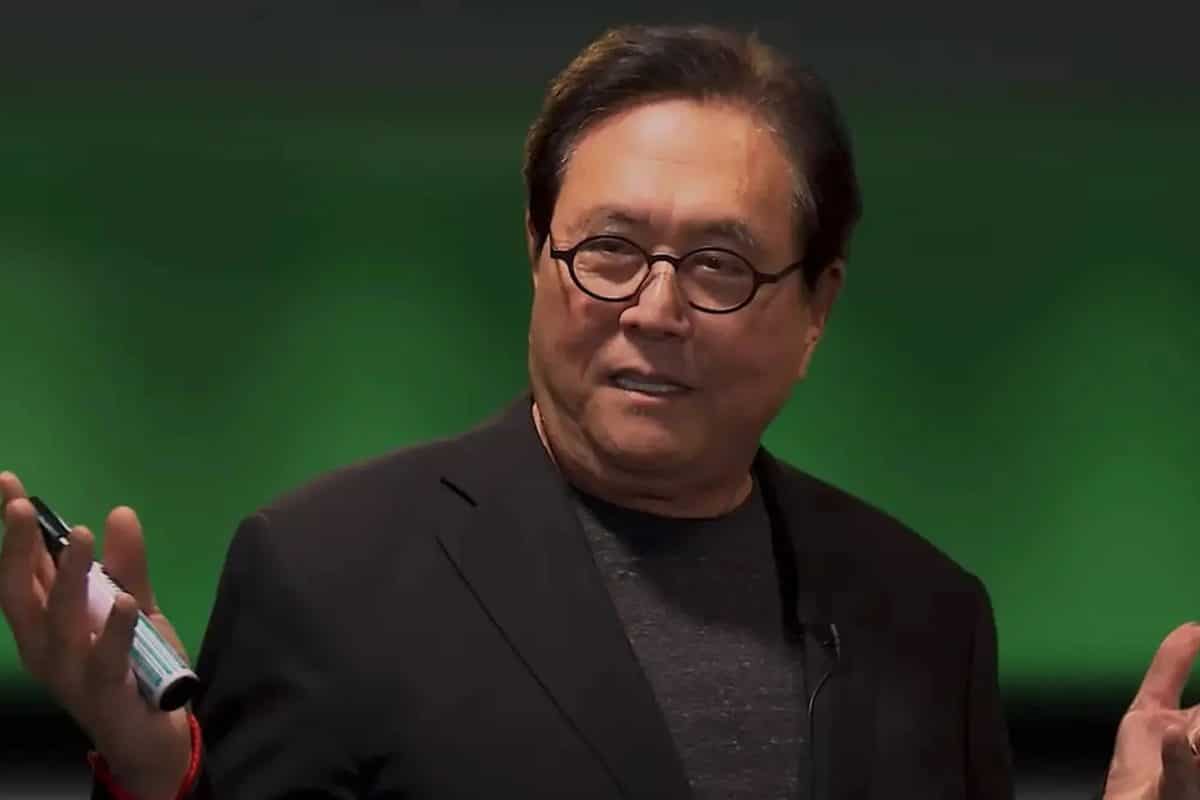

The concept of the “everything bubble” has been around for nearly a decade, and while most people associate the term with the period between 2020 and 2021, there’s definitely a lingering feeling that the stock market has been doing a little too well lately. Especially given the assumed impact that current high interest rates will have on prices. At this point, what the famous writer Robert Kiyosaki said attracts attention. In a new post, Kiyosaki again suggested cryptocurrency Bitcoin (BTC), silver and gold. Here are the details…

Robert Kiyosaki issued a balloon warning

Nvidia recently rose to over $2 trillion in value, and tech giant Microsoft became the world’s largest company just in January. The major indices are also performing quite well and are approaching their peaks. The combination of these factors, on the one hand, offered investors the opportunity to earn surprising rates of return despite allegedly tightening conditions in the context of the Fed’s fight against inflation.

On the other hand, they have further deepened fears that nearly every stock on the market is severely overvalued. This feeling gave rise to the idea of the “everything bubble” in the first place. Meanwhile, Robert Kiyosaki, author of “Rich Dad Poor Dad”, made a statement. He stated that the current state of the US stock market is nothing short of the ‘biggest bubble in history’. He is among the voices warning about this issue.

In fact, as recently as January, it took a position contrary to forecasts by major banks and other institutions (which largely predicted stormy seas in 2024 but generally projected a positive annual outcome). He warned that the United States was headed toward “war and depression.”

‘Baby boomers’ effect

By March 11 cryptokoin.com As we reported, Kiyosaki made statements. He found that the generation that would be particularly harmed by the upcoming collapse was the “baby boomer” generation. As Kiyosaki explains, Boomers will be “destroyed” because they are “the first generation with flimsy 401ks.”

As Kiyosaki notes, it’s critical that most baby boomers either retire relatively recently. This means that if the stock market crashes, they will be left with little time for their portfolios to properly recover. As a result, this does not make the “bubble” situation any easier.

Kiyosaki recommends Bitcoin (BTC) to escape crash

In addition to being known for his gloomy predictions and best-selling book, Kiyosaki has long been a strong advocate of certain commodities (gold and silver) and the world’s leading cryptocurrency, Bitcoin (BTC). Indeed, Kiyosaki’s main advice for weathering the coming storm is not to try to fight the Fed, regardless of what you think of its policies, but instead to invest in gold, silver, and Bitcoin (BTC).

The recommendations are largely in line with the historical performance of gold and silver. Both are known for their relative stability in times of crisis due to their reputation as stores of value. Bitcoin has yet to be tested in a major recession. But it is also widely considered “digital gold” and essentially a store of value. In fact, BTC’s roots go directly back to the disillusionment with the global financial system following the 2008 crisis.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.