Local presence of Binance, the world’s largest cryptocurrency exchange Binance Coin (BNB) It continues to trade above an important level to maintain its uptrend.

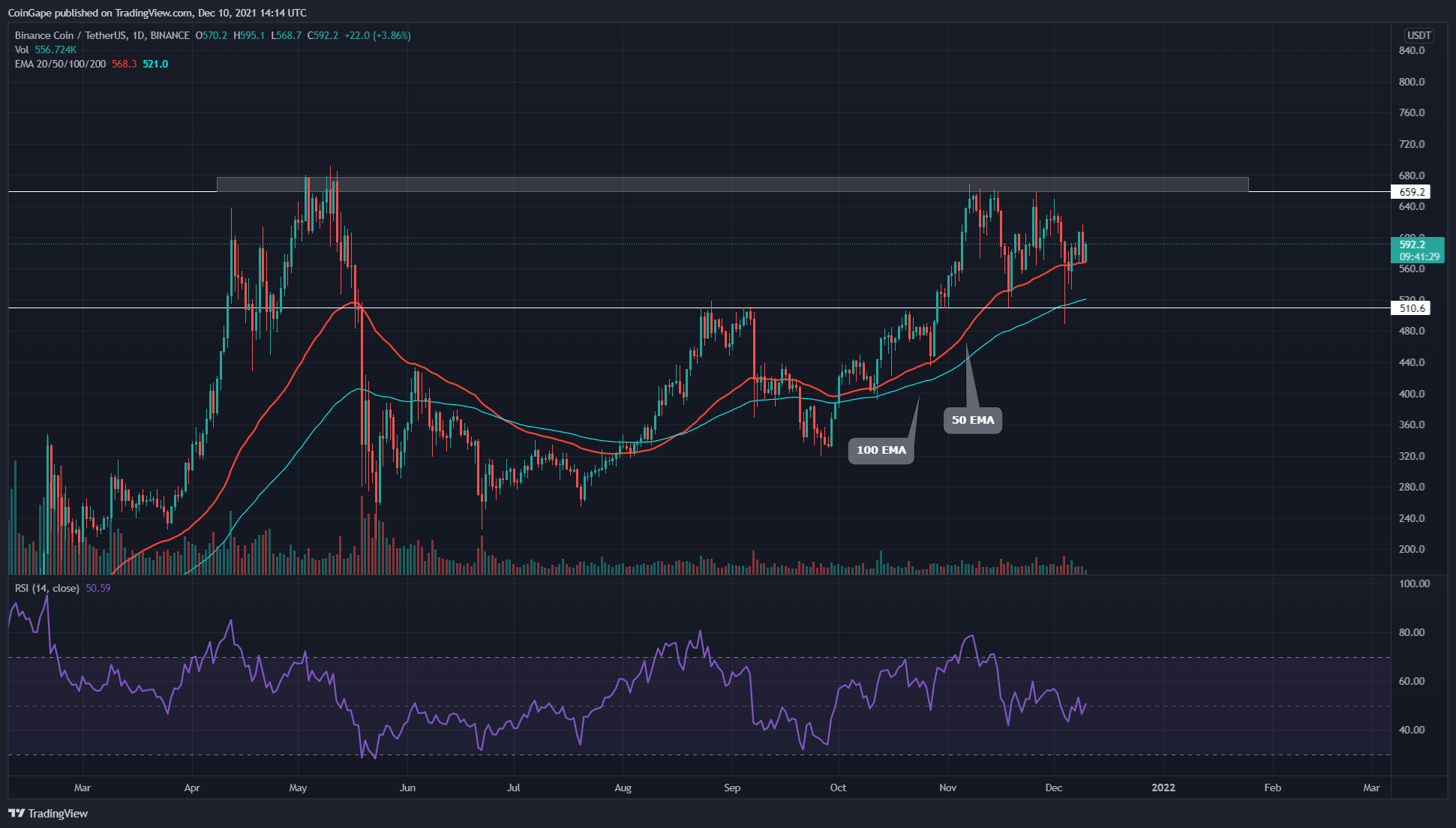

When we look at the BNB/USD chart, the general trend is still bullish, although there are decreases in price. In addition, the price of BNB has been fluctuating between $ 660 and $ 500 for a while. If BNB investors and traders are expecting a big move, they can expect the price to break in one direction between these levels.

In addition, from Indonesia Binance news, on the other hand, helps maintain a positive mood.

Important Technical Points

- BNB The price is holding dynamic support from the 50-day EMA and extended pullback support from the 100-day EMA.

- BNB maintains the “cup and handle pattern” on its daily timeline chart.

- The intraday trading volume on BNB is $2.03 billion, which means a 5% loss.

On December 4, BNB, one of the crypto markets that lost blood in general, had its share and retested the important level of $ 500. With this; The price has been able to break out of this decline as the chart shows a long low price rejection candle indicating heavy buying pressure.

BNB still maintains the “Cup and Handle pattern” where the price echoes for the “handle part”. Traders can wait for the price to surpass the overhead resistance of $680 to trigger a long entry opportunity in BNB.

BNB shows bullish alignment of key EMA levels (20, 50, 100 and 200). Also, the 50 EMA line provides strong dynamic support in a stable uptrend, and the 100 EMA covers the prolonged pullback in price.

The Relative Strength Index (50) line fluctuates near the neutral zone of the chart.

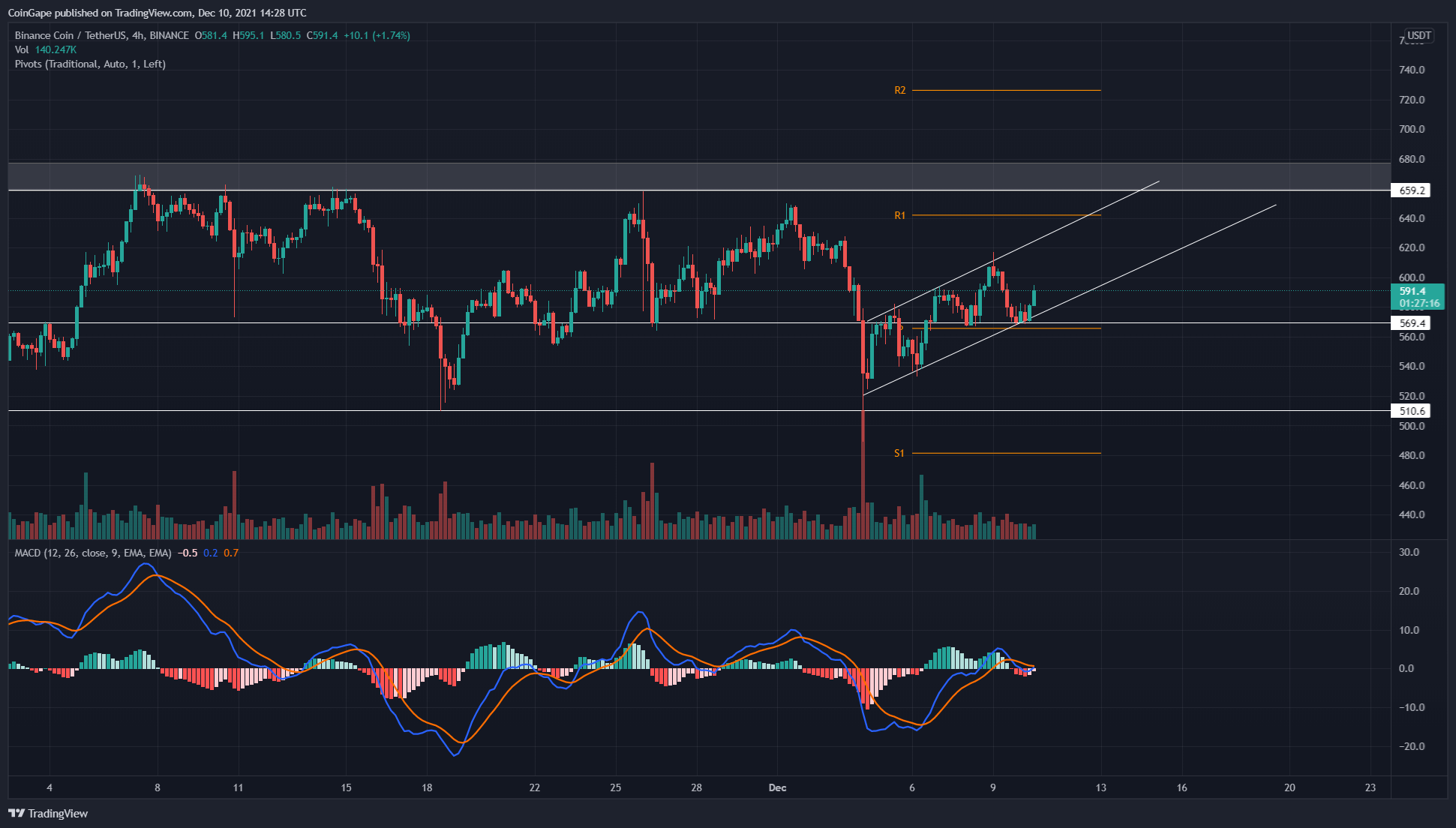

BNB/USD 4-Hour Timeframe Chart

The 4-hour time chart, on the other hand, shows the price swinging in an ascending parallel channel pattern. Using this pattern, BNB price will retest the overhead resistance zone of $660-680 for a possible bullish breakout. However, this pattern is also notorious for experiencing a significant drop in price when the lower support leaves the trendline.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.