for Render price to test the confluence between the horizontal line and the 25-day Exponential Moving Average (EMA) at the $2,266 support level. Or, more dire, it could extend lower and slide below the 200-day EMA at $1,720.

On-chain metrics also support the bearish trend

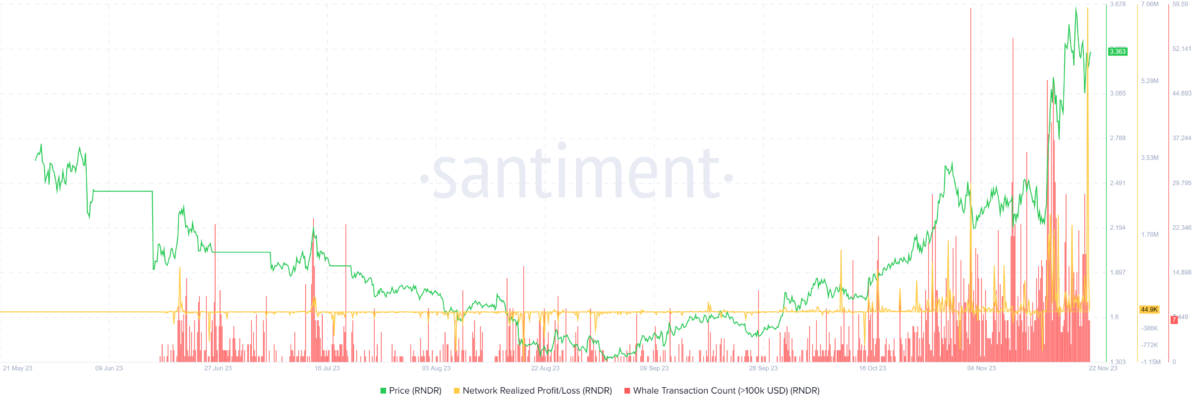

Various on-chain metrics, starting with RNDR Network Realized Profit/Loss (NPL) and number of whale transactions (WTC) of $100K and above, support the bearish case for the altcoin price. These have shown a consistent rise and their pairs often precede a correction in the market. While NPL and WTC are showing significant increases, it is possible for investors to take short positions on the altcoin.

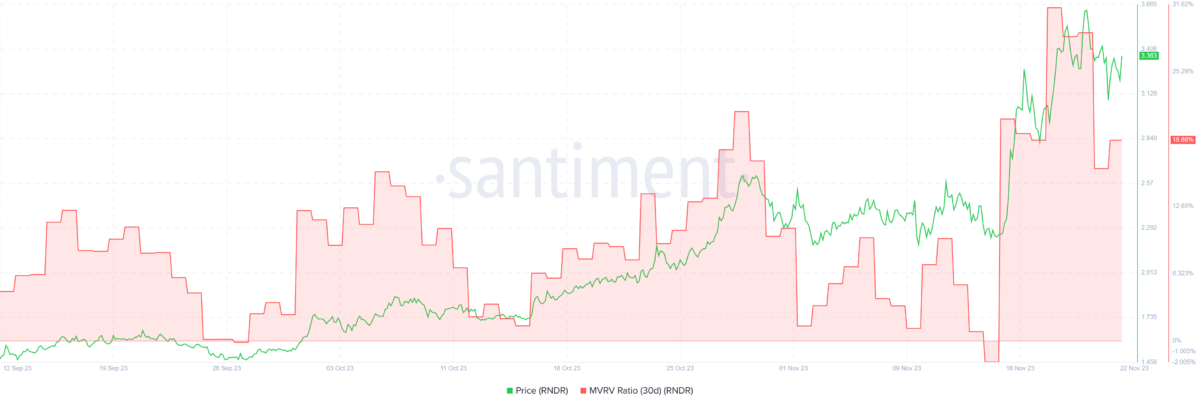

Additionally, the Market Value/Realized Value Ratio (MVRV), which shows the profitability of the holding, indicates a potential pullback or correction in the RNDR price.

Additionally, the supply distribution of addresses containing between 1,000 and 1,000,000 altcoins also shows that seller momentum is increasing.

This situation is also supported by the increase in supply on the exchanges, which is generally interpreted as an intention to sell.

On the other hand, increased buying pressure above current levels is likely to send the altcoin price north. In this case, the bearish thesis will be invalidated with a decisive move above $3,451. This is likely to set the tone for RNDR price to reach $4,000. Or in a highly bullish case, it is likely to extend a neck higher towards the $4,409 resistance level. Such a move would mean a 30% rise above current levels.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!