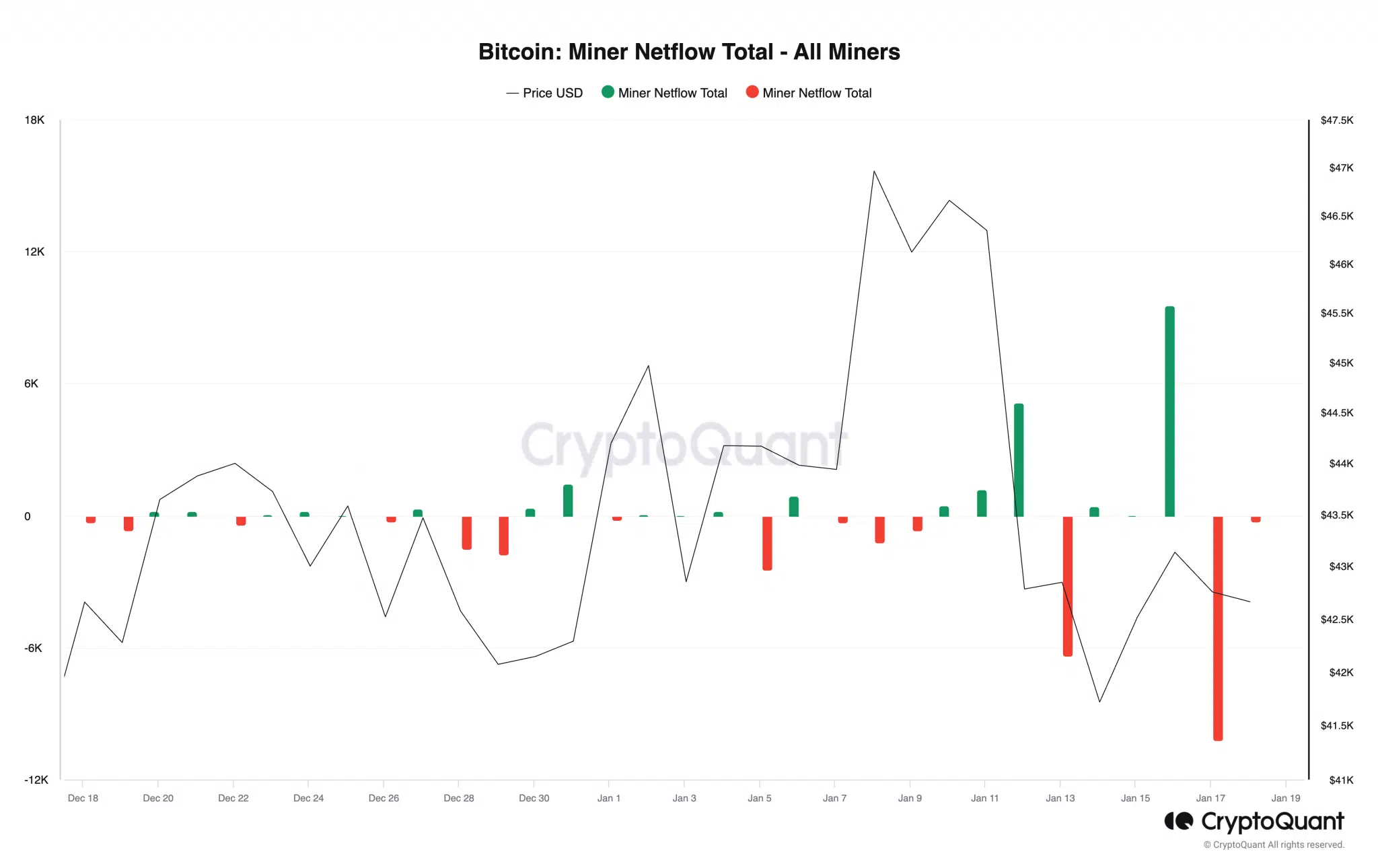

According to CryptoQuant’s data, Bitcoin Miner Net Flow fell to its lowest level of the year on January 17, indicating a significant decline in miner reserves.

According to the on-chain data provider, more than 10,000 BTC worth $436 million were sent to exchanges for onward sales.

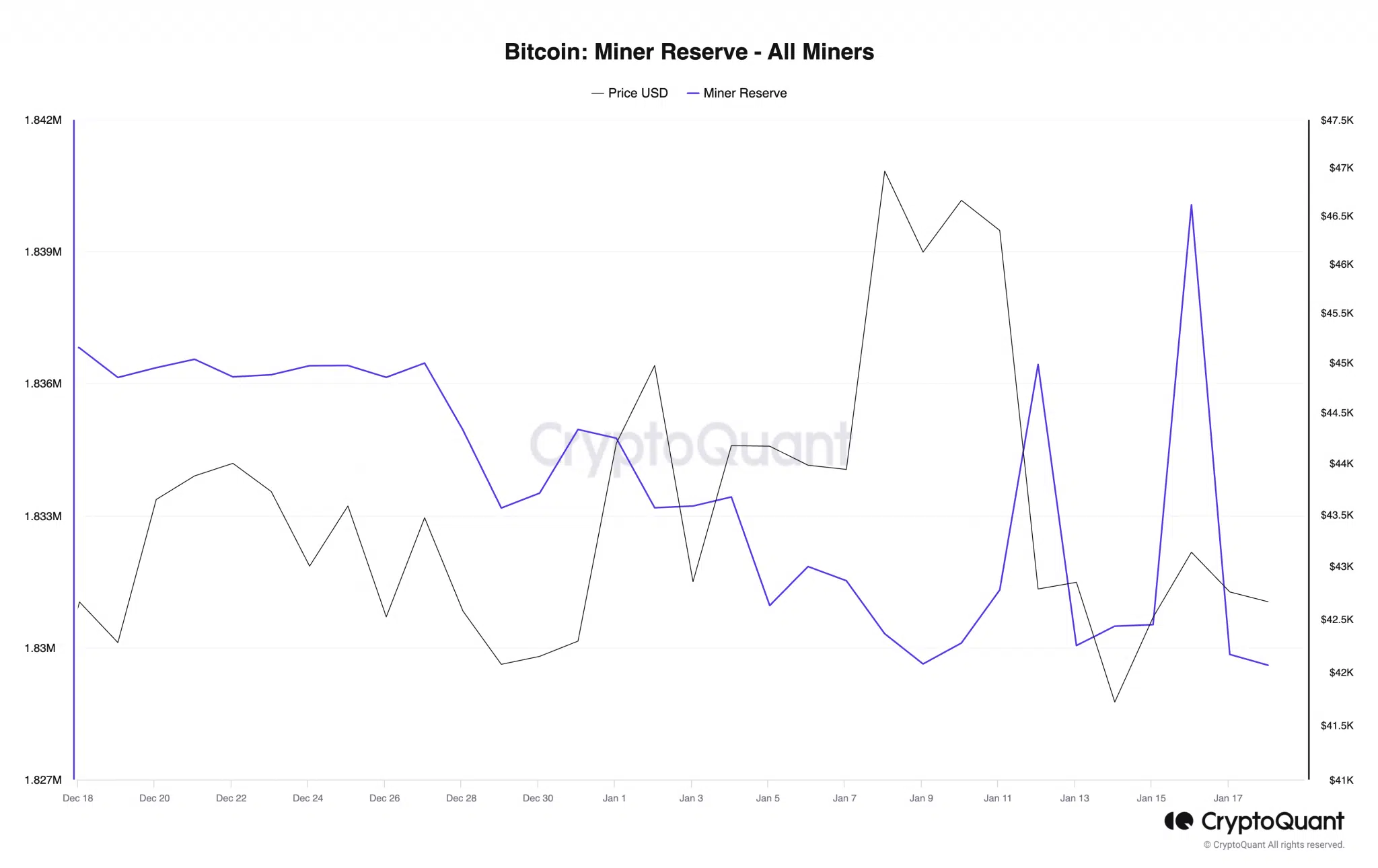

When BTC’s Miner Net Flow drops in this way, it results in a corresponding drop in miner reserves, which measure the amount of coins held in connected miners’ wallets over the period studied.

Koinfinans.com As we reported, on January 17, BTC’s miner reserves fell by 1%, falling to its lowest level since the beginning of the year. According to data from CryptoQuant, 1.82 million BTC was held in all existing miner wallets that day.

In a recent report, CryptoQuant analyst Woo Minkyu commented on the impact of the decline in BTC’s Miner Net Flow and reserves.

This trend may indicate miners’ strategies to secure long-term operational funds. Selling Bitcoin on the market to offset mining and operational costs is a typical part of its business activities. In summary, such significant selling by miners can impact the market in several ways and potentially lead to short-term price fluctuations for Bitcoin.

Bitcoin in a Latest Phase

According to CoinMarketCap data, BTC has recorded an 8% price decline in the past week, trading at $42,695 at press time.

According to BTC’s Moving average convergence/divergence (MACD) measurements, BTC’s MACD line crossed below the trend line that day and has only posted red histogram bars since then.

A downward intersection of an asset’s MACD line with its trend line indicates that the market’s upward momentum is waning. It also indicates that a downward trend may be developing. Those who have accumulated assets will see this as a warning sign as it indicates a decline in market dynamics. As if confirming the bearish trend in sentiment, BTC’s positive index (green) at 16.90 is pegged below its negative index (red) at 21.26.

Similarly, the red line crossed over the green line on January 12, adding further confidence to the above position. When a token experiences this type of crossover, it indicates that the strength of the bears has exceeded the strength of the bulls and a price decline is to be expected.