A new report by CryptoRank shows that investors are first turning to Ethereum (ETH) for ‘passive income’. This trend is accompanied by a new peak in the amount of altcoins staked on the Ethereum network.

CryptoRank reports altcoin investors rely on Ethereum for ‘passive income’

With the Shanghai upgrade, where Ethereum releases staked ETHs in the 2020 period, more investors are choosing to lock their coins on the ETH network. The aforementioned spike was published on April 12 and activated staking withdrawals. The amount of ETH staked has been increasing rapidly since the upgrade. This trend was crowned with a new high yesterday.

Analytics platform CryptoRank reported in a new report yesterday that the amount of staked ETH has exceeded 25.8 million ETH, registering a new ATH. The Ethereum network is currently valued at over $48 billion.

Notably, the Ethereum deposit contract balance has risen sharply since the introduction of the critical feature, which was not available during its transition to PoS, surpassing $40 billion in late May.

Altcoin whales did not allow higher ETH levels

A recent tweet from Lookonchain showed that whales were selling hefty ETH during the recent spike. cryptocoin.comAs you follow, UNI and AAVE were among the coins that were heavily purchased during this time.

However, ETH’s foreign exchange reserve was increasing, according to CryptoQuant. An increase in the metric means that investors are selling their holdings, which is a bearish signal.

Santiment’s chart shows that Ethereum’s supply on exchanges and off-exchange supply are also close to each other. This points to a bearish trend as there is a possibility that the first will reverse the second in the coming days.

Vendors may soon step up their game

A look at Ethereum’s daily chart reveals quite a few metrics supporting the bears. For example, the Money Flow Index (MFI) is about to enter overbought territory. ETH’s Relative Strength Index (RSI), on the other hand, fell. Additionally, the MACD showed the possibility of a downtrend, increasing the probability of a downtrend continuation.

Interestingly, the Exponential Moving Average (EMA) Strip has chosen to support the buyers as it is bullish.

Like the EMA strip, a few of the on-chain metrics are bullish. According to CryptoQuant, the buy/sell ratio of ETH was green. The metric shows that buying sentiment is dominant in the derivatives market. At the same time, ETH’s network growth remains high.

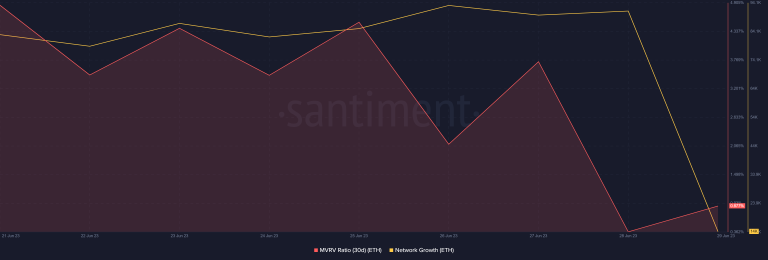

However, nothing can be said for certain as Ethereum’s MVRV Ratio has dropped significantly, which was showing a bearish trend.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.