Analyst Ali Martinez talks about a deep correction in Bitcoin price if a historical pattern is realized. Crypto analyst Benjamin Cowen also says that BTC is likely to make a significant correction.

Analyst expects first a rally and then a sharp correction for Bitcoin

cryptokoin.comAs you follow from , BTC is failing to gain traction despite spot Bitcoin ETF news. BTC is fluctuating between $42 thousand and $43 thousand. In addition, analysts warn of a sharp decline. Popular analyst Ali Martinez says Bitcoin is prone to a significant pullback after emerging from a bear market. According to the analyst, Bitcoin followed the same pattern after making major rallies in 2016 and 2019. In this context, the analyst makes the following statement:

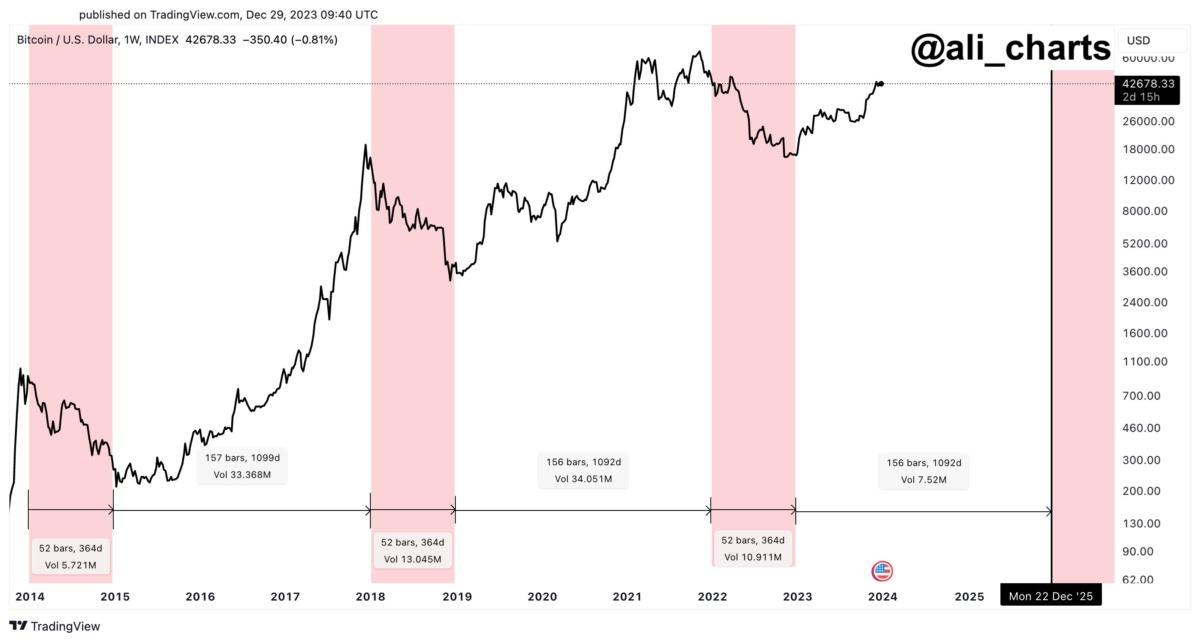

In 2016 and 2019, after finding a market bottom, Bitcoin’s first major correction occurred when it reached the 0.786 Fibonacci retracement level. Based on this pattern, if history repeats itself, BTC could climb towards $50,000 before experiencing a 40% correction.

If the same pattern continues, a 40% correction from $50,000 would mean the Bitcoin price would drop to $30,000.

“In the long term, the bull market will continue until the end of 2025!”

Ali Martinez remains bullish for the long term as he sounds the alarm about a possible major correction for Bitcoin. Based on BTC’s halving cycle, Martinez suggests that the bull market will last until the end of 2025. He says. In this regard, Martinez says:

Bitcoin is designed around four-year cycles driven by halving events, which typically reflect price movement. Historically, this means a three-year uptrend followed by a one-year downtrend. According to this cycle, BTC is in an uptrend phase that potentially extends until December 2025!

Benjamin Cowen: A significant price movement is coming for BTC!

Crypto analyst Benjamin Cowen also looks at Bitcoin’s past price movements. Based on this, the analyst says that there is a high chance of a significant correction soon. Cowen notes that he is paying attention to Bitcoin’s 100-week simple moving average (SMA). According to the analyst, every time Bitcoin breaks above the 100-week SMA, it tends to bounce back to retest before continuing upwards. BTC broke above the 100-week SMA a few months ago. Since then, Cowen says there is a downside risk from a historical perspective. The analyst also notes that the Federal Reserve’s actions will determine whether Bitcoin holds the 100-week SMA as support. In this context, the analyst makes the following assessment:

Historically, we have retested the 100-week moving average at this point in the cycle. This is something that we recognize seems like something that occurs at some stage in the cycle. We did not experience a hard landing in 2016. (…) Bitcoin basically retested the 100-week SMA and continued to rise. However, we tested this again in the last cycle, we experienced a jump but eventually started to decline. So I think we’ll see some sort of backtest of the 100-week moving average at some point, probably within the first few months of 2024. After that, the question of whether this continues will likely depend on whether the Fed makes a soft landing or a hard landing like the last cycle.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!

For the rest of the article, These Bottoms are on the Cards for Bitcoin: A Warning Came from Two Master Analysts!