bitcoin It has been under selling pressure for some time and is trading around $26,600. While the last few weeks have been with low trading volume for BTC and cryptocurrencies, investors are relatively worried.

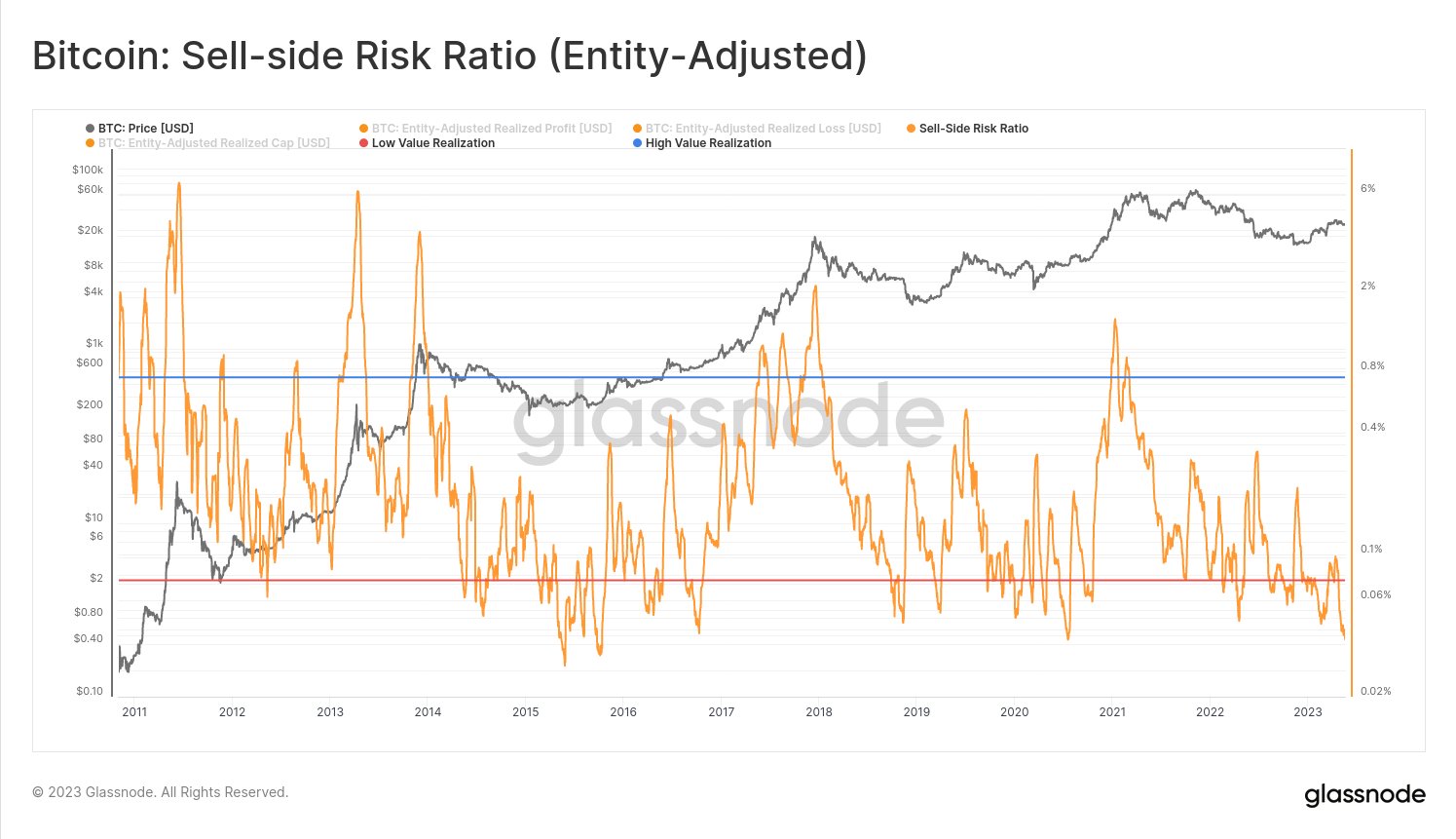

On-chain data, on the other hand, offers some optimistic data that will comfort investors. Glassnode analyst Checkmate recently reported that Bitcoin’s sell-side risk ratio has reached an all-time low.

This shows that investors are reluctant to spend their BTC at profit or loss in the current price range. Typically, this happens when sellers get tired on both sides, indicating that big moves are imminent.

Also, on-chain data from Glassnode, cryptocurrency As the trading volumes and liquidity decrease in the market, it also shows that volatility is imminent.

It is unlikely that BTC will remain dormant for very long as price ranges are squeezed and in-chain transfers are at the low end of the cycle.

NEWS CONTINUES BELOW

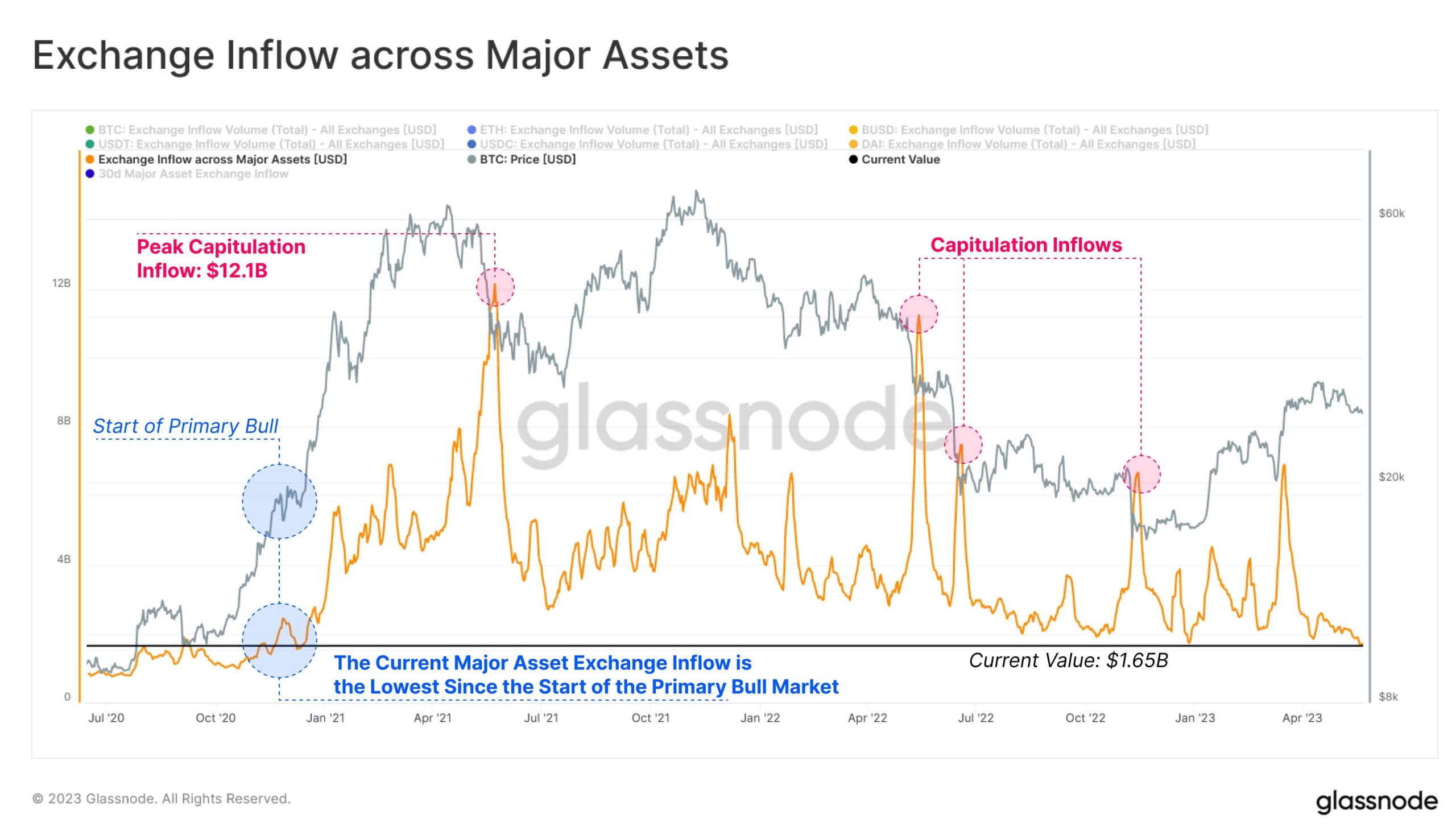

Bitcoin Entries Drop

Glassnode explains that large Bitcoin inflows on exchanges are at their cyclically lowest at $1.65 billion. This is the lowest value seen since the beginning of the primary bull market. This massive squeeze in stock market entries typically implies that “structural market liquidity remains extremely low.”

After a strong rally earlier this year, Bitcoin failed to break the $30,000 level to the upside. It has been under constant selling pressure ever since. It will be interesting to see if BTC manages to hold $27,000 or if it drops further.

You can follow the current price action here.