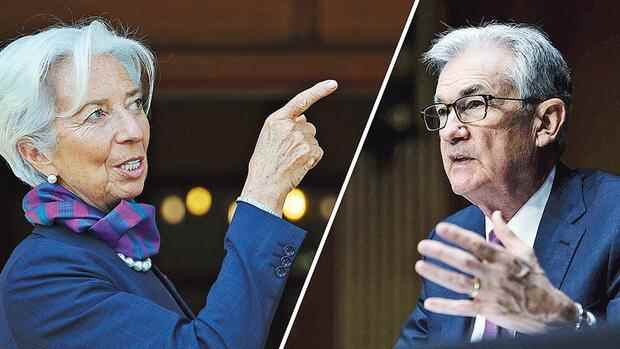

The ECB President and the Fed Chair are under pressure to act in the fight against inflation.

(Photo: Imago, dpa)

It is perhaps the event of the year for anyone even remotely interested in monetary policy and its implications for capital markets and the real economy. The trading floors around the world were on high alert when Jerome Powell, the chairman of the US Federal Reserve, began his speech at the traditional class reunion of central bankers in Jackson Holle on Friday.

This time the audience didn’t have to read between the lines. Powell chose unusually clear words for a central banker to make it clear that the Fed will continue to hike interest rates and that easing is out of the question for the time being.

Such a clear announcement was Powell’s only chance. The hand of the central bankers must not tremble. They must show no sign of weakness in fighting inflation. This applies not only to the Fed, but also to the European Central Bank (ECB). Both have hesitated for far too long in combating inflation.

This mistake may be understandable, after all the central bankers had to weigh up whether they should really risk stalling the recovery after the corona crisis with significant interest rate hikes. However, this hesitation has consequences: If they don’t want to jeopardize their credibility for good, they have to act all the more decisively now and, if in doubt, also accept a recession.

Top jobs of the day

Find the best jobs now and

be notified by email.

The central banks’ credibility problem can be seen in the USA, the world’s largest capital market. Long before Powell’s speech, Fed officials had been making it clear that the Fed would stick to its tight stance, but investors didn’t quite want to listen.

The Fed can’t afford to bet against the Fed

Equity and bond markets lost some of their enthusiasm in August. But prices are still well above their June lows – and the Fed can’t be happy about that.

There are two reasons for this: first, tightening financing conditions would help fight inflation, and second, and this is the more important reason, the Fed cannot afford to have investors bet against them, and ultimately perhaps neither can still have success.

>> Read here: “We won’t stop until we get there”: Powell announces further tough fight against inflation

The Fed has not yet succeeded in convincingly conveying to investors that it is carrying out a paradigm shift. In the years after the financial crisis, the central banks, with their extremely loose monetary policy, have repeatedly rushed to help the markets when things got tight, most recently during the pandemic. Now the Fed but also the ECB must make it clear that the fight against inflation is clearly a priority for them. It wasn’t the first time Powell said that in Jackson Hole, but so far his message has only gotten through to a limited extent.

The Fed has already dared two unusually large rate hikes of 0.75 percentage points each – a third could now follow. At the ECB, supporters of a significant tightening of monetary policy are at least becoming louder. On Friday, it got out that the euro central bankers want to discuss at least a three-quarters percentage point hike in interest rates at their next meeting.

Actually, that wouldn’t be a bad strategy to regain credibility in the fight against inflation. However, it is unlikely that it will come to that because of the resistance of the southerners.

>> Read here: Jackson Hole without ECB boss: The world is burning, Lagarde is reading Joyce

The task facing ECB President Christine Lagarde is far more delicate than that of her colleague Powell. The danger of a deep recession is much greater in the monetary union because the energy crisis is hitting Europe harder than the USA. In addition, sharp interest rate hikes are poison for highly indebted countries like Italy. The acute political crisis in the country finally makes a euro crisis 2.0 a real danger.

Perhaps there is still a chance that the ECB will manage the delicate balancing act between recession and inflation. But the probability that the central bank will pull off this feat without making a dangerous misstep is not particularly high.

More: Central banks let the Dax slip 300 points – the leading index should now test the low for the year