A prominent crypto analyst said that Tether (USDT) dominance and dollar index (DXY) are giving big bullish signs for crypto.

In a new tweet, Justin Bennett posted a chart showing USDT’s market dominance to his 99,000 followers. The analyst noted that the recent drop in USDT’s market dominance is a bullish sign for cryptos.

“First lower low from USDT.D (Tether dominance) since November. Rise for cryptos.”

Bennett also supported the bullish thesis by examining the DXY charts, which measure the value of the USD against cryptos. With DXY falling below the current trendline, Bennett said this is a good sign for the crypto markets.

“DXY 4-hour (chart) breakout. Rise for cryptos.”

As for what these indicators mean for the leading crypto asset Bitcoin (BTC), Bennett predicts that BTC has changed current resistance levels and potentially moved towards higher resistance areas of $45,500, $53,000 and even $60,000.

“It is time for BTC to act responsibly.”

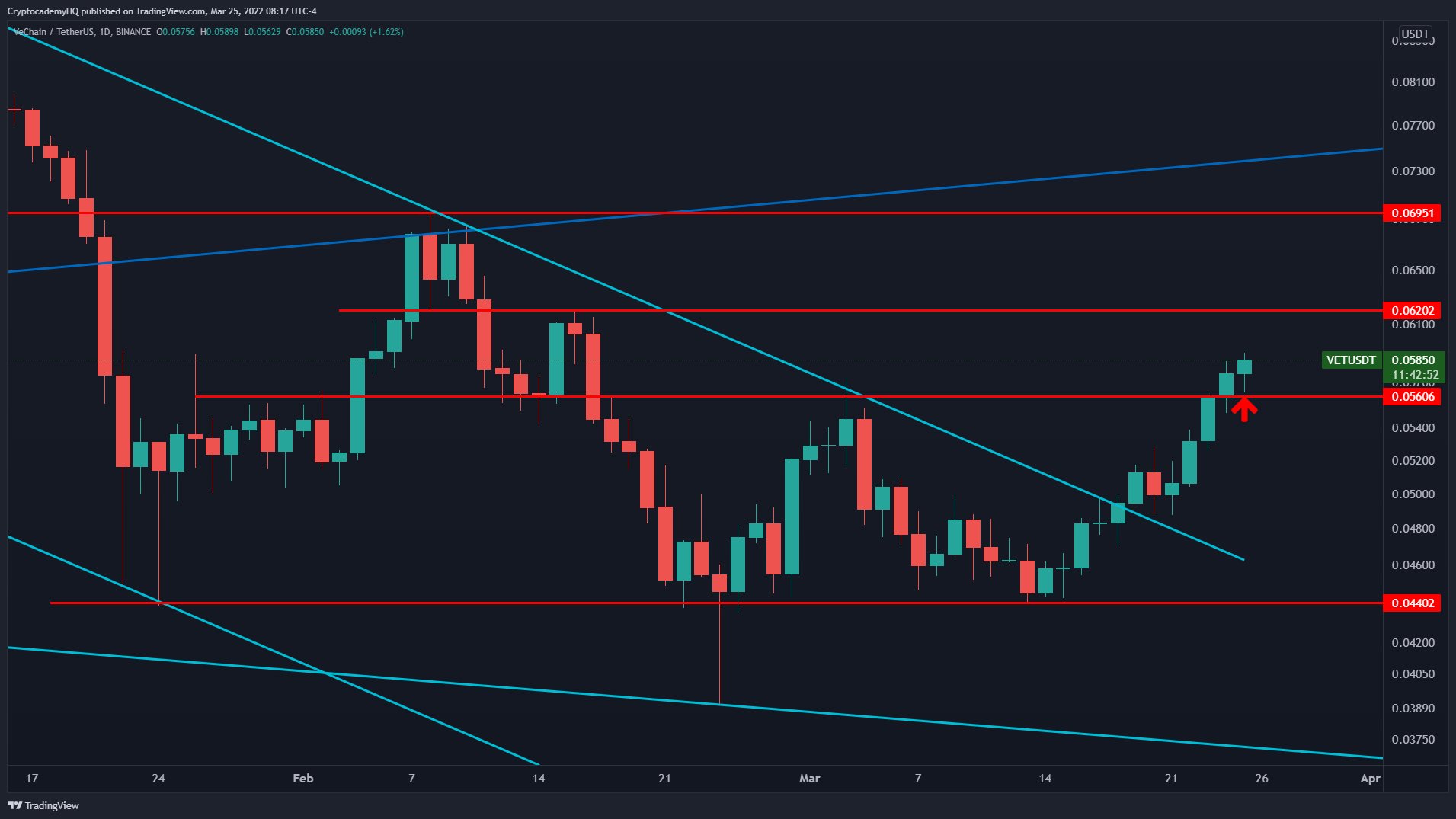

In addition, in a new blog post, Bennett made an assessment, calling VeChain (VET) a “traders’ dream”.

“VeChain (VET) has been a trader’s dream this month. I wrote about the potential of this rally on the 17th and VET confirmed the breakout two days later. Since then, VET has increased by about 18% and it still looks pretty optimistic.”

Currently, Bennett thinks VET has turned the $0.056 resistance level to support. The analyst hints that VeChain could jump 25% from the current levels to the $0.07 range once the next resistance level is turned to the support at $0.062.

“Daily close on VET (this) + retest as new support. Simple.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.