A popular altcoin project AAVE, recently announced the development of a new stablecoin specific to its platform, called GHO. The announcement fueled the AAVE bulls and made the altcoin experience more than 45 percent gains.

Having experienced a negative pullback towards the end of June, this new rally of AAVE started at the beginning of July. The cryptocurrency had slumped as low as $54.8 by January when the bulls emerged.

Following the launch of the stablecoin, AAVE expanded its rally and the announcement allowed the popular altcoin to peak at $83.2 on July 9. Correcting AAVE is trading at $77.73 at the time of writing, following a 7.57 percent bearish trend.

Latest comeback in AAVE, AAVE price It took place after briefly breaking above the 50-day moving average and if there is still enough positive pressure, its current reversal could be a temporary move. Despite the current fix, there are a few reasons to expect more.

What is the reason the bulls are not done yet?

The recent rally has pushed AAVE back to May lows, which means there may be some prospects for higher price levels. Stablecoins tend to strongly increase demand for the cryptocurrencies that support them, and AAVE’s supply breakdown revealed that there is still strong demand for AAVE at its current level.

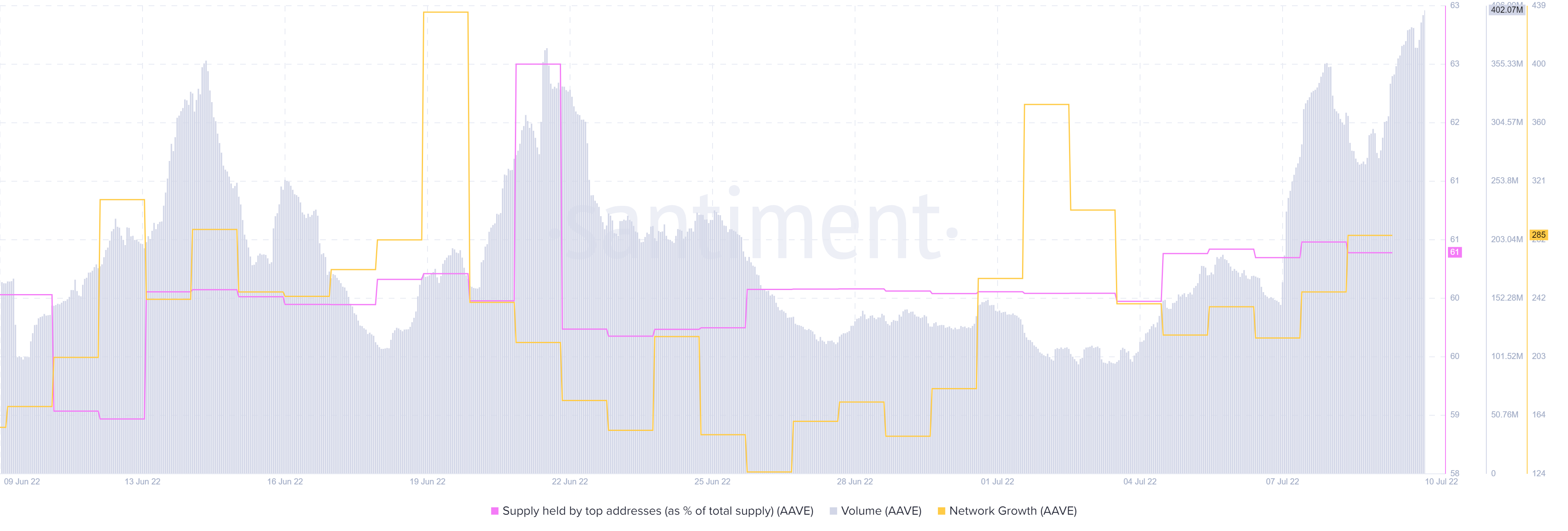

In addition, according to Santiment data, addresses holding 10,000 to 100,000 AAVE coins have also accumulated heavily in the last 24 hours on July 10. The whales’ balances have increased from 17.94 percent to 19.23 percent last weekend.

Addresses holding between one million and 10 million coins, on the other hand, increased their balances to 40.6 percent by July 10, after significant savings in the last six days. This confirmed that AAVE was still in high demand at its price at the time of writing.

An interesting event occurred in addresses holding 100,000 to one million AAVE coins. It reduced its assets from 29.36 percent on 9 July to 27.77 percent by 10 July. That means they’ve contributed most of the selling pressure in the last 24 hours of July 10. Despite short-term profit taking, AAVE’s supply held by the largest addresses remained higher than five days ago.

Despite the slight correction in AAVE price, the altcoin’s trading volumes hit a monthly high in the last 24 hours of July 10. This confirms that there is still enough volume to support the price action.

AAVE traders need to keep their eyes open for a retest of resistance at the $101 price level highlighted by the 0.236 Fibonacci retracement level. However, according to experts, the realization of this result depends on the continuation of the rally. More importantly, the launch of the stablecoin is thought to help AAVE price rebound and long-term price action.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.