Bitcoin saw a 15% decline from its high on January 11 to its low on January 12. This sudden price change caused the downward trend to increase. Thus, investors bet against the leading cryptocurrency. In addition, the leading altcoin Ethereum recently experienced a similar situation. Crypto expert Vinicius Barbosa talks about a possible ‘short squeeze’ for these 2 cryptocurrencies. Therefore, it is possible that this will push BTC and ETH prices north.

Leading cryptocurrency could reach $50,000 in a ‘short squeeze’!

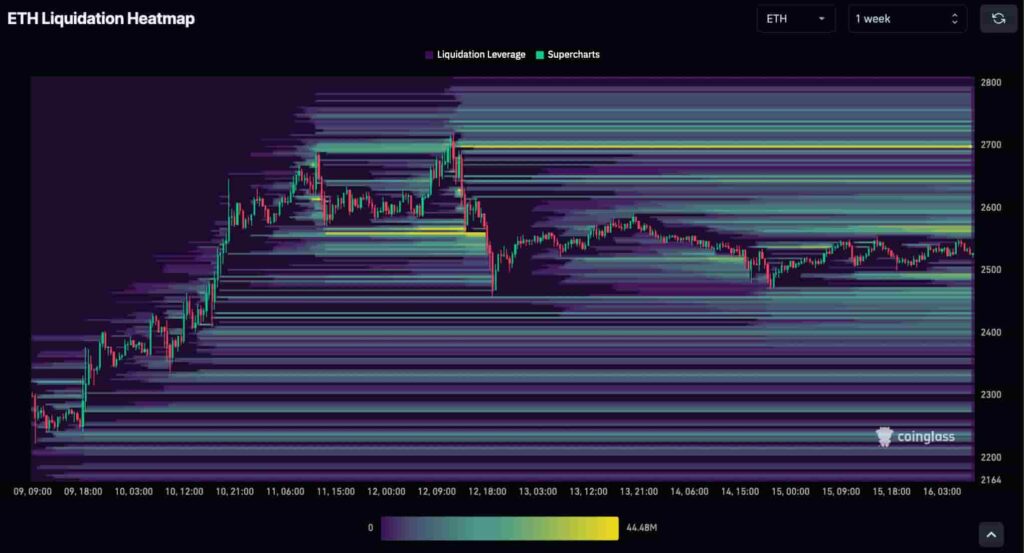

Interestingly, traders create upward liquidity pools by opening short positions. These can also become the target of market makers. If the cryptocurrency reaches these liquidity pools, positions are closed or liquidated. In this case, prices rise even more. This is called ‘short squeeze’. Liquidation heat maps from CoinGlass show the possibility of a ‘short squeeze’ for Bitcoin and Ethereum.

Notably, Bitcoin has a liquidity pool worth $575.95 million at $49,281 on the weekly time frame. Before that, CoinGlass’ chart shows large amounts awaiting short liquidations around $42,800 at current prices. Bitcoin could rise 15%, wiping out this existing liquidity, which makes it an easy target for bull whales. Moreover, there is almost no liquidity on the downside for the leading cryptocurrency. This supports a price pump at any time this or next week.

‘Short squeeze’ warning for Ethereum (ETH)

It wasn’t just Bitcoin that suffered in the recent price drop. Other cryptocurrencies also witnessed selling and more short positions against them. For example, Ethereum (ETH) lost nearly 10% in value from its highest price on January 11 to its lowest price the next day.

Ethereum, meanwhile, has a slightly more balanced scenario with some distributed liquidity downwards. However, the most important weight for the cryptocurrency points to $2,700. Here, a 40 million dollar concentrated liquidation awaits a ‘short squeeze’ at this price. Breaking the closest positions between $2,560 and $2,570 will be crucial to initiate a liquidation event. Reaching the top target would mean gains of over 8% from $2,500 for Ethereum investors buying at current prices.

However, it is important to understand that concentrated liquidity does not guarantee that these liquidations will occur. Demand is necessary for prices to increase. This is essential to trigger a ‘short squeeze’. As a result, the cryptocurrency market is unpredictable. So it’s possible for things to change in a few hours or even minutes.

The opinions and predictions in the article belong to the expert and are definitely not investment advice. cryptokoin.com We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!