The crypto market experienced the biggest decline in April since August 2023. However, the bulls took action and gave hope for a new rally in May. While meme coin season is still said to be about to explode, Floki Inu (FLOKI) has experienced a significant increase in active wallets in the last 2 weeks. In this context, the coin hopes to enter the list of best cryptos in May.

The daily charts are interesting for FLOKI and offer good price action in the coming sessions. Increasing expectations among investors are creating renewed excitement in the market. Therefore, investors are eagerly waiting to see the next events.

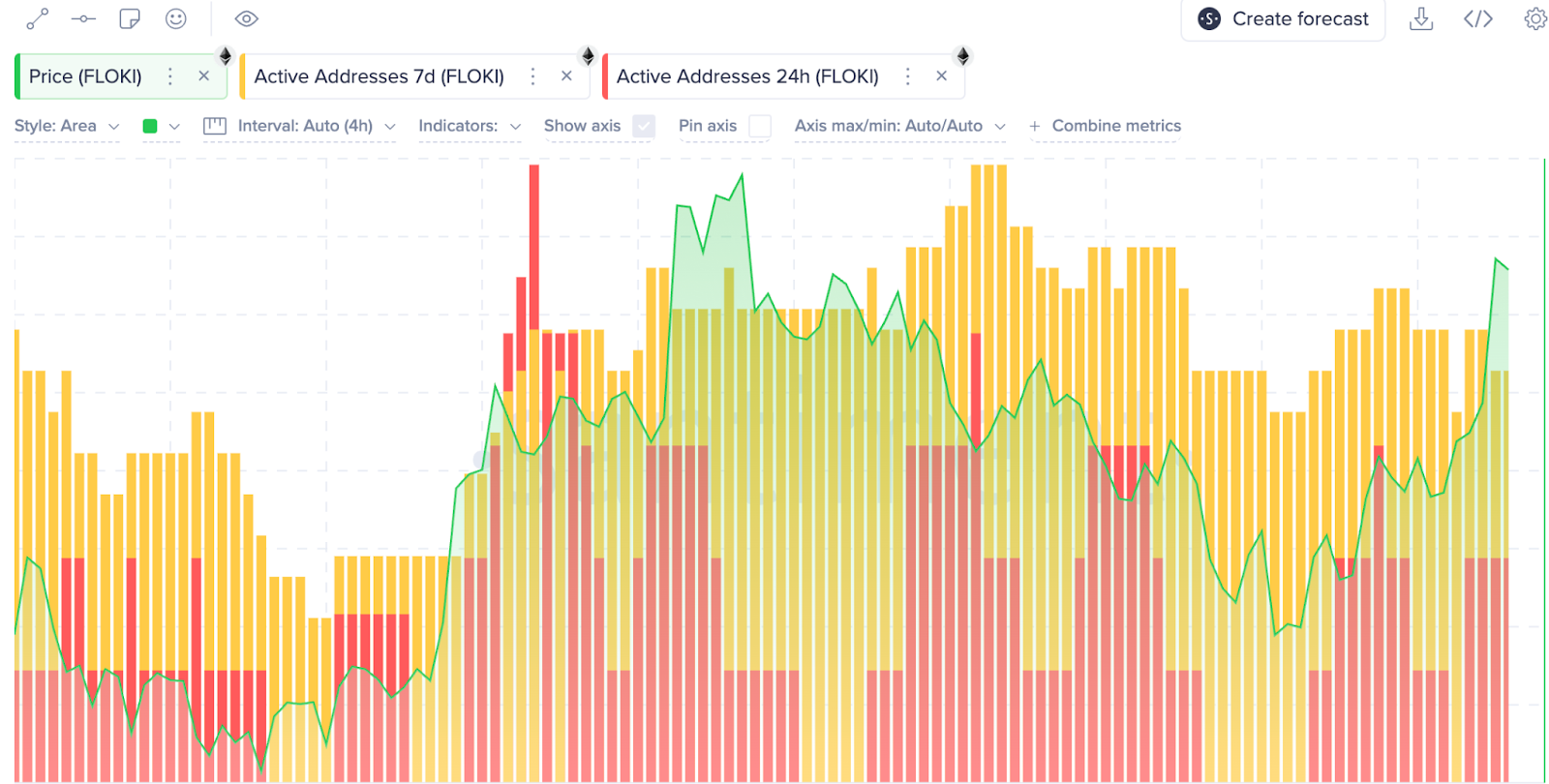

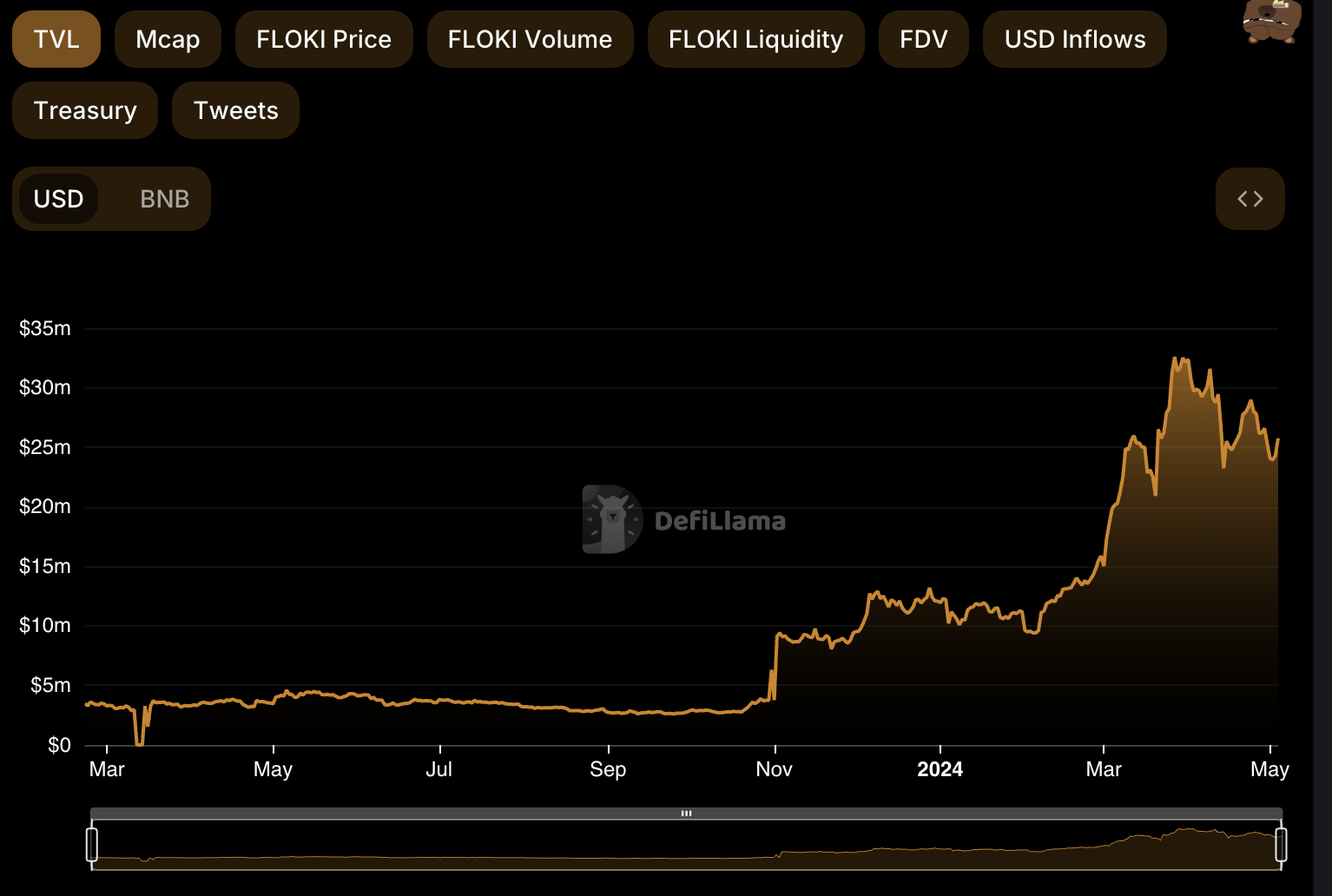

Rising TVL and Active Addresses Attract Attention

Floki moved dramatically in March. meme coin, entered a correction phase at the end of March after reaching yearly highs. There has been a decline since mid-March, forming a parallel formation.

Amid the decline, May started with a positive tone. In this context, FLOKI’s active wallets increased by 30% on 24-hour and 7-day frames in the last 2 weeks. It is possible that this increase could provide a potential basis for continuing the price trend.

Floki Inu Technical Analysis

Floki’s value at the time of the news was trading at $0.000192 and showed bullish momentum. Market capitalization increased by 16.30% and 24-hour trading volume increased by 34% to $285,564,622. A break above the $0.0002 resistance to start attracting new investors indicates a positive trend.

Floki markets are currently facing a high volatility of 5.88% and the RSI is at 63, just above the signal line, indicating relatively stable price action. The MACD appears slightly positive with upward pressure. However, a massive sell-off is possible if bears gain control.

SMA signals are in strong buy mode with the 200-day SMA price trading, 20-day and 50-day Crossovers also bullish. This is likely to be an opportunity for investors who missed the previous rally. But even though all the signals are semi-bullish, caution should be exercised as the market may face corrections.