According to CryptoQuant data bitcoinAfter averaging 100% in early 2023, it had a choppy start, correcting 10%. However, there are many technical and on-chain factors that support BTC’s market structure. These details show that investors should remain calm.

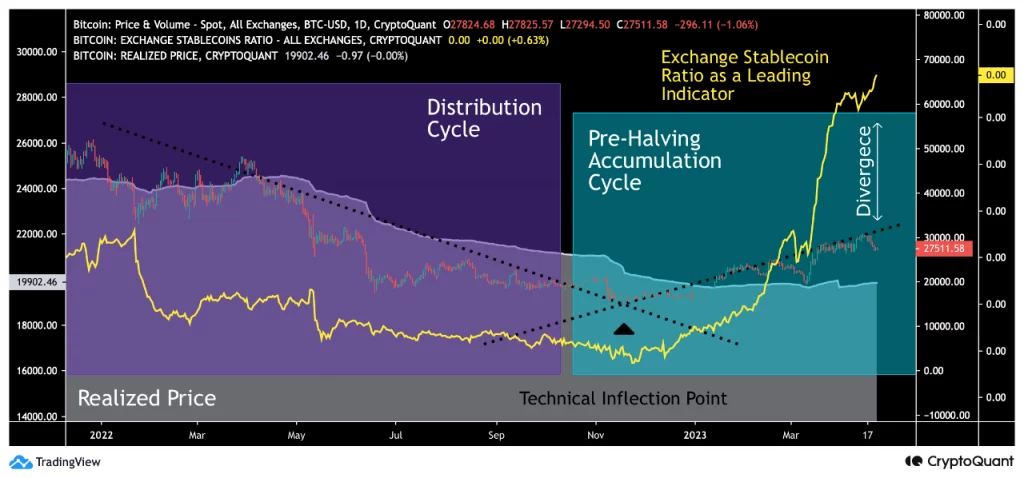

From a technical standpoint, Bitcoin passed the critical turning point at the beginning of 2023, where the descending and ascending trendlines meet. This point serves as a technical milestone and defines the market from 2021 to the halving year of 2024.

Moreover bitcoin pricewhich represents the average price of all BTC purchases.actual price indicator“He managed to get on top of it. This means that average buyers profit from their investments. This is interpreted as an encouraging signal for the market.

Koinfinans.com As we have reported, the market behavior of Bitcoin is also interpreted as the accumulation and distribution phases, which together form a series of multi-year cycles. Institutional money traditionally favors accumulation cycles, while retail investors are active in distribution cycles. BTC’s history is also associated with halving events, and an accumulation cycle is always seen before these events.

Despite the falling spot price, Bitcoin’s stock market stablecoin rate (ESR) is currently acting as a leading indicator for BTC and other digital assets in correlation. ESR and BTC’s spot price were close to each other from 2021 to 2022, but the selling pressure from last year was enough to break their correlation. However, in late 2022, the stock market stablecoin rate began to bounce back towards new highs, and in the current market structure, ESR is acting as a magnet for bitcoin’s spot price.

In conclusion, despite the recent correction in Bitcoin price, there are many technical and on-chain factors supporting the market structure. The multi-year milestone, realized price, increasing ESR divergence and pre-halving accumulation cycle suggest that investors need to stay calm and hold on to their investments.

You can follow the current price action here.