Polygon released the 2.0 Gorel test-net on October 4th. The altcoin project’s native token, MATIC, experienced a 16.4% rally around the same time. However, the $0.60 resistance turned out to be stronger than expected. This was followed by a 10.6% increase in the six days leading up to October 10. followed by a decline. Analyst Marcel Pechman, He is investigating what will happen next.

Why did the altcoin rally end?

Polygon 2.0 consists of ZK-based layer-2 blockchains combined through a new cross-chain coordination protocol. cryptokoin.comAs you follow from , the scaling technology was announced in June 2023 as a plan for a scaling ecosystem consisting of four layers: staking, execution, interoperability, and proof. Each of these layers contributes to creating an interconnected Blockchain ecosystem. Thus, it facilitates safe, fast and extremely cost-effective transfers.

Benefits of Polygon 2.0 include enhanced security and privacy through ZK-proof, full compatibility with the Ethereum Virtual Machine (EVM), and instant cross-chain interactions without requiring additional security or trust assumptions. It should also be noted that the altcoin project continues to develop the ZK-STARK-based layer-2 solution Miden. Recently, MATIC experienced a 10.6% retracement. One could argue that this merely reflects an adjustment to the extreme excitement triggered by the test-net launch. However, other factors are likely contributing to the worsening investor sentiment towards Polygon. For example, Polygon’s ZK sun-net, zkEVM, has lagged behind its competitors in terms of activity and deposits.

Data shows Polygon losing steam

Measurements from on-chain data provider Artemis reveal a significant disparity between Polygon zkEVM’s 6,210 active addresses, StarkNet’s 154,390, and zkSync ERA’s 239,810 addresses. There is a similar inconsistency in the daily transaction count analysis. Additionally, Polygon’s zk-rollup lags behind its competitors.

Moreover, suboptimal results occur in the total number of transactions and deposits on the Polygon network. For example, the altcoin project has a total value locked (TVL) of $756 million, according to DeFiLlama. In other words, this figure is less than half of Arbitrum’s layer-2 scaling solution.

It is noteworthy that Polygon currently faces direct competition from Optimism (OP) and Base, despite being launched in June 2020, much earlier than most Ethereum layer-2 solutions. Altcoin co-founder Jaynti Kanani left on October 4 after six years with the project. This has triggered a degree of unease among investors, given the project’s proximity to significant completion of the enhanced multi-layered scalability solution.

Other factors affecting altcoin performance

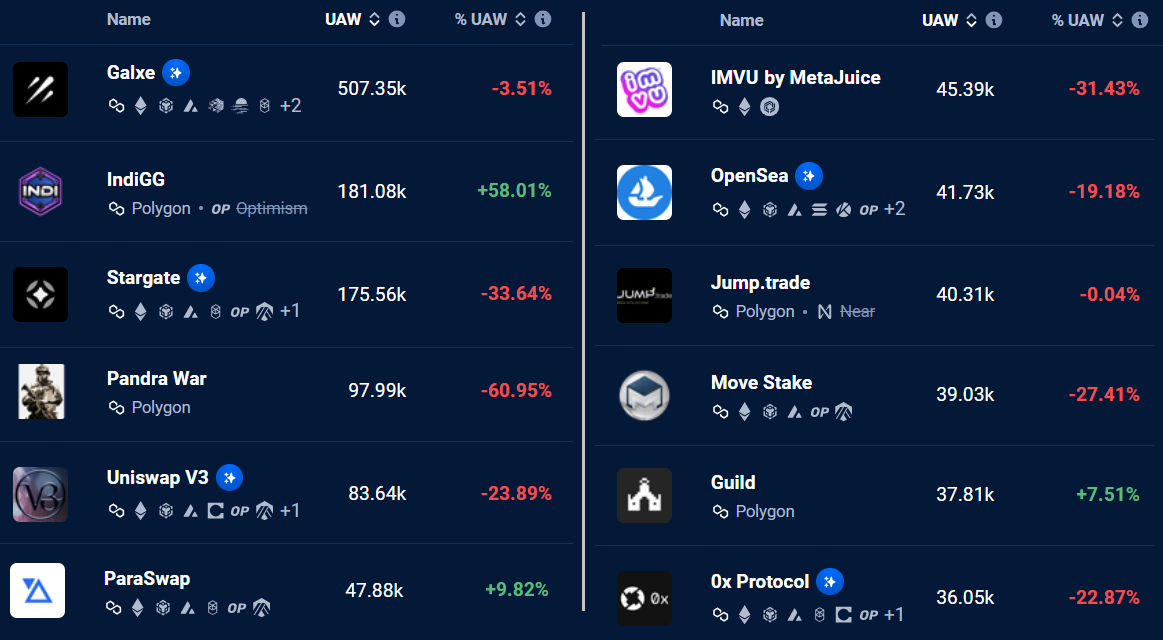

The number of active addresses using the decentralized applications of the Polygon network also dropped. This further affected the altcoin price performance. The top 12 Dapps on the Polygon network experienced an average decline of 17% in active addresses over the past 30 days. This issue has caused concern, especially in the NFT and decentralized finance (DeFi) markets. It has also specifically impacted applications such as Uniswap, OpenSea, and Move Stake.

Whatever the reasons behind MATIC’s early October token surge, the recent 10.6% negative performance can be attributed to reduced network activity, the departure of a co-founder during a critical upgrade phase, and stiff competition from other ZK scaling solutions. After all, the team consistently makes necessary updates and improvements to the Polygon network. But even so, there is enough bearish news flow to justify this correction.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!