One of the former members of the crypto world Litecoin (LTC) it had been searching for a force that would trigger its upward movement for some time. Litecoin bears are “fighting” for control, according to technical data.

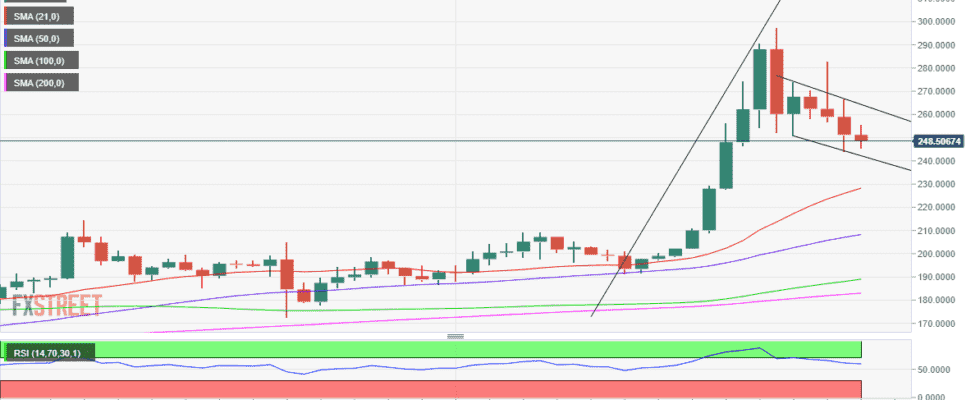

An important “bullish flag” has appeared on the Litecoin (LTC) 12-hour chart, but this signal has yet to be confirmed. RSI stopped its decline while above 50 and supported buy signals. As LTC bulls struggle to take control from the early morning hours today, Litecoin price corrections seem to have lost strength after falling from a six-month high of $298.

LTC price reached yesterday (Friday) $244It’s trying to make a calm bounce from its “three-day low” and is currently $251traded from.

Despite the pullback after a six-month peak, Litecoin’s underlying bullish trend remains unchanged amid promising fundamentals.

FXStreet’s Crypto Editor Ekta MoryaHe stated, “Based on data from crypto intelligence platform IntoTheBlock, 88% of wallet addresses holding Litecoin are currently profitable.”

A famous Forex trader and analyst Peter BrandtAdding confidence to its bullish potential, he said he expects LTC price to retest 2021 highs at $395.

LTC Price Expects Rise Under A Potential Bull Flag

The consolidated situation in Litecoin showed a “bull flag formation” following an uptrend from the $191 low on Nov 6 to half-year highs.

LTC bulls need a sustained break above the falling trendline resistance at $264 to confirm the uptrend. Then, a rally will begin towards the “multi-month” highs that remain near $300.

As post rebound buys increase, LTC price could challenge the $350 psychological level. Later, the model target measured at $371 will be followed by LTC investors.

If the LTC bulls continue to hold their ground, an upside rebound to $400 will come as no surprise.

The Relative Strength Index (RSI) has stopped its downside momentum and is now attempting a bounce above the midline.

If the selling momentum continues, the downtrend support at $242 could be put at risk. A 12-hour candlestick closing below this level will erase bullish sentiments and open additional downside to the 21-Simple Moving Average (SMA) at $228.

The next critical level will be $208, which is the bullish 50-SMA.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.