Sometimes, when the BTC price drops or rises, bitcoin Traders called whales are thought to influence the crypto market. Bitcoin whales are groups or individuals who own large amounts of BTC and are believed to manipulate market prices with large trades. Although the market power of whales has decreased as more people own Bitcoin and the value of the digital asset market has risen over the years, whales remain important in the market. The movements of the whales are still newsworthy.

Whales are often dangerous as they are the largest fish in the ocean and eat small sea creatures. Crypto whales are also notorious for eating small traders, so to speak. The more a whale owns the total supply of a cryptocurrency, the wider its sphere of influence. For example, if a crypto whale owns 15% of the total LINK supply and is determined to sell these tokens, the LINK price will definitely be strongly affected.

Whales can manipulate the market without trading BTC

Bitcoin whales are also notorious for bluffing. In crypto currency exchanges, buy and sell orders can be created at different prices apart from the spot price. Wanting the Bitcoin price to rise or fall, whales can build a wall at the target price by placing a very heavy trade order on very high volume exchanges such as Binance, FTX, OKX or Coinbase. For example, placing an order to buy 3,000 BTC at less than the spot price could create a support point for Bitcoin. If the whale is indeed bluffing, it will cancel its order once the BTC price approaches the buy level.

How much crypto do whales hold?

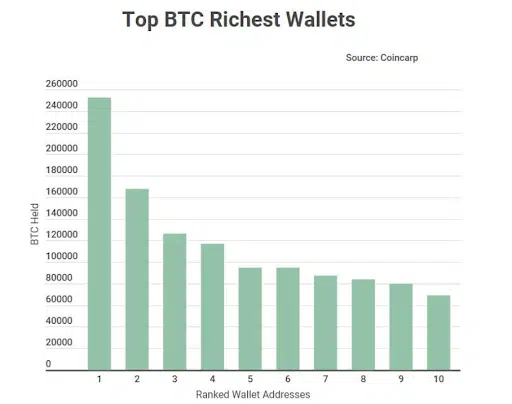

Whales often hold large amounts of crypto. 85 Bitcoin wallets currently hold about 15% of circulating BTC. 8 million BTC, which corresponds to almost 42% of the amount of BTC in circulation, is also found in the 2200 wallets with the most BTC. Whales like to buy and sell manipulative and volatile cryptocurrencies like Doge and Shiba Inu for short periods. While 27% of the total amount of Doge is held in a single wallet, the 15 wallets holding the most Doge hold 50% of the circulating supply.

Exchange to wallet transfer

Bitcoin whales use cold wallets to store their funds as it is a much safer solution. The large amount of crypto sent from the exchange to the wallet indicates that the whale does not want to sell this asset in the near term. If the withdrawn crypto is a stablecoin, this is negative for the Bitcoin price because the whale preferred to stay in cash rather than buy Bitcoin.

Transfer from wallet to exchange

It is also important that a Bitcoin whale sends BTC from the wallet to the exchange. Cryptocurrency exchanges are the most popular platforms for crypto trading. If a whale sends their BTC to the exchange, it can be said that they intend to sell them in the short term. And again, it’s a different situation for stablecoins. Sending a large number of stablecoins to the exchange wallet may mean that a whale is preparing to buy a different crypto.

How to watch crypto whales?

Whale Alert is a Twitter account known to crypto followers. This account instantly shares major crypto transfers that happen on the blockchain. Koinfinans.com As the team, we often share with you the developments regarding whale movements.

If you have analytics skills on chain and know how to use blockchain explorers, you can track major crypto whales and transactions.

Conclusion

The crypto market does not yet have the controls and regulations that traditional markets are subject to. Although the market is less volatile than before, it still shows sudden and relatively large-scale changes. Market manipulation is a common problem for whales. You should watch whales and track their trades, but not just trade on those trades. You should always make your investment and trading decisions after doing enough research and using technical and fundamental analysis methods.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.