Cryptocurrency market sentiment fell during this week’s pullback following the approval of the Bitcoin ETF. However, some indicators point to this downtrend being about to end. According to crypto analyst Vinicius Barbosa, this could trigger a ‘short squeeze’ against crypto short sellers.

Data supports ‘short squeeze’ for these 2 cryptocurrencies!

cryptokoin.comAs you follow from , the total cryptocurrency market cap has lost $132.5 billion (7.68%) in the last seven days since January 12. The volume of the movement amounted to 4.95 trillion dollars. Meanwhile, the Relative Strength Index (RSI) has recovered slightly from the oversold threshold.

Some cryptocurrencies continue to accumulate open short positions in the derivatives market despite technical analysis signs of trend reversal. This scenario favors a ‘short squeeze’ event as the remaining traders provide upside liquidity that can become attractive targets for market makers. CoinGlass data shows a large number of short liquidations still open for Bitcoin and Solana.

‘short’ for leading cryptocurrency Bitcoin ‘squeeze’ warning

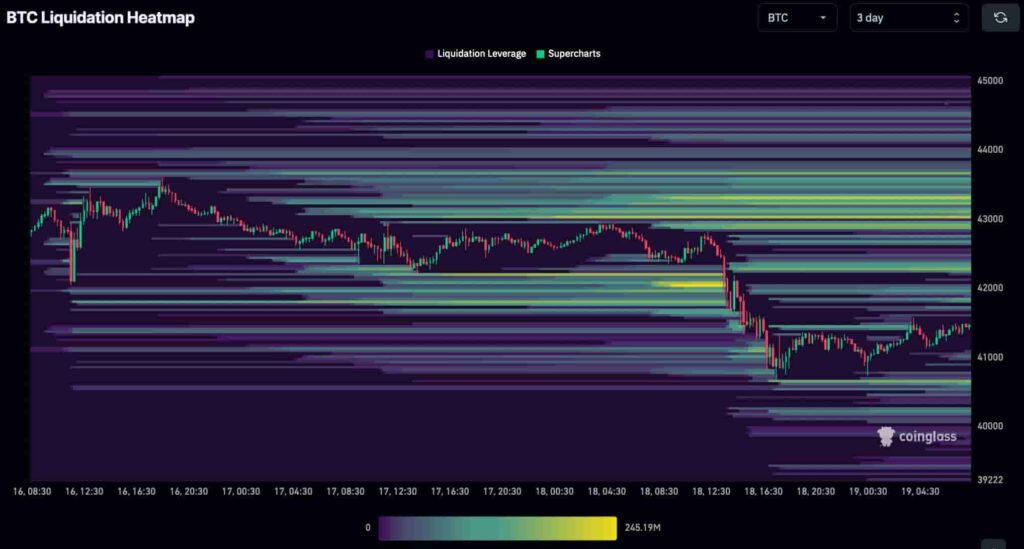

Bitcoin’s ‘short squeeze’ warning from January 16 remains valid as liquidation accumulates at higher prices. On this occasion, BTC has sufficient liquidity for up to $50,000 in the weekly time frame at current prices. Interestingly, the 3-day liquidation heat map shows that a ‘short squeeze’ is gaining strength and is possible next week. Specifically, current liquidity of $207 million sits at $43,323. This supports an initial run towards these prices very soon.

Leading cryptocurrency Bitcoin is currently trading at $41,453. Moreover, its last 24-hour volume is over $50 billion and has started to rise again. While traders opened short positions of $25.32 billion in the last 24 hours, the amount of open positions was $18.12 billion.

Short-term trend reversal possible in Solana!

On the other hand, Solana lost price value, volume and open interest in the last 24 hours. However, short positions continued to increase by $3.15 billion in the same period. Currently, short positions account for 51.91% of cryptocurrency volume.

This combination of factors suggests that the market may reject the current trend, which could push prices slightly higher. Therefore, such behavior would be enough to trigger the nearest liquidations between $95.9 and $96.8 in a small ‘short squeeze’. Moreover, considering Solana’s liquidity pools, $100 would be the next attractive target.

However, it is important to understand that concentrated liquidity does not guarantee that these liquidations will occur. Demand is required for prices to increase. This is necessary to trigger short sales. After all, the cryptocurrency market is unpredictable and everything can change in a matter of hours or even minutes.

The opinions and predictions in the article belong to the analyst and are definitely not investment advice. We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!